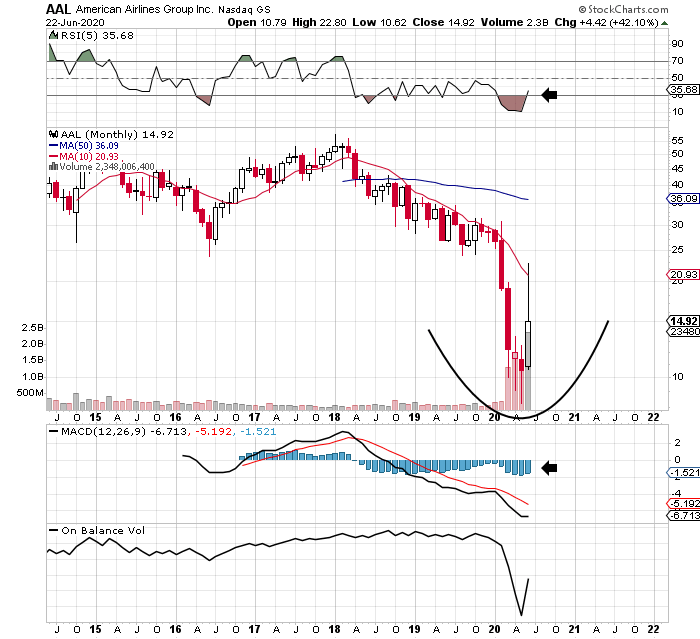

If we look at the long-term technical picture of American Airlines (NASDAQ: AAL), we can see that the shares have actually formed a monthly low that is significant. This positive development has meant that the RSI momentum indicator, as shown, is finally beginning to emerge from its oversold conditions. Furthermore, the MACD histogram has also started to turn optimistic in recent sessions.

Due to the high fixed costs and the significant debt that enters this crisis, many analysts who follow this airline remain ultra pessimistic about this action. When the pandemic and blockades came, we sold many stocks in airlines like Hawaiian Holdings (HA) due to the large increase in implied volatility in this sector. Bears are grappling with the fact that many airlines like American were too leveraged to enter this crisis and will continue to face liquidity problems that could result in bankruptcy proceedings.

We always like to refer to the history of a company before this pandemic. To do this, we looked at profitability metrics, how the company in question was taking care of its shareholders, and its valuation. In late 2019, we saw that American’s gross margin actually increased to 23.6%, resulting in the interest coverage ratio increasing to 3.06%. On the shareholders’ side, management maintained its dividend payment at $ 0.40 per year, but reduced floatation by approximately 22 million shares. Earnings increased to $ 3.79 per share, which was approximately a $ 274 million increase in net earnings. The assets practically covered the number of liabilities on the balance sheet in December 2019 and the shares were trading at around 8 times earnings.

Fast forward in less than 6 months and stocks are still around 50% lower than in December 2019. Earnings have obviously been decimated at $ 2.65 as the number reported in the first quarter and $ 7.77 the number expected to the second trimester. Thereafter, it becomes a waiting game. Will the airline be able to withstand a sustained recession in the industry? We believe it will be especially when you consider that the airline has many avenues on the table regarding how it will be able to finance itself in the future.

Yes, we recognize that many travelers will choose to avoid air travel for now. Testing, tracking, and long lines are here to stay east for the time being at most international airports. However, many business travelers, for example, need to travel, so we are seeing a huge increase in flights during the summer.

The fall election in the United States is critical as to how governments will react if we have another wave of some strain of this coronavirus. If Trump wins, for example, would he allow the country, once again, to enter a multi-month blockade? These are all unknowns at the moment, but what we do know is the following.

American Airlines was in very good shape at the end of its last fiscal year. Yes, the airline is burning cash right now, but the combination of the large increase in activity (as can be seen by the upward push in earnings projections at the end of the year) and its access to cash, we believe the airline at least he has bought time.

Suffice it to say that we believe there is a high probability that any price around the $ 10 mark is an excellent entry point for this action. Furthermore, due to the huge increase in implied volatility in the United States in recent months, there are ample selling opportunities for the investor who doesn’t mind limiting his earnings. Remember, because the market is setting wide-range pricing for American Airlines stocks in the coming months, the implied volatility (especially on the sell side) remains well above average for this stock.

Source: interactive corridors

So in summary, keeping AAL below the $ 10 mark remains an attractive risk / reward opportunity. We affirm this due to how the market in general is now appreciating a significant recovery in this sector. Remember that earnings growth (even from a negative position) will invariably move the stock price. As sales continue to grow, earnings growth will eventually continue. Let’s see what the second quarter brings.

———————-

The Elevation Code model is simple. To be relentlessly on the lookout for attractive setups through value plays, swing plays, or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We start with $ 100k. The wallet will not stop until it reaches $ 1 million.

Join us here

———————–

Divulge: I / we do not have positions in any of the actions mentioned, but I can start a long position in AAL for the next 72 hours. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.