[ad_1]

ANALYSIS

- The latest GDP data was worse than expected.

- SA’s economy contracted by a wide margin.

- But due to the way it is calculated, the 51% title number may be a bit of a stretch.

- For more articles, visit www.BusinessInsider.co.za.

The latest economic data was enough to throw even the biggest South African optimist into a vat of existential despair.

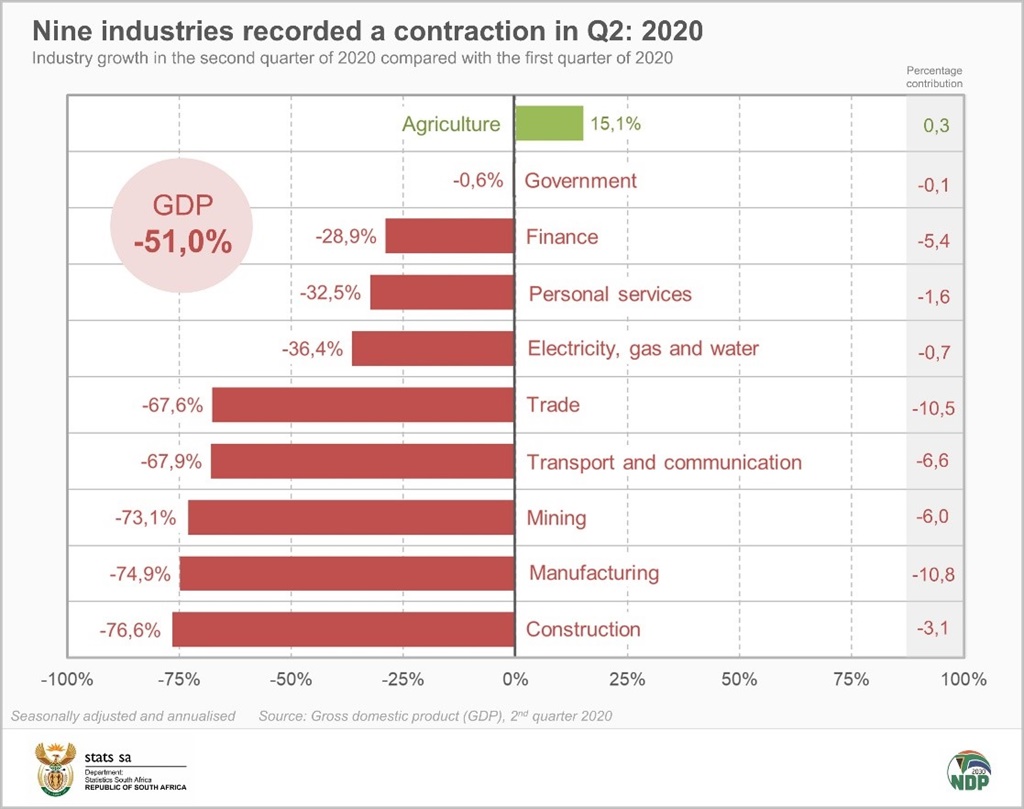

Given South Africa’s strict lockdown, with mining and manufacturing paralyzed for weeks, only limited purchases were initially allowed and a ban on restaurant visits, travel, alcoholic beverages and cigarettes for long periods, a sharp economic downturn was expected. Still, the headline figure, in particular, was a surprise: GDP fell 51% in the second quarter. It was worse than most economists expected.

Manufacturing and mining production fell more than 70% during the three months to June, as almost all sectors contracted.

Here’s what you need to know about the new GDP data:

Not really a 51% decrease

The leading figure of 51% does not mean that the economy more than halved in the second quarter.

In fact, the economy contracted “only” 16.4% from the first quarter to the second quarter. And compared to the second quarter of 2019, the economy was 17.1% smaller.

51% is seasonally adjusted, annualized Speed. Calculate how the economy would perform for a full 12 months if the quarterly performance were to repeat for another three quarters.

This annualized rate is calculated by increasing the percentage change between the two quarters by the power of four, after all seasonal effects of the numbers have been removed. “This method is based on the assumption that the percentage change from one quarter to the next will be maintained throughout the year,” says Statistics SA.

But the economy will (hopefully) also not contract by 16.4% in the next three quarters, which means that 51% should vastly overstate the rate at which the economy will contract over the next year.

Currently, the economy is expected to contract this year by between 7% and around 11%, depending on who you ask.

