[ad_1]

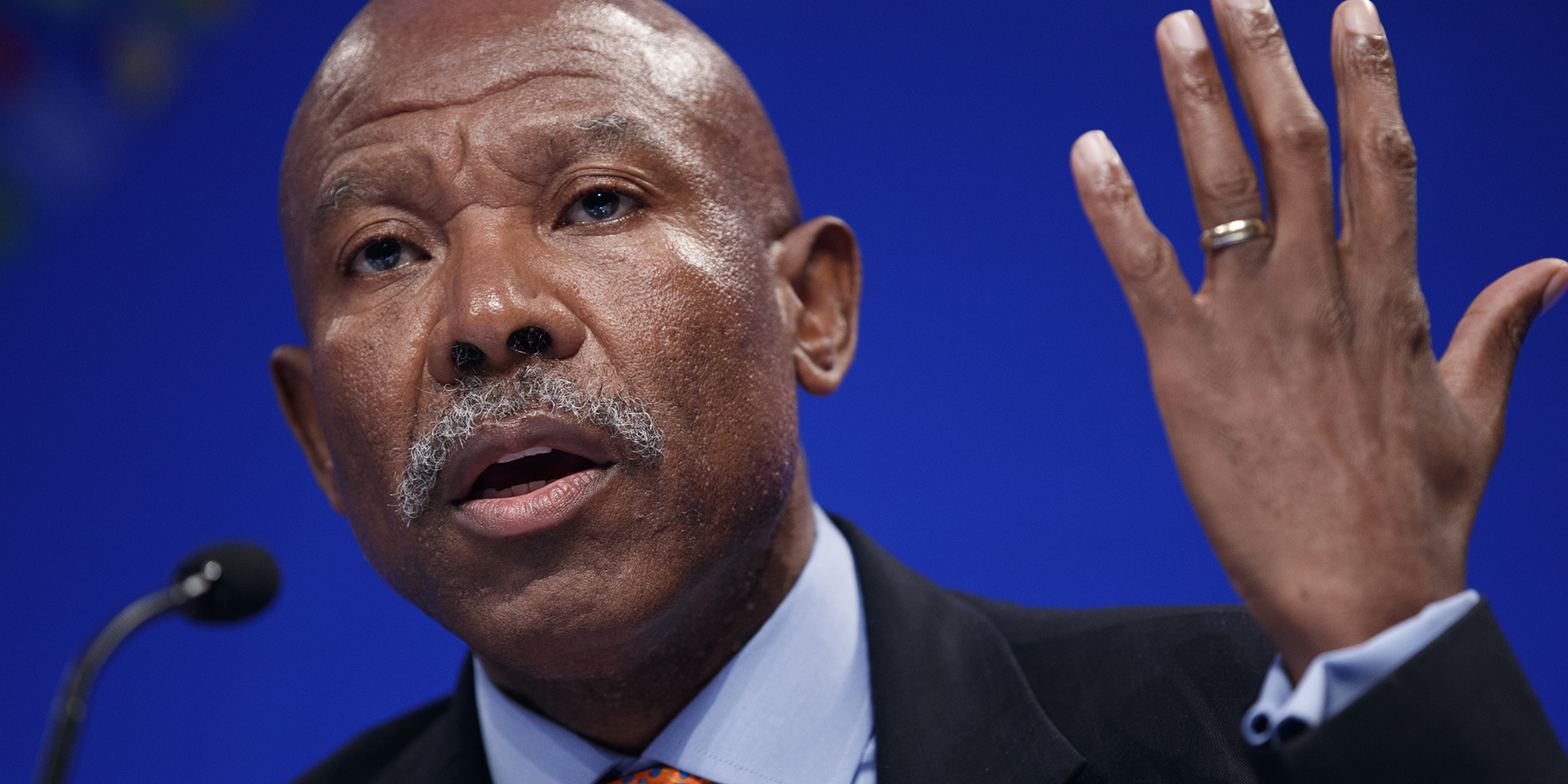

Governor of the Reserve Bank of South Africa, Lesetja Kganyago. (Photo: EPA-EFE / SHAWN THEW)

The Reserve Bank of South Africa expects the economy to expand massively in the third quarter, but starting from a low base after the collapse of the second quarter. And while it has room to cut interest rates, the bank has kept its finger off the trigger for now.

The statement of the Monetary Policy Committee (MPC) read by the Governor of the Reserve Bank of South Africa (SARB), Lesetja Kganyago, was of a moderate tone, suggesting that an interest rate cut is possible, but not in this moment.

The governor ended Thursday’s press conference by wishing everyone a Merry Christmas, it was the last MPC meeting of 2020, but there was no parting gift in the form of a rate cut. Still, the SARB has cut its key interest rate by 300 basis points so far this year, to 3.5%, so the governor could argue that it was not a Grinch and that Santa arrived earlier this year. year. In fact, his first appearance was around Easter.

While the MPC kept rates, it hardly stayed in a hawkish mode:

“The overall risks to the inflation outlook appear to be downward in the short term and balanced in the medium term. Global producer price inflation and oil prices remain low. Local inflation in food prices is expected to remain contained, ”he said.

Inflation is at the bottom of its target range of 3% to 6% and it was clearly stated that “there is no obvious pressure from the demand side.” With nearly half of the South African working-age population unemployed, that is to be expected, sadly.

The SARB revised its growth forecasts for the better, which may also explain why it kept rates stable. After bringing a chainsaw to the buyback rate this year, there’s not much else you can do to spur growth. That will require the structural reforms that the government has been slow to undertake.

“The bank’s forecast for GDP growth in the third quarter has been revised to 50.3% quarter over quarter, seasonally adjusted and annualized,” the statement said. As a result, you now see a slightly smaller contraction for all of 2020 of 8% instead of the 8.2% estimate it gave in September. A lot of data pointed to a massive rebound in the third quarter.

But that happens after the collapse of the second quarter, when the economy contracted just over 50% on an annualized and seasonally adjusted basis. If your GDP adds up to, say, 1 trillion rand and shrinks to 50%, it leaves it at 500 billion rand. If you add 50% to that, it hits R750 billion, which means there is still a lot of lost ground to make up.

Therefore, the MPC statement said: “Returning to pre-pandemic production levels … will take time. This year’s markedly lower investment by the public and private sectors will affect growth prospects in the coming years. GDP is now expected to grow 3.5% in 2021 and 2.4% in 2022. “Some bright spots were highlighted.

“South Africa’s terms of trade remain strong. Export prices of raw materials are high, while oil prices generally remain low, ”the statement read.

This is not a bad time to be the world’s leading producer of platinum group metals. Oil producers, on the other hand, are looking to the bottom of the barrel.

That, in turn, has supported the rand, which has gained about 7% against the dollar since the September MPC meeting, reducing its losses for the year to date to about 9%. Political uncertainty in the world’s largest banana republic, sparked by Donald Trump’s refusal to concede an election he lost two weeks ago, could further undermine the dollar and support the rand.

Is there an interest rate cut on the cards when the MPC has its next meeting scheduled in January?

“The path of the implicit policy rate of the Quarterly Projection Model indicates that there will be no more cuts in the buyback rate in the short term, and two increases of 25 basis points in the third and fourth quarters of 2021,” said the SARB . That would still mean relatively low borrowing costs for South African consumers, those lucky enough to be able to access credit. DM / BM

![]()