/cloudfront-us-east-1.images.arcpublishing.com/copesa/4HNJ43JQIVAAZCCKUVNIP6IUXI.jpg)

[ad_1]

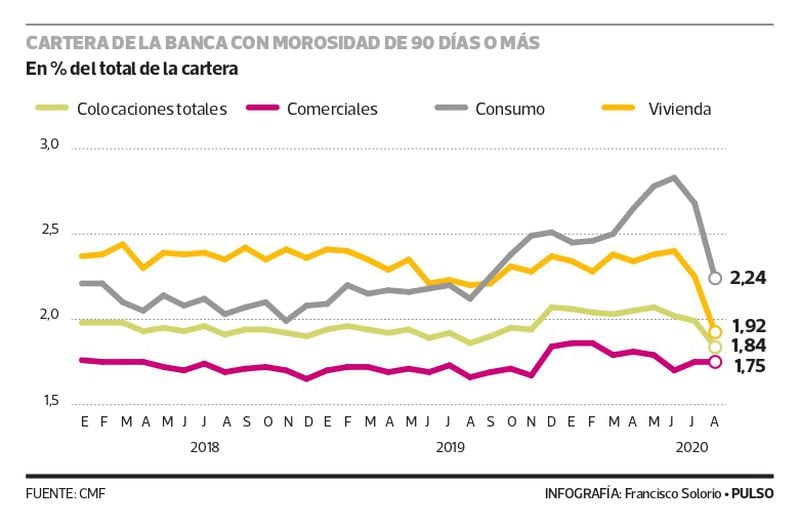

The collection companies and Equifax already warned: people used part of the 10% withdrawal from the AFPs to pay their debts. That is what the official figures of the Commission for the Financial Market (CMF) confirmed on Tuesday, where a pronounced drop in delinquency levels is observed, just the month in which payments for the withdrawal of pension funds began.

Specifically, August marked the largest monthly drop in non-performing loans greater than 90 days since there are comparable records (2011), where the greatest decline was recorded by consumer arrears.

In this way, delinquency in the total registered its lowest level since August 2017, while in consumption it returned to levels prior to October 18 of last year.

The Central Bank recognizes a relevant, albeit transitory, effect of the withdrawal of funds on consumption: two thirds of the expenditure will take place this year

Sanitary companies report an increase in delinquencies, but see an improvement in bill payment in August

After withdrawal of 10% of the AFP collection companies affirm that defaulters have returned to pay debts

In total loans, arrears greater than 90 days decreased 15 basis points (bp) with respect to the previous month, reaching 1.84%. When broken down by portfolio, in consumption the index fell 44 bp when compared to July, reaching 2.24% of loans, its lowest level since August last year. This is the highest monthly loss since there are comparable records, in both cases.

On the other hand, in the housing portfolio, the index decreased 34 bp, reaching 1.92%, its lowest level since there are comparable records. What’s more, it has never dropped below 2% on this portfolio before.

“The reduction in delinquency indicators is observed in a generalized way through banks and different credit products, and coincides with the specific effect generated by the withdrawal of 10% of the pension funds, as well as the delivery of the various aid state in the ability to pay of households. Indeed, in August there was a significant increase in the payment of delinquent obligations by natural persons and in the level of recoveries from penalties for this segment, ”the Association of Banks (Abif) said in a report.

Abif complemented that “the decrease in non-performing debt as well as the increase in both mandatory and additional provisions, has raised the provision coverage ratio in the personal segment, which between July and August increased from 0.56 to 0, 67 times the default in the mortgage portfolio, and from 3.04 to 3.63 times the default in the consumer portfolio ”.

On the other hand, non-performing loans of companies remained at the same level as in July, since in August it ended at 1.75% of loans, “while the substandard commercial portfolio -which includes the obligations of debtors in individual evaluation that They are considered highly risky, but currently do not have a default of more than 90 days – it has increased gradually during the last six months, reaching 4.89% of the balance of commercial loans in August, 110 basis points more than in February ”, said the Abif.

The deputies of the Economic Commission this Tuesday approved two projects that are in their first constitutional process. The first of them is the one that prohibits communicating debts while the State of Catastrophe decreed by the pandemic is in force, and for up to 120 days after the end of that period. This was approved in particular, so now it must go to the Chamber and then to the Senate.

The second project was presented by the government, which allows postponing mortgage loans to people who have not been able to do so in this contingency. Of course, this initiative still has a long way to go, since it is in its first constitutional process and was recently approved in general, so the vote in particular is missing.

[ad_2]