Here are the top headlines from Fox Business Flash. Check out what is clicking on FoxBusiness.com.

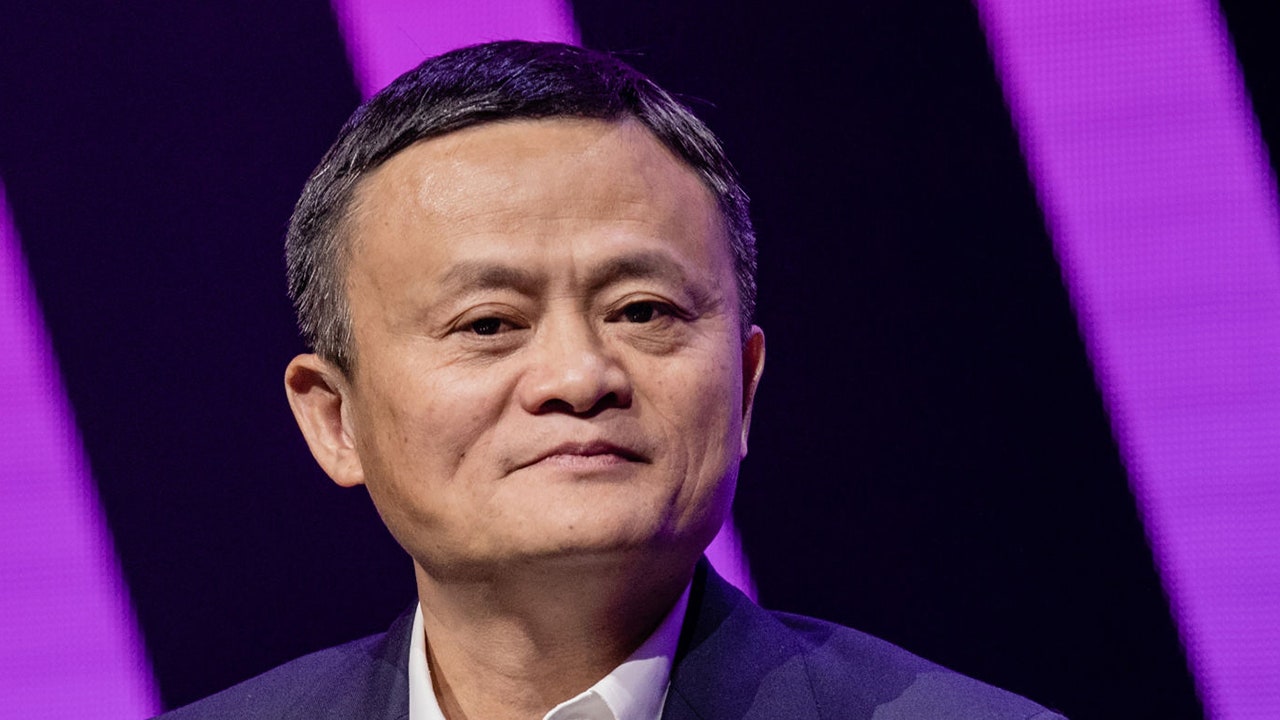

As per the prices set on Friday night, the huge double listing for Chinese fintech giant Ant Group will be the largest in the world, Alibaba founder Jack Mae said on Saturday.

Get Fox Business on the go by clicking here

“It’s the first time that the price of such a large inventory – the largest in human history – has been determined outside of New York City.” He told the Bund Summit in Shanghai’s Eastern Financial Center.

“We didn’t dare think about it five years ago or even three years ago. But, a miracle happened,” he told the audience, including officials from China’s regulators.

He did not give exact details of the prices which are likely to be officially announced next week.

Goldm SA joins AN 30 billion IPB banking syndicate, sources say

Backed by Chinese e-commerce giant Alibaba, Antony plans to list together next week in Hong Kong and Shanghai’s Star Market.

Sources said the listing could be worth billion 35 billion, surpassing the record set by Saudi Aramco’s 29 29.4 billion float last December.

Mae said the financial and regulatory system hinders innovation, calling for reforms to extend financial services to more small companies and individuals based on technology – which is largely based on Athos.

He said the global system established after World War II is old and very risky, calling the Basel Committee on Banking Supervision a “club of old men” and warning that risks are accumulating across the economy.

Who is Jack MA?

In China, he said, banks still operate with a strong “pawnshop” mentality, seeking collateral and guarantees before lending, a model that will fail to accelerate future growth, he said.

Instead, he said, a new, inclusive and universal banking system that lends to small businesses and individuals based on big data should be established.

Ant, whose extensive payment and micro-lending business is largely based on big data, has faced increasing scrutiny by regulators.

Click here to read more on Fox Business

“Today’s financial system is the legacy of the industrial age,” Mae said. “We must establish a new one for the coming generation and the youth. We must improve the existing system.”

(Reporting by Samuel Shane and Brenda Goh; Editing by William Mallard)