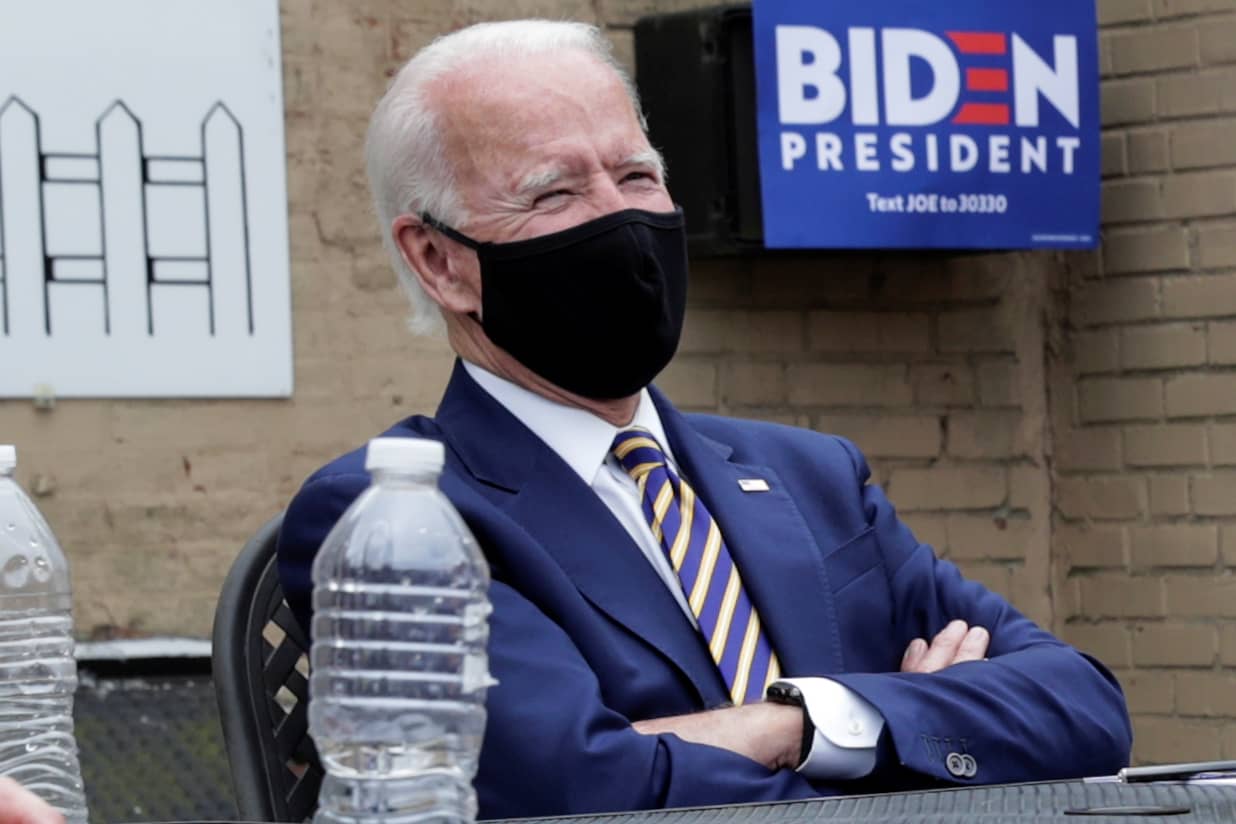

Democratic presidential candidate and former Vice President Joe Biden listens as he meets with local residents at Carlette’s Hideaway sports bar during a campaign stop in Yeadon, Pennsylvania, the United States, on June 17, 2020.

Jonathan Ernst | Reuters

Vice President Joe Biden jumped to a 9-point lead over President Donald Trump with five months to go before the election, but the CNBC All-America Economic Survey finds that the president still has an advantage among voters on the critical issue of the economy. .

The June poll shows President Biden as 47% to 38% among registered voters, four points above his lead in April. Biden benefited from increased support among young and wealthy voters and solidified his base, seeing a 7-point gain in his approval rating among Democrats. President Trump lost considerable ground among independents, suffering an 11-point drop in his support. Those independents didn’t end up in Biden’s column. Instead, there was an increase of 11 points in the independent who declared themselves undecided.

The survey of 800 Americans across the country was conducted June 19-22 and has a margin of error of plus or minus 3.5%.

It showed that the former vice president dominated or even with President Trump on all but one of the key issues – the economy. When asked who has the best policies for the economy, voters favored the president from 44% to 38% over Biden. But it was the only problem the president led to.

Biden had a 14-point lead in coronavirus treatment, 16 points in health care, and 25 points in racial equality policies. Biden even had a slight edge on several of the president’s main problems: immigration and dealing with China. Although those advantages were small and within the margin of error, they showed that the president did not dominate the issues on which he had spent considerable political capital.

“The economy may be what President Trump’s saving grace is advancing,” said Jay Campbell, a partner at Hart Research Associates, who served as a Democratic pollster for the poll. Campbell notes that among independents, President Trump has a 42% to 26% edge on the best policies for the economy.

United States President Donald Trump addresses a joint press conference with Polish President Andrzej Duda in the Rose Garden of the White House in Washington on June 24, 2020.

Carlos Barria | Reuters

Still, President Trump’s approval rating on the economy fell to 46% from 52% in April. Disapproval increased to 46% from 38%. But those numbers are much better than his overall rating, which dropped to 39% approval and 52% disapproval. It was a radical change from his positive approval rating in April. That hit in positive territory now appears to have been more of a thoughtful reaction in which Americans join the president in times of national crisis. It has been shown to be short lived.

Coronavirus, economic perspective

This may be because Americans are beginning to believe that the coronavirus will last longer. Three-quarters of the public believe that a new wave of coronavirus infections is highly likely in the next six months. Sixty percent say the economy will not be fully restored until next year or more, up from 52% in April. And 46% plurality of Americans say their biggest concern is that their state will move too fast to lift virus restrictions; Only 30% say they are concerned that restrictions will be lifted too quickly, compared to 38% in April.

And yet, Americans remain optimistic about the prospects. While 32% of employed Americans report they lose hours, wages, or salaries, 51% say the economy will improve in the coming year. While the US assessment of the economy remains much bleaker than before the coronavirus success, it has improved somewhat since April. That improvement has been driven almost entirely by Republicans, who have a net positive view of the economy, compared to deeply negative evaluations of Democrats and independents.

Overall, Americans view the current recession as less severe than the Great Financial Crisis, as 54% rate it as an economic slowdown or mild recession compared to 36% who see it as a severe recession or depression . The numbers were reversed when CNBC asked the question in 2008: 37% to 59%. And American views on stocks have rebounded: 43% say it is a good time to invest in stocks and 37% say it is a bad time. In April, the bearish view dominated by four points.

However, an echo of the last recession does not bode well for the economy and consumer spending: only 31% believe they will see their wages grow in the coming year, the lowest percentage since 2012.

.