[ad_1]

Bitcoin has been performing extremely well over the past week and is up 20%, according to data from Coin360.com. This is a move that has carried the cryptocurrency from one resistance to the next, suggesting a possible upward trend.

However, the cryptocurrency has slipped since it peaked at $ 9,500, with BTC trading at $ 8,800 at the time of this writing. In hindsight, this is not too convincing that the currency is in a bull market, as one analyst indicated.

Bitcoin will receive the $ 9,090 back weekly

According to a Crypto Swing Trader, Bitcoin will remain “completely bullish” at a weekly close above $ 9,090, suggesting that this level was a major resistance and support zone last year.

A BTC close above $ 9,090, according to the chart, would confirm a change in resistance support at that level, giving the cryptocurrency the momentum to recover to an even higher level.

Unfortunately, this bullish conclusion doesn’t seem to be coming as BTC was trading at $ 8,800 at time of writing.

Unless cryptocurrencies meet in the next two hours, a weekly closing rate of more than $ 9,090 should be postponed for next week.

There are other reasons to be optimistic.

It seems unlikely that Bitcoin will close the weekly candle above the level indicated by the operator, but analysts say there is an accumulation of other reasons to be optimistic about the main cryptocurrency in the medium term.

A well-known trader pointed out that there are currently compelling reasons for a bull market in Bitcoin. The reasons coincide as follows:

- The refinance rate on BitMEX, that is, the amount Longs paid for the shorts and the premium index, that is, the difference that people pay for Bitcoin on BitMEX compared to the price of the BTC index is “still negative.” This suggests that the lengths are not too stretched yet.

- Bitcoin is trading above the volume weighted average annual price.

- BTC is above the 200-day moving average.

- One-day Ichimoku cloud turns bullish.

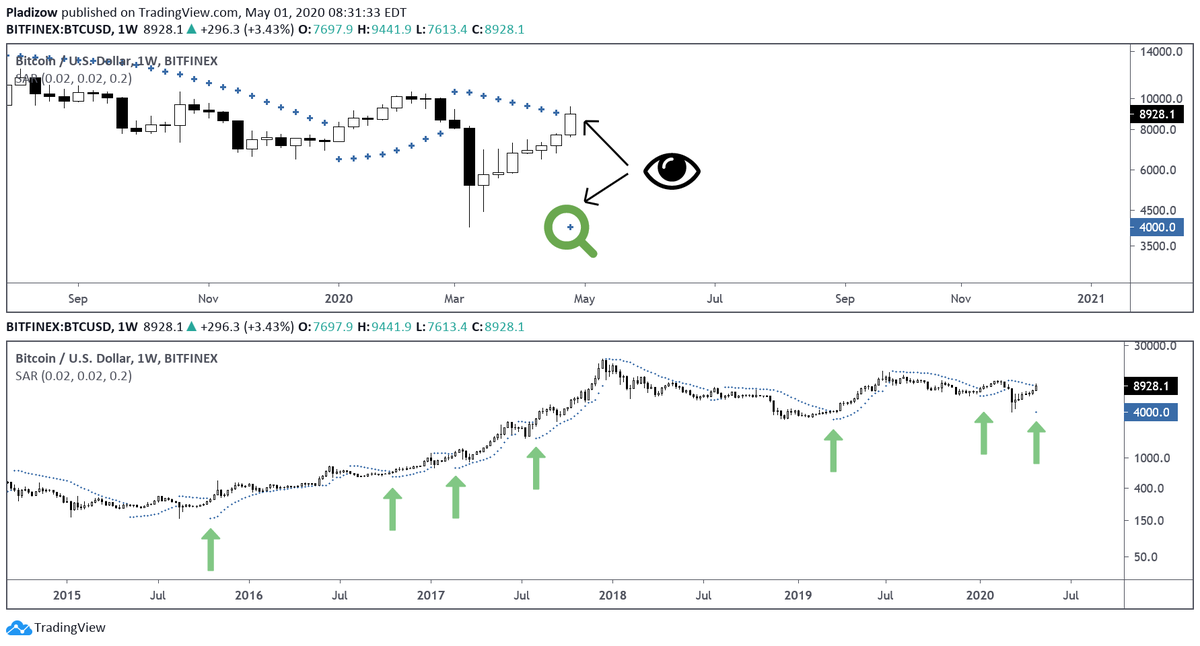

The parabolic stop-and-run investment indicator just gave a bitcoin buy signal on the weekly chart.

Nunya Bizniz, a crypto cartographer, said that after this indicator appeared six times in the past five years, Bitcoin has seen “significant upward movements.” This was the case in early 2019, when PSAR rebounded shortly before the 25 percent outbreak on April 1, ushering in a recovery of more than 300 percent.

Trading without a commercial view is like sailing without waves. Register now!

If history repeats itself, BTC will suddenly explode again in the coming weeks.

In terms of fundamentals, it is estimated that halving Bitcoin’s block reward is just 10 days away. Analysts expect this pivotal event to act as a catalyst for a parabolic surge in the cryptocurrency market.

Source: NewsBTC

In order to support and motivate the CryptoTicker team, especially in Corona times, to continue delivering good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Nexo – your crypto bank account

Instant crypto loans with only 5.9% interest per year. Earn up to 8% interest per year with your stable currencies, USD and GBP. $ 100 million escrow account insurance.

Ad

This publication may contain promotional links that help us finance the site. When you click on the links, we receive a commission; however, prices don’t change for you! 🙂

Also note our disclaimer.

If you are considering opening an account with a CFD provider, you should know that CFDs are complex financial instruments that, through leverage, involve a high risk of losing money quickly. Most retail accounts lose money when trading CFDs.

You may also like

More analysis

[ad_2]