The contraction was in line with other countries locked

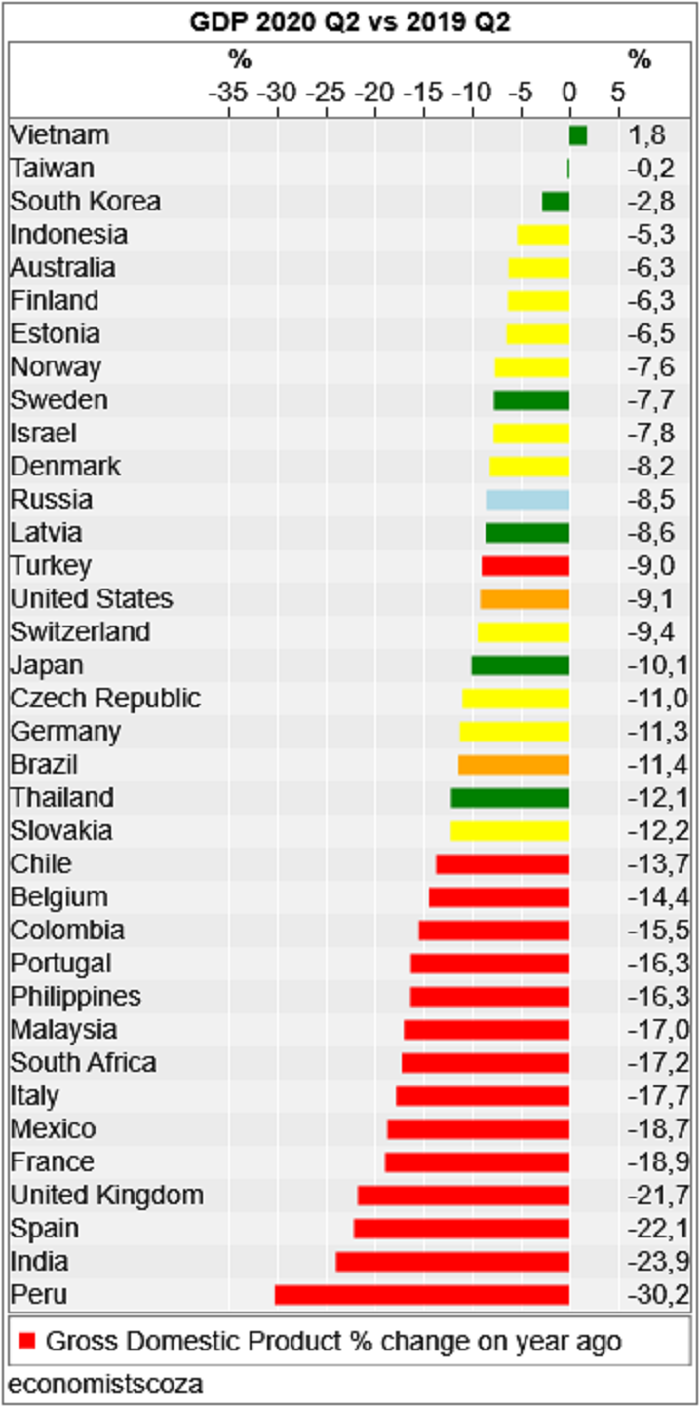

South Africa’s economy was 17.1% lower in the second quarter than in the same three months of 2019.

This is unfortunate, but in general it matches other countries that were also locked in. India (-24%), Spain (-22%) United Kingdom (-22%) and France (-20%) suffered greater falls and a higher number of deaths from Covid-19 than South Africa.

South Africa’s GDP drop was actually very much in line with that of other major countries, says Econometrix chief economist Dr. Azar Jammine..

Still, despite South Africa’s much lower death toll, it is unclear to him whether the strict lockdown succeeded, given that the country has some of the highest infection rates in the world. South Africa has had a total of more than 600,000 cases, which is the seventh highest number of infections in the world.

And unlike other countries, South Africa was already bleeding economically as it entered the pandemic. The last quarter was the fourth consecutive drop in quarterly GDP. (Ironically, the pandemic will pull South Africa out of recession: the recovery in the third quarter will finally bring a positive quarter, halting the negative streak, for now.)

