[ad_1]

- The pandemic has wreaked havoc on South Africans’ ability to repay debt, a new report from TransUnion shows.

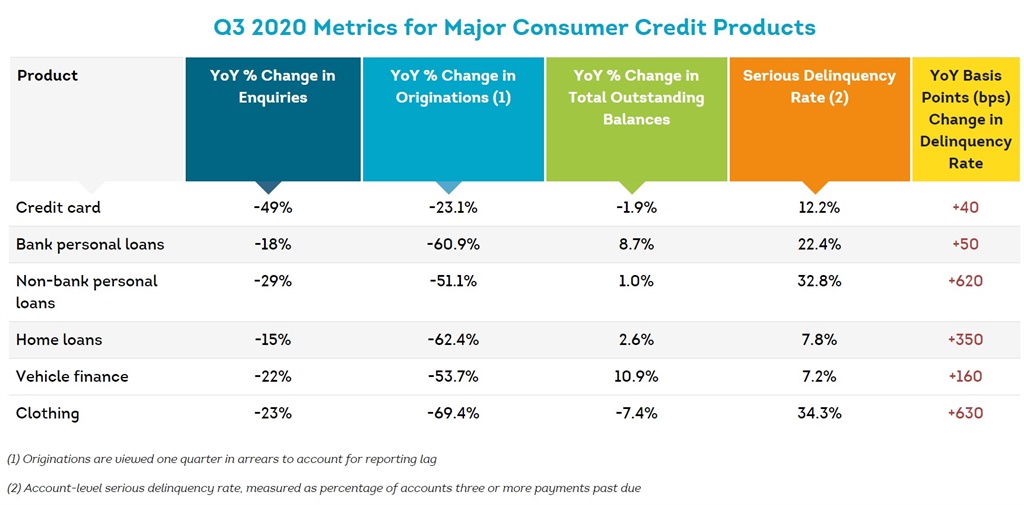

- A third of clothing account holders were behind on three or more payments in the third quarter of this year.

- Most credit categories experienced sharp increases in defaults, but credit cards were the least affected.

- For more articles, go to www.BusinessInsider.co.za.

A third of clothing account holders have fallen behind on three or more payments by the third quarter of this year, a new report from the credit reporting group TransUnion shows. Out of the 17.2 million apparel accounts in South Africa, the average outstanding balance reached 100 R2.

The South African Industry Outlook Report for the third quarter of 2020 shows that 12% of credit cards and 22% of personal loans made by banks were now also past due on three or more payments, which ranks as a “serious delinquency”. Almost a third of non-bank personal loans were behind on three or more payments.

Most credit categories saw an increase in severe delinquencies. Clothing accounts and non-bank personal loans registered increases of more than 6 percentage points from the previous year. Credit cards, which only grew less than half a percent, were the least affected.

“Consumers may be prioritizing credit card payments to preserve both the utility and liquidity they provide in times of Covid-19,” TransUnion said in a statement.

The average outstanding balance of the seven million credit cards in South Africa increased by 1% over the past year to almost R18,800. The average credit line granted by credit card is around R35,000.

The average holder of a personal bank loan now has an outstanding balance of R40,000.

“In some cases, bank personal loans are used as a holiday payment mechanism in which loan balances are increased to provide liquidity. This leverage is helping consumers avoid delinquencies and, at the same time, increasing overall outstanding balances (up 8.7% year-on-year in Q3 2020), ”concluded TransUnion.

A TransUnion survey of South Africans shows that 85% of consumers are concerned about their ability to pay bills and loans, and 29% expect to find a deficit within a month.

The weak state of the economy and downsizing fears have dominated South Africans’ appetite for new credit: the number of new personal bank loans and home loans granted in the third quarter fell by more than 60%, while new clothing accounts fell nearly 70%. .

Receive a daily news update on your cell phone. Or receive the best of our site by email

Go to the Business Insider home page for more stories.

[ad_2]