[ad_1]

The combined fiscal and monetary package to boost the economy as we fight Covid-19 is estimated to exceed R800 billion. But where will this money come from and has it already been paid?

More details are likely to be revealed once Finance Minister Tito Mboweni presents the adjusted budget to Parliament. The Treasury plans to be ready to present the budget by June 24.

The SA economy, meanwhile, is recovering from the devastating effects of the blockade, which was instituted just over seven weeks ago to curb the spread of Covid-19. The Treasury projects that the economy will contract up to 16.1% and that more than seven million jobs will be lost, as the worst case scenario.

Companies also report lower turnover and increasingly have to lay off staff, according to data from South African Statistics. A Nedbank survey showed that almost 70% of small businesses were unable to operate during the initial five-week shutdown, Fin24 reported.

But the government has been adamant about taking a risk-adjusted approach to reopen parts of the economy, so as not to have an influx of Covid-19 infections overwhelming the health system.

The government has made efforts to strengthen the “economic safety net” to support households and businesses during this difficult time. While the Treasury has developed a fiscal package worth R500 billion, the Reserve Bank has also taken steps to support the financial system, bringing the total stimulus to R800 billion, Finance Minister Tito Mboweni previously said.

“Our combined fiscal and monetary policy package exceeds R800 billion. This is an important fiscal and monetary policy response,” said Mboweni.

Tax response

According to Mboweni, the tax package allows spending on health care and “other front-line services” to increase by R20 billion immediately. This will support virus treatment, contact testing and tracing, and the purchase of personal protective equipment.

The government also intends to expand financial support through existing social programs to support low-income households. A total of R50 billion will be made available to complete social grants and provide social assistance for six months. Starting in May, child grant recipients receive an additional R300. Starting in June, caregivers will receive an additional R500 each. All other grants will be completed with an additional R250 per month for six months. A separate Covid-19 social relief grant of R350 has been established and will be paid over the next six months to those who are not employees and who do not receive social grants or a FIU benefit.

President Cyril Ramaphosa, in a briefing on Wednesday night, confirmed that three million South Africans had so far applied for the Covid-19 grant, Fin24 reported. Since the beginning of May, the government has paid an additional R5 billion to the beneficiaries of social subsidies.

The FIU will provide a total of R40 billion for employers to apply for financial support on behalf of their employees. Ramaphosa said so far more than R11 billion from the FIU’s Covid-19 aid plan had been paid to employees of more than 160,000 struggling companies.

A loan guarantee scheme was established, in association with major banks (including Absa, Investec and FNB, and Standard Bank), the National Treasury and the Reserve Bank of South Africa, to assist companies. This will have no immediate tax implications, according to the Treasury.

The plan was officially launched on Tuesday, May 12 and is made to help companies with a turnover of less than R300 million, to help them cover their operating expenses. The Treasury has provided a guarantee of R100 billion, initially, and there is an option to increase the guarantee to R200 billion if necessary and if the scheme is considered successful.

The government has also set aside R100 billion to support small businesses. Various government departments have established various funds: small business development, tourism, and the Industrial Development Corporation. These funds, as well as the South African Future Trust established by the Oppenheimer family, has provided assistance to more than 27,000 companies so far.

Meanwhile, a total of R20 billion is reserved to support the municipalities. The Treasury announced Tuesday that more than R5 billion was made available to municipalities to provide basic services such as water supply and sanitation to vulnerable communities during the shutdown, and to disinfect public transportation facilities.

“The largest amounts have been made available through the reallocation of conditional grant funds already allocated to municipalities in 2019/20,” the Treasury said. In addition, the Treasury has allowed funds transferred to municipalities, but not contractually committed, to be reallocated to responses to the Covid-19 pandemic.

A set of tax relief measures worth R70 billion is also part of the package. This includes deferral of tax payments on excise taxes, carbon tax and employee tax. The government has postponed some corporate tax proposals, outlined in the national budget. SARS will also accelerate VAT refunds. Donations to the Solidarity Fund, created to support the vulnerable, will also be tax deductible.

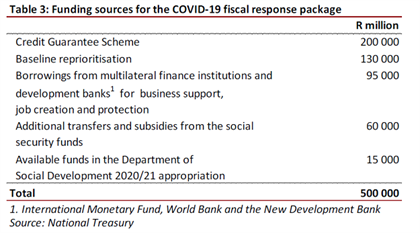

Funding sources for the R500 billion tax package include a new prioritization of R130 billion from the existing budget. The government is in talks with multilateral institutions such as the World Bank, the IMF and the New Development Bank to secure R95 billion in financing, while the appropriation department for social development allocates approximately R15 billion for 2020/21.

Monetary policy response

The balance would come from monetary policy measures, according to the Treasury. “The Reserve Bank of South Africa (SARB) estimates that the monetary and financial policy elements of the package of measures will inject more than R300 billion into the economy. This brings the total combined fiscal and monetary policy measures to more than R800 thousand. millions”.

As part of its contribution to ensure the smooth functioning of financial markets, the Reserve Bank has injected liquidity by reducing the repurchase rate by 200 basis points, and during April purchased government bonds worth R11.4 billion .

Deputy Finance Minister David Masondo previously shared views that he would not oppose the Reserve Bank buying government bonds directly, rather than the secondary market as a means to support the Covid-19 measures, as well as the structural reforms for growth.

Reserve Bank Governor Lesetja Kganyago has emphasized that the purchase of bonds is strictly to address dysfunctions in the markets. Kganyago also said the bank would attend the party to support the SA economy, using its tools when appropriate and in accordance with the bank’s mandate, Fin24 previously reported.

The Reserve Bank has also relaxed regulatory requirements for banks to extend more loans. Potentially this could free R540 billion into the economy, Business Insider reported.