[ad_1]

The government has started a process of gradual reopening of the South African economy.

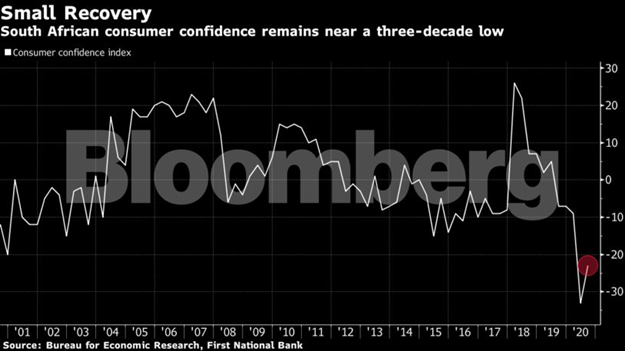

- South African consumer confidence held at a nearly three-decade low in the third quarter, even after a partial recovery as lockdown restrictions gradually eased.

- According to First National Bank, a quarterly index that measures confidence rose to -23 from -33 in the three months through June.

- Despite the improvement, sentiment is the weakest since the first quarter of 1993, when the economy broke through eight straight quarters of contraction amid the uncertainty that led to the nation’s first all-race pick.

South African consumer confidence remained at a nearly three-decade low in the third quarter, even after a partial recovery, as restrictions aimed at slowing the spread of the coronavirus pandemic gradually eased.

A quarterly index that measures sentiment rose to -23 from -33 in the three months through June, FirstRand’s [JSE:FSR] First National Bank said in an emailed statement Monday.

Despite the improvement, sentiment is the weakest since the first quarter of 1993, when the economy broke through eight straight quarters of contraction amid the uncertainty that led to the nation’s first all-race pick.

The median estimate from three economists in a Bloomberg survey was that the index, which was compiled by the Office of Economic Research, would rebound to -30.

The government began a gradual and phased reopening of the economy on May 1 and moved to so-called level 2 in mid-August, allowing most business and domestic travel to resume.

However, many companies permanently closed or laid off workers during the shutdown, and the unemployment rate likely rose to 35% in the second quarter, according to the median of estimates from eight economists in a Bloomberg survey.

The easing of restrictions and the resumption of economic activity “has finally allowed the majority of consumers to go back to work and earn a living,” said Mamello Matikinca-Ngwenya, chief economist at FNB. “Low-income consumers who were largely unable to work from home would have been particularly relieved by this development.”

Longer recovery

The partial recovery was driven by improvements in the sub-indices that measure household financial prospects and the convenience of buying durable goods. However, the sub-index that measures the economic outlook deteriorated to a nearly four-year low.

The difference between consumers’ outlook for their finances and the national economy may be due to an increase in social welfare spending by the government and temporary relief measures for workers who lost their income due to the virus and the shutdown, he said. Matikinca-Ngwenya. It could also reflect expectations of a higher salary by those unable to work or had to work reduced hours, he said.

“Unfortunately, there is a significant risk that family finances, in general, will recover less or take longer to recover than consumers currently anticipate,” said Matikinca-Ngwenya. “Not only will the Covid-19 social grant supplements and the new social distress relief grant expire in October, but job losses are projected to further increase over the next six months.”