/cloudfront-us-east-1.images.arcpublishing.com/copesa/2TJNYAUJGVGBZJG5575ZOM6V2A.jpg)

[ad_1]

Never, since the top executives of the AFPs can remember, has there been so much noise in the industry, due to the uncertainty about what may happen in the future. Before, the only concern they had was that a reform that would improve pensions be implemented, “but now the threat is evident,” they acknowledge. The 10% withdrawals, where one has already been completed and another advances in Congress, accentuated this scenario.

From the headquarters of an AFP they point out that today Chile is losing the attributes that made it stand out in the region. Although they admit that the commitment they have in the country is long-term, they also point out that they must watch over their interests as investors, so they will see how the situation evolves to decide what actions to take.

In a context where more and more parliamentarians are joining the idea of being able to withdraw pension funds, an industry actor argues that experts are no longer even listened to.

Thus, the AFPs do not rule out that there may be a third and even a fourth withdrawal, because there are already pre-announcements in this regard, so the question is who stops them and how. “Being a populist today pays,” says one executive. And in fact, he exemplifies it with the following: it was on September 23 when the second withdrawal of 10% began to be processed in the Constitutional Commission of the Chamber of Deputies, an initiative promoted mainly by Deputy Pamela Jiles. In October, the parliamentarian jumped immediately in Criteria’s presidential poll, going from 3% of preferences in September to 7% last month.

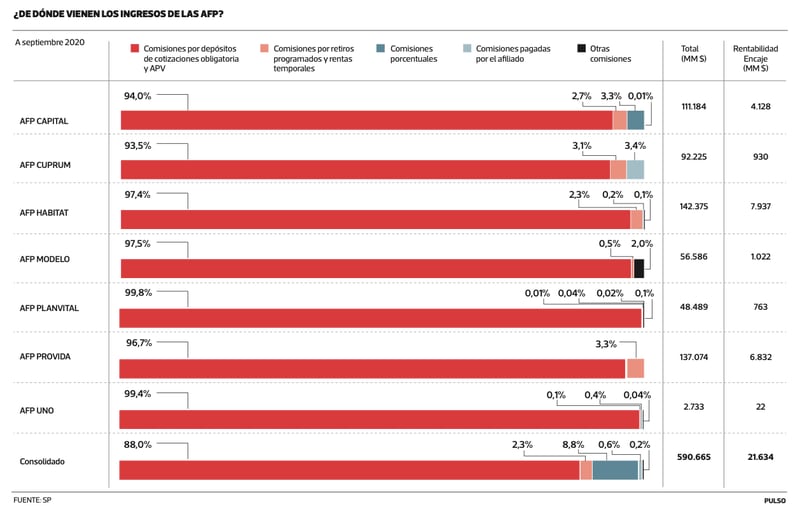

The AFPs have explained that the withdrawal of 10%, of about US $ 19,000 million, does not impact their income, since they obtain them through the commissions they charge for salary, so managing a lower balance, in practice, does not provide them generates changes. In addition, they release lace. The same general manager of the AFP Association, Fernando Larraín, said this Friday on radio Duna that the withdrawals “affect the amount of pensions that are delivered, but with respect to the operation of the AFPs and with respect to the income of the administrators, they do not it affects them at all ”. (See infographic)

Executives from different AFPs point out that a second retirement will not mean making changes in the structure of the business, nor in the composition of the portfolios, but if in a few more months a project for a third and fourth retirement takes hold This could imply modifications mainly in the way of investing, since it would be necessary to stop looking at the structure of the portfolio thinking of finding the highest returns, to turn to instruments that provide more liquidity. It would also stop investing in longer-term horizons, to go for a shorter-term one.

The foregoing, considering that currently the AFPs have not had to make major adjustments in their portfolios to sell assets to pay 10%, since they have sufficient liquidity, in part due to the constant calls for changes of funds made by pension advisers.

However, if Congress begins to regularly approve new withdrawals, they say they will have to review the portfolios. For example, it would become more complex to invest in alternative assets. This would lead to sacrificing profitability for liquidity. Furthermore, if the portfolio managed by the AFPs decreases significantly, they would not be able to take advantage of economies of scale, so they would not have access to discounts or preferential commissions by volume, as they do today abroad.

But along with withdrawals, what generates additional noise is what can happen with other topics that are discussed, such as limiting profits and bidding on the stock of affiliates. That is why today and in the future they believe that they should seek to be more efficient to compensate for the above.