Jammine believes that the country will take years to recover from the pandemic if the government does not address the fundamental problems of the economy: corruption; weak state companies; poor educational results; political uncertainty; land expropriation; inconclusion on the mining charter and the National Health Insurance; Small business over-regulation, as well as the high cost of the internet, given that connectivity will be even more essential in a post-Covid environment.

Lullu Krugel, chief economist at PwC Strategy Africa, believes that finding a solution to the country’s electricity problems should be the top priority. “PwC estimates that the negative impact of the load reduction in 2020 will completely cancel out the positive impact created by the interest rate cuts and payments under the [UIF’s] Temporary Assistance Plan for Employers / Employees (TERS) “.

Sanisha Packirisamy, an economist at Momentum, expects the economy to experience a “shallow recovery” of 2% next year, as an increase in the number of business closings, persistently higher levels of unemployment and continued challenges to the supply of electricity detract from the expected rebound. .

“In our opinion, the level of economic activity is likely to return to pre-Covid-19 levels by 2023/2024.”

Agriculture is doing very, very well

If there is a bright light amid the gloom and second quarter doom, it was agriculture.

Thanks to good rains and near-record harvests, the sector grew 15% (annualized) during the quarter. Summer cereal and oilseed production was 34% higher than last year, while the total maize harvest was 38% higher.

Estimates for the first winter harvest are also notably higher than last year, as good rains and snow boosted crop prospects in the Western Cape growing areas. The citrus industry is also booming, with citrus exports increasing 19% over last year.

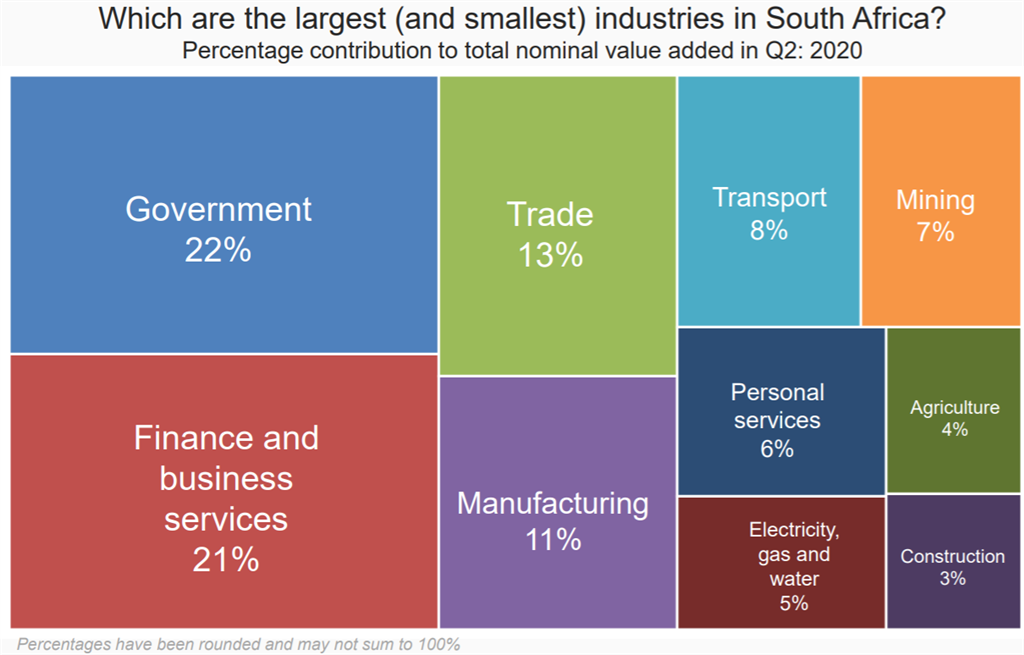

However, unfortunately, agriculture only accounts for 4% of the total economy:

Write in pencil another interest rate cut, or even more

The GDP figure was much worse than the Reserve Bank predicted: it was expecting an (annualized) drop of almost 33%.

So while consumer inflation unexpectedly spiked to 3.2% in July, and two of the five members of the monetary policy committee already voted against another cut in July, the depressing economy may convince them to take another rate cut. buyback next week.

Krugel believes that the combination of weaker-than-expected growth and still-low inflation opens the door for more than one rate cut in the short term.

So far this year, rates have fallen by 300 basis points, the lowest level in half a century.

Receive a daily update on your cell phone with all our latest news – click here.

Get the best of our site by email daily: Click here.

Also from Business Insider South Africa:

[ad_2]