[ad_1]

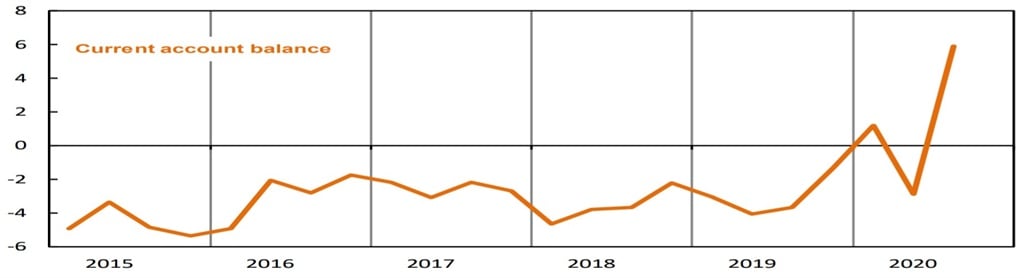

- South Africa is on track to achieve its first annual current account surplus in many years.

- The current account records South Africa’s transactions with the rest of the world and is an indication of whether more money flowed into the country than abroad.

- A sustained current account surplus is good news for the rand, inflation, and interest rates.

- For more articles, visit www.BusinessInsider.co.za.

South Africa just posted an extraordinary current account surplus during the third quarter. The current account records South Africa’s transactions with the rest of the world and is an indication of whether more money flowed into the country than abroad.

The current account measures all kinds of money flows, including imports and exports, as well as other cross-border payments, such as dividends and interest, as well as foreign aid.

For decades, South Africa ran large deficits. That’s in part because we import most of our oil, and huge amounts of interest and dividends are paid to foreigners outside the country.

But in the third quarter, South Africa posted a current account surplus of R 297.5 billion. This is more than four times the size of the previous largest surplus, recorded in the first quarter of 2020, says the Reserve Bank.

This is partly due to strong exports: South Africa’s trade surplus (exports minus imports) reached R 453.6 billion in the third quarter. South Africa is enjoying a brilliant export year. A record gold price has helped, as well as bountiful agricultural exports. For example, corn exports rose 235% to 963,441 tonnes in the third quarter, while South Africa could export almost 10 billion pieces of citrus this year, one of the best seasons on record. This helped offset lower vehicle exports.

Massive trade surplus in the third quarter of almost R300 billion, the highest in 40 years. It will end the year with a record surplus, I think. Another reason for a strong rand

– Wayne McCurrie (@WayneMcCurrie) December 10, 2020

The trade surplus was also helped by the much lower price of oil, which meant that less money had to come out to pay for fuel. Furthermore, due to the depressed state of the South African economy, imports have been weak: companies are hesitant to import machinery and other expensive goods.

What also contributed to the current account surplus was a drop in dividend and interest payments to foreign investors who own South African stocks and bonds.

Because foreigners have been selling so many stocks and bonds, dividend and interest transfers have dropped, says Old Mutual’s head of economic research. Johann The. So far this year, foreign investors have sold almost R140.5 billion more in South African stocks than they have bought, and almost R60 billion more in bonds.

South Africa is on track to post a current account surplus for all of 2020, Els predicts. This will be the first time in almost three decades that the country has achieved a sustained current account surplus.

What does this mean for South Africans?

A sustainable current account surplus generally indicates that the rand will remain stable or strengthen, says Els. If more money goes out of a country than in, it is bad for the value of a currency.

And a stable rand means that inflation will likely remain stable as well, which means that interest rates may not rise.

Is the current account surplus sustainable?

No, says Los.

Foreign investors are beginning to regain their appetite for investments in emerging markets such as South Africa.

For many months, investors have worried about the coronavirus pandemic and its impact on the world economy. They have been very risk averse, choosing to buy “safe” investments like gold, US bonds and dollars. But the recent good news about Covid-19 vaccines has increased confidence that the worst of the crisis could be over. Your appetite for risk has increased and emerging markets are back on the menu.

He expects more purchases of South African bonds and stocks in the coming months, which will increase dividend and interest payments next year.

Stronger growth is also expected next year, which should mean higher demand for imports. The government’s infrastructure initiative could also require increased imports of machinery and other equipment. This means that South Africa cannot export more than it imports next year, which will likely bring a return to the current account deficit.

Receive a daily news update on your cell phone. Or receive the best of our site by email

Go to the Business Insider home page for more stories.

[ad_2]