Continuing along these lines, one of the most worrying issues is the proposal to divide the industry so that they are mere fund managers and not manage accounts. In fact, from the parent company of an AFP they believe that these modifications would have characteristics of an expropriation, therefore, a change in the rules of the game for foreign investors. In addition, they warn that it would only make costs more expensive, because economies of scale could not be taken advantage of.

The new Constitution can also change the rules, and they do not rule out that the AFPs may disappear in the future.

Given all the above, AFP controllers are concerned and have held meetings with local authorities. Of the seven administrators that operate in the country today, Provida, Capital, Cuprum and Planvital are foreign capitals: Metlife, Sura, Principal and Generali, respectively. Habitat, meanwhile, is controlled equally by ILC and Prudential.

More about Withdrawal of funds

An industry actor points out that what worries the controllers of the second withdrawal is the signal that Chile is no longer respecting the rules of the game, because part of the country’s attractiveness is legal certainty. Another administrator comments that the first withdrawal of 10% did not generate as much noise for the controllers. But a second is already different, because it occurs only three months after the first, with more favorable votes in the Chamber, so it is difficult to see them stop in the future: the scenario changed, they say.

From the matrix of another AFP they describe that the approval of the second withdrawal, in circumstances that it had been said that the first was going to be something unique and extraordinary, as a loss in the credibility of Congress and the government.

Another industry source explains that by taking measures that lower pensions, the image of the AFPs will worsen, which could further discredit the industry, so it will be a business with greater risk if it is looked at in the long term.

On the other hand, although everyone has wanted a pension reform for years, this is the worst context to do it, they comment. The government does not have bargaining power, which is demonstrated in that it has not even obtained the support of its own parties in the second 10% withdrawal. “Anything can come out,” they say.

Without going any further, in July the president and CEO of Principal Financial Group, Daniel Houston, raised with President Sebastián Piñera his “concern regarding the private pension system industry in Chile, that the pension system is at risk,” he said. in that occasion.

The chief executive of the US firm that controls AFP Cuprum, continued by saying that “the political process that has now been carried out in Santiago can have a great impact, both due to the private retirement savings of millions of Chileans, as well as the support for the capital markets for pensions, which will be vital for the country’s recovery due to the pandemic. We are also concerned about what the political spark could generate on the pension system ”.

Houston also noted: “I couldn’t help but reflect on your comments that Chile welcomes foreign investment and that it is a friendly country to do business, and that you would like to continue having that environment for the benefit of Chileans. At Principal, we have consistently advocated for responsible reform of the pension system (…) but we also appreciate the political situation in Congress, (which) puts the prospects for beneficial reform at risk ”.

But at the end of the day, future new withdrawals are what could most affect the outlook for the industry, because if there is no savings pillar, you do not have AFP, says an actor. “If people have no balance, who will defend the savings?” Says an industry source. In this case, people would demand that the state pay them a pension, which ends up affecting the fiscal coffers and the future growth of the country. This is what the president of the Central Bank, Mario Marcel, pointed out this week.

In addition, another actor warns that if the withdrawals of funds continue, only the people with higher incomes will remain with a balance, which would facilitate the possibility of expropriating the funds, because it would take savings from those who apparently have more. But they are mainly middle class, because people with higher incomes do not necessarily contribute. In any case, another industry executive notes that this is more difficult today, since after the first withdrawal the affiliates understood that the money is theirs. Thus, the challenge for the future goes beyond what may happen with the AFPs. The former Superintendent of Pensions, Alejandro Ferreiro, affirms: “I don’t know what is going to happen from now on. Obviously I see it with concern, because this golden rule that was in the Constitution, on which the parliamentarians would not have initiative in pension matters, has been violated through the formal expedient of achieving the majorities of a constitutional reform ”.

The former Superintendent of Pensions, Guillermo Larraín, estimates that there are two forces operating on the pension system and that explain what is happening today. The first has to do with high unemployment, at a time when the State has focused aid on people with lower incomes, and not on the middle class. “That explains the first withdrawal, and the second in a way as well. I don’t know if there will be a third, ”says Larraín.

The second reason, he says, is more structural, and “has to do with the legitimacy of the pension system. There are people who have long questioned the AFPs, even right-wing parliamentarians have criticized the system, ”he says. This is why he believes that a reform must give more legitimacy to the system, and that goes beyond individual savings. “Chileans have to be given reasons to believe that the pension system belongs to them,” he says.