(Bloomberg) – Advanced Micro Devices Inc. gave strong forecasts, suggesting that the company is winning orders from its biggest rival Intel Corp. in the lucrative market for server chips. AMD shares rose more than 9% in extended trading. Third-quarter revenue will be approximately $ 2.55 billion, AMD, based in Santa Clara, California, said Tuesday in a statement. That compares to analysts’ average estimate of $ 2.3 billion, according to data compiled by Bloomberg.

The company also raised its year-over-year sales forecast, and second-quarter results exceeded Wall Street expectations for sales of Epyc server chips and Ryzen PC processors. After decades behind Intel, AMD has been catching up in recent years, helped by progress made by its factory partner, Taiwan Semiconductor Manufacturing Co. Meanwhile, Intel is in crisis after saying its new process. Production is delayed one year. That hurt Intel’s shares, while AMD’s shares rose in hopes that its chips will perform better than Intel’s.

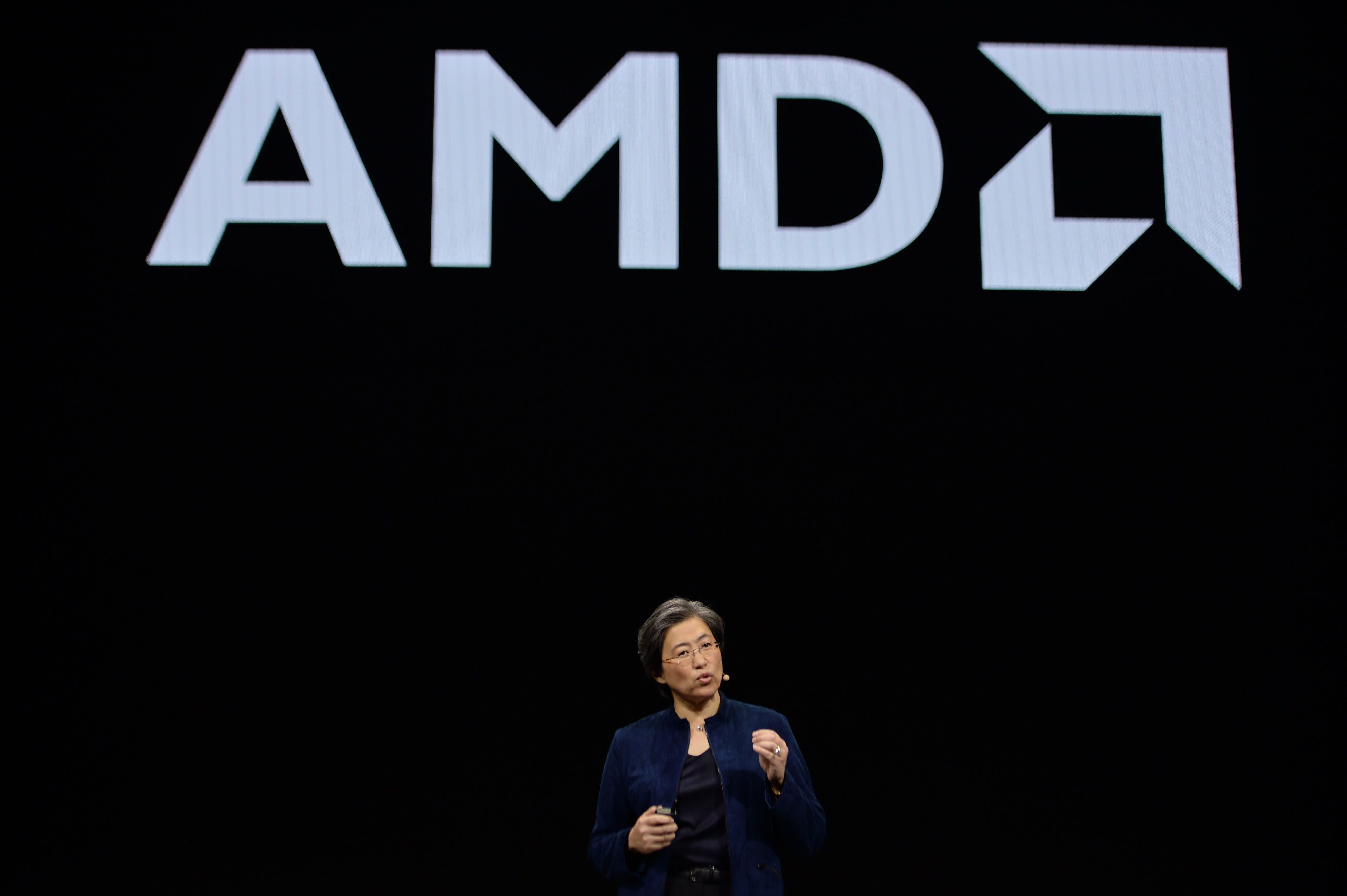

Under Chief Executive Lisa Su, AMD has renewed its products and has returned from what analysts said was on the verge of insolvency. Investors now want the company to justify its growing valuation by becoming more than just an afterthought for computer makers.

On Tuesday, AMD said it sees 2020 revenue rise roughly 32%, driven by the strength in PC, gaming and data center products. Wall Street expected the company’s sales to rise 25% this year to $ 8.4 billion. Either way, that’s about half of what Intel reserves for a quarter.

AMD has said it is targeting a double-digit market share on servers by the middle of this year. That would be less than 1% before introducing new products in 2017. Server computers are the backbone of corporate networks and data centers that run the Internet. Server chips can sell for thousands of dollars each.

AMD reported second-quarter net income of $ 157 million, or 13 cents a share, compared to $ 35 million, or 3 cents, in the same period last year. Revenue increased 26% to $ 1.93 billion. Profit, excluding certain items, was 18 cents. Analysts estimated earnings of 16 cents on sales of $ 1.86 billion.

(Updates with AMD actions in the first paragraph).

For more items like this, visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2020 Bloomberg LP