/cloudfront-us-east-1.images.arcpublishing.com/copesa/63C3JFQJM5ACHG2YHH5TDD5RCQ.jpg)

[ad_1]

More than 5.1 million members of the local pension system have gathered these days to ask the pension fund managers (AFPs) for their second partial withdrawal amid the coronavirus pandemic.

If the first withdrawal of funds meant, according to the Superintendency of Pensions, a withdrawal of US $ 18,500 million from the system, this second window of request for funds would imply, according to the regulator’s estimates, “less than US $ 16 billion.” Market sources land those projections and believe they will be between US $ 10 billion and US $ 13 billion. In total, the pension system at the end of November handled $ 160.6 billion, the equivalent of about US $ 209 billion.

These withdrawals imply that the AFPs have to sell investment positions, in order to obtain the liquidity to pay their affiliates in a timely manner. As the noise of this measure of return of funds was happening weeks ago in the debate, the pension administrators in November made abrupt movements in their investment portfolios to advance the availability of money requested by their affiliates.

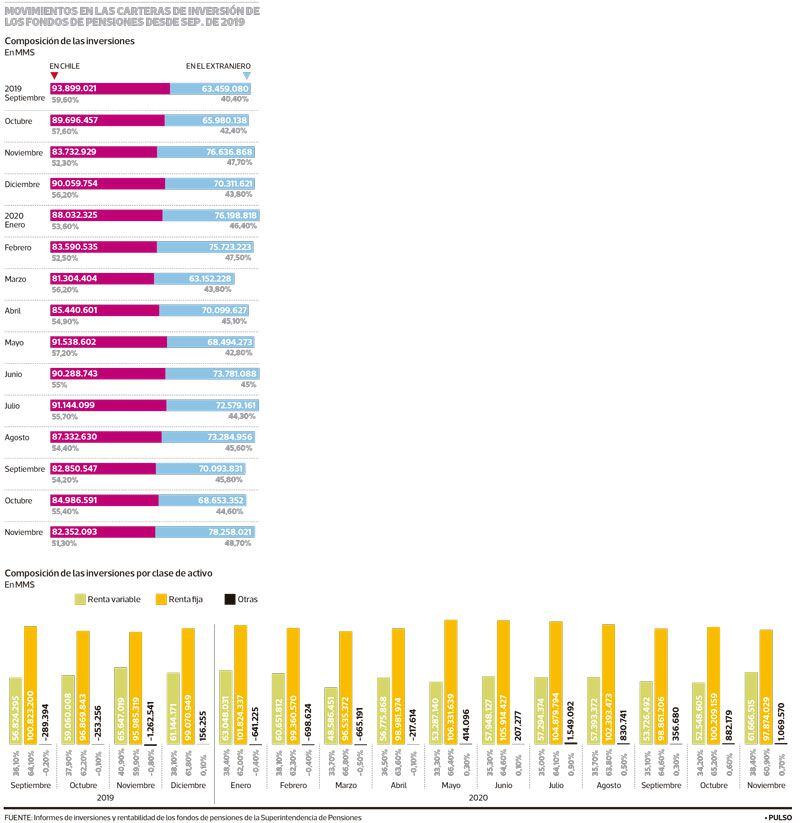

Since June, and despite the first rescue of funds, Chile’s exposure within the investments of the AFPs remained stable at around 55% of the total portfolio, while the other 45% went to investments abroad. However, in November the fund managers showed a strong sale of local assets, which at the end of the month amounted to 51.3% of the portfolio (see infographic), $ 2.6 trillion less than in October.

And if it is already identified that they sold local positions in the last month, it can also be seen in the monthly statistics of the Superintendency of Pensions that the flight occurred in fixed income, since since May this asset class represented around 65% of the investments of the AFPs, but in November it became 60.9% (see infographic).

But it is believed that the AFPs did not obtain all the liquidity to pay the second withdrawal in November, given that the strong movements of their investments have continued to be felt in the market these days. Thus, local money desks operators assured that last week the AFPs sold bank bonds to the Central Bank.

Other big buyers of local fixed income in the last month have been North American mutual funds and insurance companies.

From AFP Capital they indicate that “it is important to highlight that international assets are very liquid, they do not have sales restrictions, and as for local assets such as fixed income, the Central Bank implemented the REPO program in July that helped fund managers they had sufficient liquidity to make payments, so there were no difficulties from that point of view ”.

More about Companies & Markets

Meanwhile, a money desk operator in the local market comments that the AFPs “made a good part of the cash to pay the bailouts in November, but they have not liquidated everything they could sell, because the market has been on the rise in recent weeks. , for which they have wanted to maintain some key positions until the end of the year, in order to try to obtain better profitability than the competition “and predicts that” after the end of the year, I think there will be a wave of asset sales -a pro rata of all asset classes – by the AFPs to be able to pay the more than 5.1 million people ”.

With this outlook, market agents consulted estimate that the most affected locally will be the dollar, since they foresee that if some US $ 3 billion or US $ 4 billion from sales of the AFPs abroad arrive in the country, that will move the type of shift downward.

An investment fund manager thinks that the AFPs “sold a lot of local fixed income in November, but I think that now they will turn to selling international assets, given that their exposure has hit the bottom and they will gather liquidity by selling mutual funds from abroad or positions in Exchange Traded Funds. (ETF) ”.

Meanwhile Gastón Angélico, partner of the distributor and fund manager Excel Capital, has noticed that currently the AFPs “have more recently invested in fixed income emerging debt, high yield and equity funds in China and Europe”. In any case, the recent report on investment exposure of AFPs abroad prepared by Excel Capital reveals that in November there was a monthly jump of 14.56% in the positions of AFPs abroad, where the main flows of purchases were concentrated in assets in the US and Canada, which grouped investments for US $ 1,042 million, followed by purchases of positions in China for US $ 837 million and Asian emerging markets other than China for US $ 744 million.

Angélico reflects that if the AFPs sold large blocks of national assets “it would be like shooting themselves in the foot, because that would generate a rise in interest rates, which would affect the rest of the portfolio.” In addition, he thinks that if they massively dispose of local assets, they would have to do so at lower prices, so that the remaining position that they would maintain in those assets would also appreciate downward.

A local fund manager predicts that 2021 will see a strong recovery in global markets, with interest rates that will remain low, which will discourage fixed income and strongly push the risk appetite in equities, specifically in Asia and Europe, locations where a more explosive economic recovery is expected than North America.

Meanwhile, a director of an AFP analyzes that “to aspire to returns with better averages than what funds present in the world, it is necessary to go for risk with alternative assets, and that will happen in the future. Once this happens, there will be greater differences in the returns between the AFPs, depending on how much they bet on these assets and on what subtypes they do, for example in the US or Europe, in a particular industry, in technology or pharmaceuticals, etc. ”. Therefore, he emphasizes that it will be very relevant to have high-level investment teams.