[ad_1]

“Revenues from consumption taxes tend to represent a higher proportion of total tax revenues in emerging countries,” says the OECD in its annual report on tax reforms, which has as the clearest exponent of this statement our country when try to analyze the situation of the members of the block.

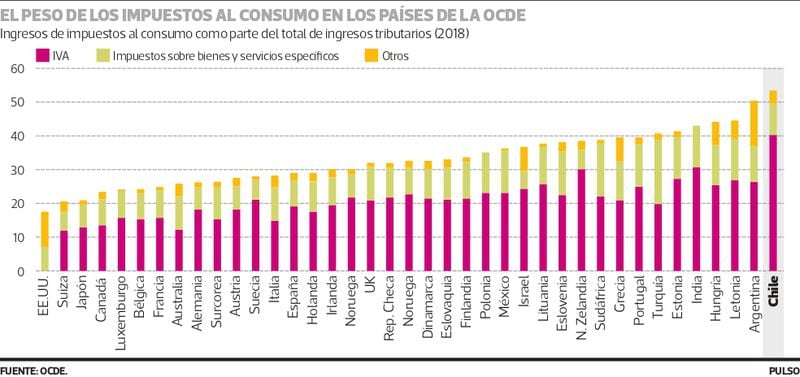

In Chile, the consumption tax represents 53.3% of total tax revenues (see infographic), being the only one in the OECD that exceeds the 50% threshold, although in the study it is accompanied by Argentina, a partner of the group that was selected for this study.

According to the detail offered by the photograph of the report, with a rate of 19%, the value added tax (VAT) in Chile is by far the most relevant, reaching 40% of total tax revenue, something that stands out more particularly , considering that India and New Zealand follow with around 10 percentage points less.

In this way, Chile is an excellent representative of Latin America, where VAT and other taxes on goods and services represent on average 53% of the total income of what the tax systems contribute, a figure that contrasts with the OECD average of 32 %.

Data in context. This situation does not surprise Ignacio Gepp, director of Puente Sur, who maintains that “it is normal that in less developed countries the consumption tax generates more collection, because everyone contributes.”

On the contrary, he explains, “in countries where you have more extended middle classes, the State collects more through income taxes, that is, the richer the population of a country, the more income tax is collected.”

Under the same reasoning, Álvaro Cordero, a CEP researcher, points out that “to make a more realistic comparison with the OECD, it is necessary to do so when other countries had the same level of development that we have today.”

In addition, it calls to observe “the percentage of the tax burden of each tax on GDP”, a framework in which, although it recognizes that it is in the upper part, preceded by only 8 countries of a total of 38, it emphasizes that “Chile it is not in the first places ”.

Faced with this scenario, Javier Jaque, director of the Magister in Taxation at the University of Chile, considers that the reading should not be simplistic, stating that the consumption tax is regressive, given that “it is progressive in its distribution because it is directed at people who have fewer resources ”.

Despite this, he considers that the imbalance is due to the evasions that are registered in the other tax branches. “VAT evasions vary by 21%, 22%, 24% … every year, but income evasion at the company level is between 36% and 40% and at a personal level it is close to 70%” , raises Jaque, indicating that the solution may be to strengthen oversight.

“Chile has an inspector for about 4,000 taxpayers, while the OECD countries have one for every 1,500 (…) What would it mean to cut income tax evasion by half? There are studies that show that for each new examiner an extra collection of US $ 1 million is expected ”, highlights the academic.

Gepp proposes another approach to tackle the issue. “Taking into account that the corporate tax rate is already reasonable, this graph that shows that the consumption tax weighs more than half, is that the personal tax collects very little.”

In this context, it considers that work is being done on the matter. “When they talk about disintegration, which Michelle Bachelet did and Sebastián Piñera maintained, it is that people pay more taxes than before. All that has been done is to increase the tax burden on individuals. When that happens, the proportion of the consumption tax can go down, “he says.

Despite the importance of consumption taxes reflected in the OECD report, when the dilemma about the source of financing for pensions arises, increasing this type of taxes has emerged as an option and, as Pulso advanced last week, it is one of the options that the government would consider.

This alternative, in Cordero’s opinion, cannot be ruled out. “I believe that today we have to weigh all the available alternatives (…) Within them, the VAT option allows collecting through general taxes, and not only from formal workers, and taking advantage of a structure that already exists and works,” he argues .

Meanwhile, Jaque postulates that “the elastic bands can always be stretched a little more” and that, thinking about pensions, although “one more point puts us higher on the graph, they mean several million extra collection”.

[ad_2]