[ad_1]

Chilean stocks fell sharply in the first minutes of trading on the Santiago Stock Exchange. The IPSA, the main index for the local market, fell by 1.48%, which was its biggest daily decline since September 23.

However, at this time the setbacks are moderating notably and the selective only falls 0.42%.

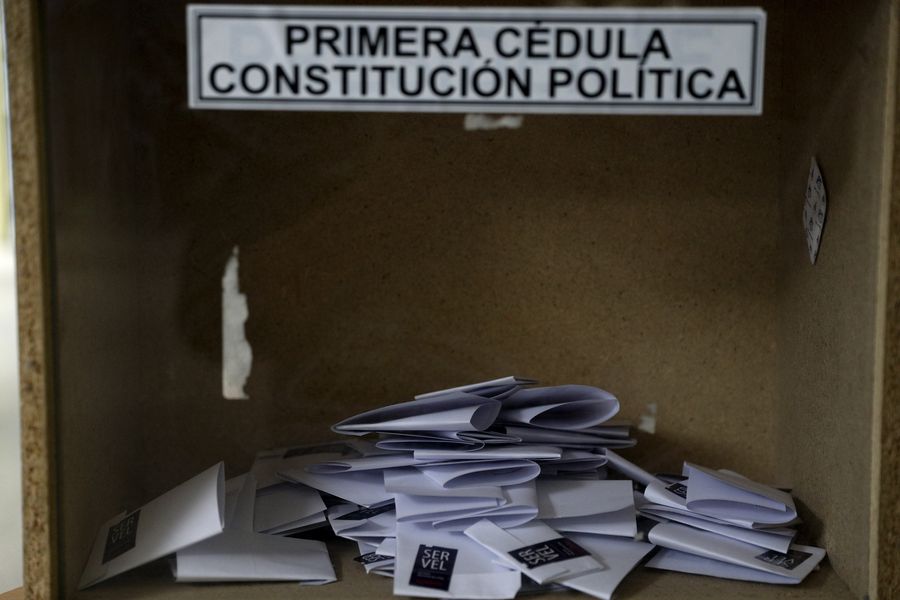

The performance of local actions is in line with the result of the historic plebiscite for a new Constitution. According to the latest balance, with almost 100% of the polling stations scrutinized, the Approval reached an adherence of 78.3% and 21.7% for the Rejection.

Although the result was not far from what the market was already anticipating, the surprise came from the mechanism chosen for the writing of a new Magna Carta, since the mixed convention reached an even lower percentage than the Rejection obtained.

The trial of Wall Street, the rating agencies and large investors to the constitutional process of Chile

Dollar comes out of the initial lethargy and shows clear progress in the first day after the plebiscite

Specifically, the constitutional convention received 79% of the accessions and the mixed convention, 21%.

“The truth is that the result is quite similar to the surveys that were. However, some expected that, despite the polls, the rejection could have had a greater adherence for a silent spiral theme. I think it was a surprise that the mixed convention had fewer votes than the rejection, ”explains Germán Guerrero, partner at MBI Inversiones.

So far in operations, Santander and Banco de Chile lead the declines with falls of 3.13% and 2.84%, respectively.

The Minister of Finance, Ignacio Briones, highlighted the process, participation and the institutional framework on which the plebiscite rested and warned that our results should not come as a surprise to the markets.

“I don’t like to speculate, but I would say This process has been observed by the markets for quite some time. That is the grace of an institutional process, institutionalized; and therefore I believe that a good part of this was expected, ”said the country’s highest economic authority.