Good results from banks and om tomobile manufacturers on Friday are helping European stocks gain, while flash purchase managers index data reveals ongoing coronavirus epidemic struggles for the sector. U.S. Stock futures were moderately high.

Stoxx Europe 600 Index SXXXP,

According to Factset, the index has risen 0.6% following a loss in the potential five of the worst losers since the beginning of March. German DAX DAX,

0.7%, French CAC PX1,

And FTSE 100 UKX,

Each rose 1.1%.

U.S. Stock futures YM100,

ES00,

NQ00,

The whole board gained about 0.1% after the second and final presidential debate late Thursday night. President Donald Trump and former Vice President J. Biden exchange barbs over the epidemic in the run-up to the November election.

“The only hope is for an immediate lift in US stocks before November 3,” said Han Tan, a market analyst at FXTM. In the excitement is the progress of negotiations. Customers.

“Investors are likely to remain neutral in the markets, with less than two weeks to go before the US election due to political risks,” the analyst said. House Speaker Nancy Pelosi noted the progress made in negotiations with the White House, but warned that it would take even longer for Congress to write and pass the bill.

One positive for the markets could be the news late Thursday night that Gilead of Gilead Science,

GIVD treatment for COVID-19, vacuoly, was formally approved by the Food and Drug Administration. Known as rimadesivir until now, Vaculory is the first COVID-19 therapy to receive full FDA approval during an epidemic.

Meanwhile, economic data shows continued conflict in Europe. In Europe, October PMI data showed that France’s composite output index fell to a five-month low of .548..5 to .3 to..3. Germany’s PMI composite fell to .5 from..5, a two-month low.

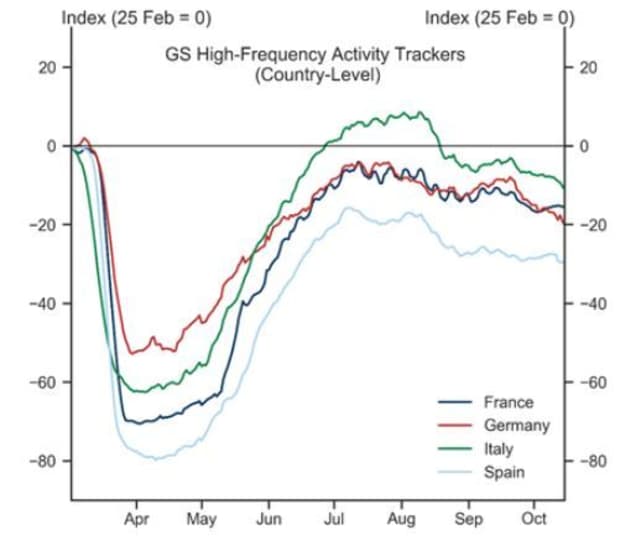

Goldman Sachs economists expect PMI data to be disappointing for three reasons: COVD-19 infection rose sharply in October, prompting further sanctions; The bank’s high frequency activity tracker shows further momentum slowdown; And recent surveys and rigorous data services show PMIs have a tougher time than manufactured PMIs.

Goldm Sachs Global Investment Research, Markets, Haver Analytics

Some European countries have imposed population restrictions and curfews to prevent the spread of the virus. French officials increased the local curfew from 9 a.m. to 6 p.m. on Thursday. French Economy Minister Bruno Le Maire warned on Friday that the economy would contract in the fourth quarter, in an interview with Europe 1 Radio.

Retail sales rose in September and the UK data was a little more positive, beating expectations.

Earnings news also ran a share action. Shares of Barclays BCS,

BARC,

UK Bank’s third-quarter total revenue, net profit and market-expected pre-tax profit, rose almost rose%, despite the provisioning.

HSBC Holdings With shares of HSBC, the banking sector was mostly higher across the board,

HSBA,

More than 2% and Banco Santander SAN,

Sen,

Above 1.5%.

Auto manufacturers were the focus, with Renault shares rising 1.8% and Daimler 1.6% after each report results. Reno RNO,

Said revenue fell in the third quarter, but the French automaker still beat analysts’ forecasts. German car maker Daimler D.I.

Profits increased, but revenue declined.

Towards the loss, shares of Kiring Kier,

The luxury-goods group’s expected third-quarter group sales fell more than 2% after the report, but disappointed with Gucci’s label, Citigroup analysts said.

“The stock price (+13% vs. Sector + 7% and the European market -6%) over the last three months and the potential price disappointment on Gucci could have reacted to the share price,” the team of analysts said. Thomas Chauvet, in a customer note.

.