[ad_1]

Chilean shares fell sharply at the close of the Santiago Stock Exchange. The IPSA, the main index of the local market, fell 2.68%, which is its biggest daily decline since last September 23.

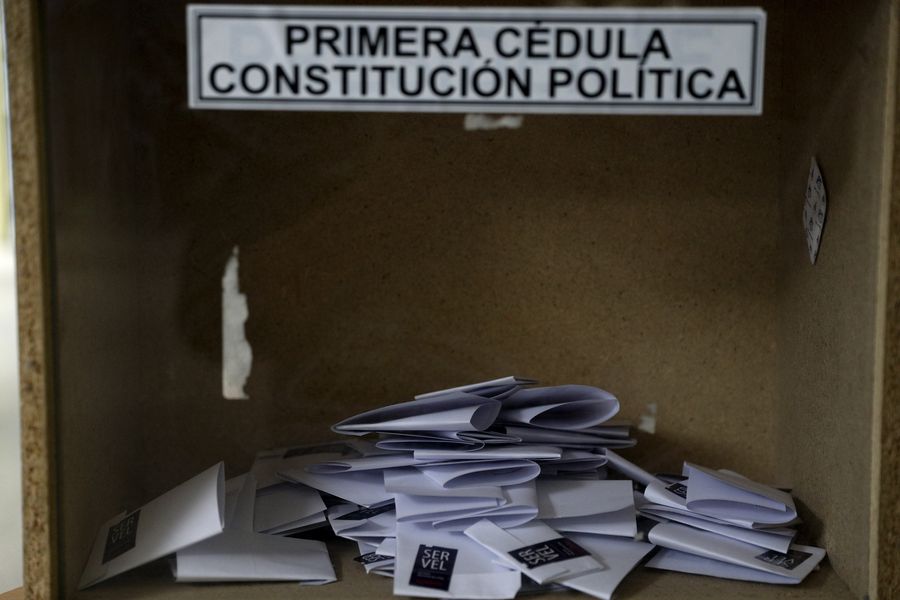

The performance of local stocks is in line with the results of most of the markets worldwide. This one day after the result of the historic plebiscite for a new Constitution. According to the latest balance, with almost 100% of the polling stations scrutinized, the Approval reached an adherence of 78.3% and 21.7% for the Rejection.

Although the result was not far from what the market was already anticipating, the surprise came from the mechanism chosen for the writing of a new Magna Carta, since the mixed convention reached an even lower percentage than the Rejection obtained.

The trial of Wall Street, the rating agencies and large investors to the constitutional process of Chile

Dollar comes out of the initial lethargy and shows clear progress in the first day after the plebiscite

Specifically, the constitutional convention received 79% of the accessions and the mixed convention, 21%.

“The truth is that the result is quite similar to the surveys that were. However, some expected that, despite the polls, the rejection could have had a greater adherence for a silent spiral theme. I think it was a surprise that the mixed convention had fewer votes than the rejection, ”explains Germán Guerrero, partner at MBI Inversiones.

The Minister of Finance, Ignacio Briones, highlighted the process, participation and the institutional framework on which the plebiscite rested and warned that our results should not come as a surprise to the markets.

“I don’t like to speculate, but I would say This process has been observed by the markets for quite some time. That is the grace of an institutional process, institutionalized; and therefore I believe that a good part of this was expected, ”said the country’s highest economic authority.

At the close of operations, the stocks that led the falls were Empresas Copec (-5.64), Banco de Chile (-5.10%), Empresas CMPC (-5.04%) and BCI (-5.01% ).

Meanwhile, on Wall Street, stocks fell weighed down by an increase in Covid-19 cases and by the deadlock in Washington in the negotiations for a new fiscal aid plan, which darkened the economic outlook prior to the presidential elections of the November 3.

“Fears about the resurgence of Covid-19 and the continued failure to reach a fiscal package between Republicans and Democrats have investors nervous,” Michael Arone, chief investment strategist at State Street Global Advisors in Boston, told Reuters.

The Dow Jones fell 2.29%, the S&P 500 fell 1.86% and the Nasdaq fell 1.64%.