[ad_1]

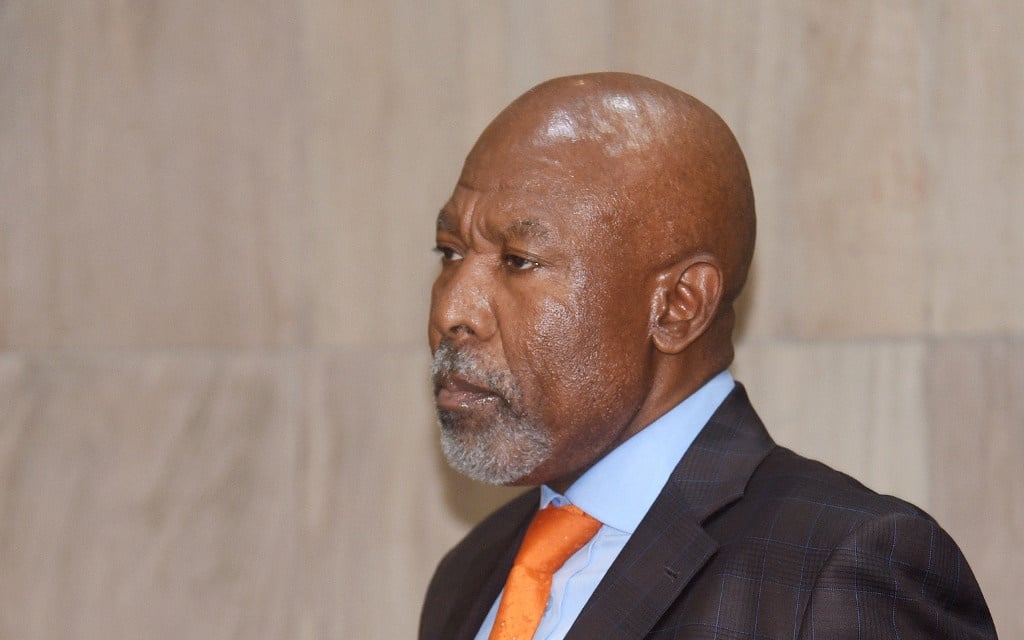

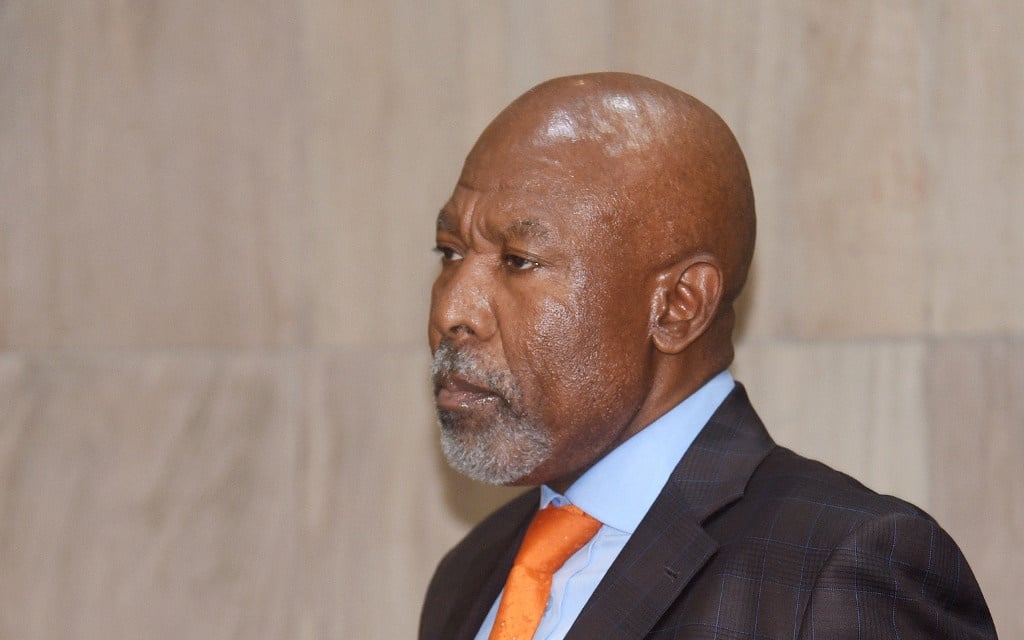

The Governor of the Reserve Bank of South Africa, Lesetja Kganyago.

Gallo Images / Business Day / Freddy Mavunda

Additional interest rate cuts will not solve the real problems that are holding back the country’s economy, said the governor of South Africa’s central bank.

“No amount of quantitative easing or lowering of interest rates would produce the kind of skills this economy needs,” Governor Lesetja Kganyago said in an interview with Business Day TV. “You do it through adequate educational policies.”

Some politicians and unions have urged the central bank to do more to support an economy that the bank expects to shrink 8.2% this year, even after it cut its key rate by 300 basis points.

A lockdown that has been in place to varying degrees for six months pushed the economy into its longest recession in 28 years with an annualized decline in gross domestic product of 51% in the second quarter (equivalent to a non-annualized decline of 16 ,4%). . Many companies permanently closed or downsized, and the unemployment rate likely rose to a record 35%, according to the median estimate of economists surveyed by Bloomberg.

Adding to South Africa’s educational problems is a national electricity company Eskom that cannot keep the lights on.

As the sadness of the most severe stages of the shutdown eased the ongoing blackouts that have periodically plagued the country since 2008 they returned in force. This year’s outages are the worst on record.

“We had just reopened the economy, but we had a power outage,” Kganyago said. “You cannot solve that problem using monetary policy. That tells you you have a structural problem. “