[ad_1]

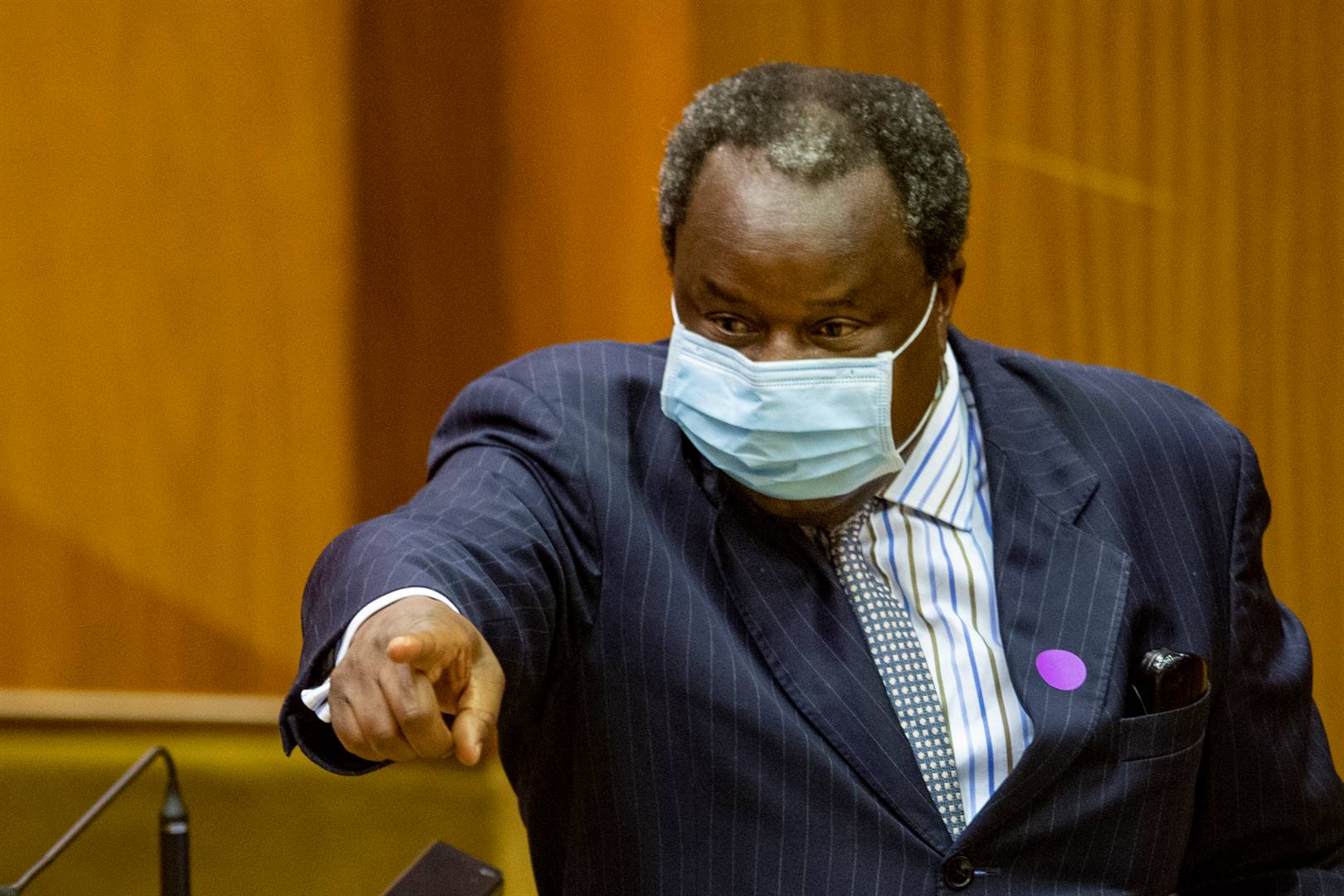

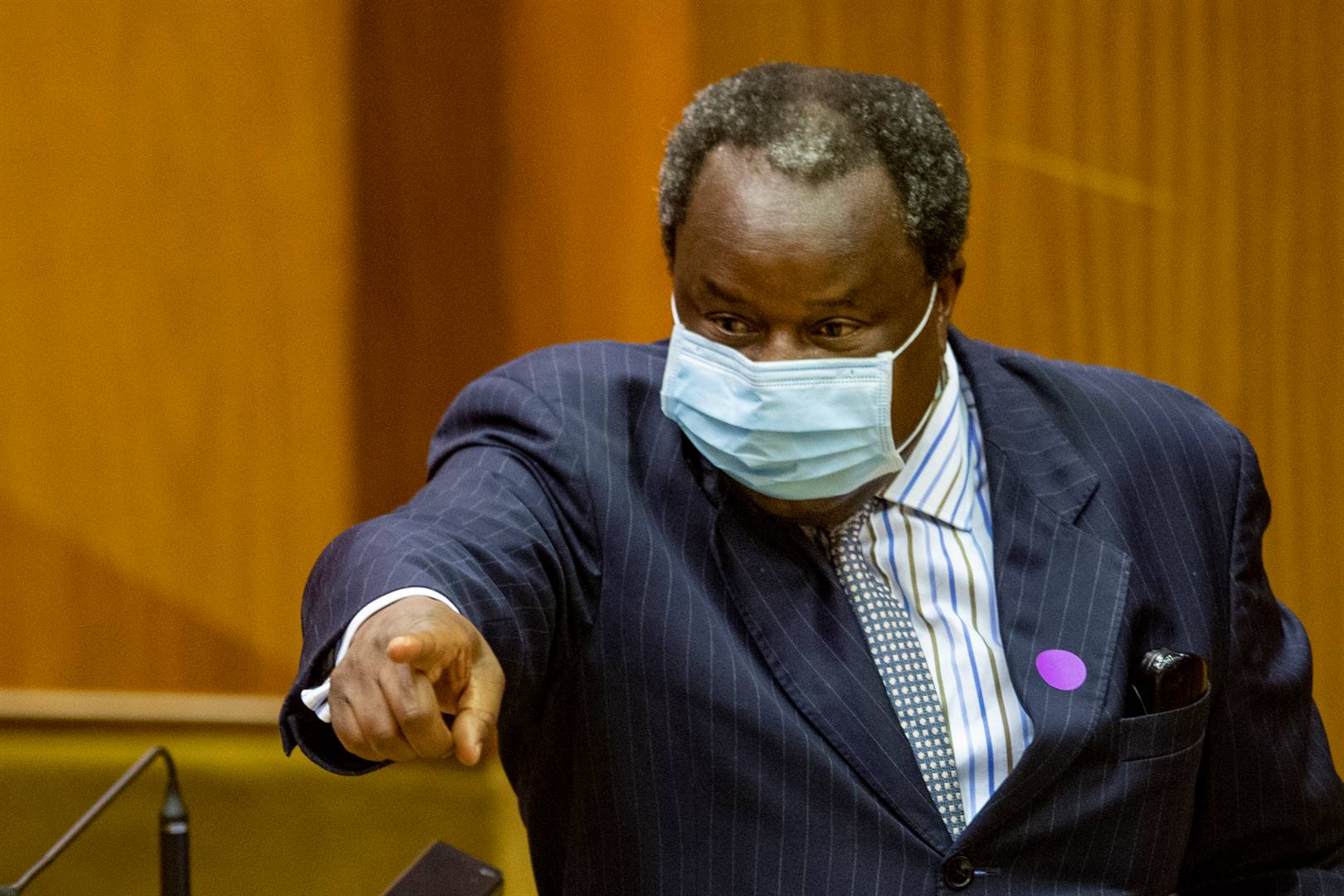

The Minister of Finance, Tito Mboweni. Photo: Jaco Marais

- Several municipalities across the country have stopped paying workers‘pension contributions to their respective pension funds.

- Finance Minister Tito Mboweni said municipalities in the Free State, North West and Northern Cape were the hardest hit by defaulting on pension fund contributions.

- The district attorney said he would press charges against the municipal officials involved.

While governance failures have nearly decimated some of the country’s poorest municipalities, roving officials have not been paying millions in employer contributions to workers’ pension funds, a parliamentary response revealed.

Due to the lack of transfer of contributions to pension funds, the pensions of some 1,600 municipal employees have expired and 64 employees cannot retire because they do not have access to retirement funds.

Cillier Brink, a spokesman for the district attorney in local government, said the party would file criminal complaints against the municipal officials involved.

“Hundreds of millions in interest have also accrued on these pending pension transfers, effectively to the account of residents and taxpayers,” Brink added.

In response to a parliamentary question from DA MP Samantha Graham, Finance Minister Tito Mboweni revealed that the Free State, North West and Northern Cape were primarily affected by non-compliance with pension fund contributions.

Mboweni said:

“The provinces that do not appear to have cases of non-payment of pension fund contributions are Gauteng (GP), KwaZulu-Natal (KZN), Mpumalanga (MP) and Western Cape (WC). The National Treasury will engage with the relevant authorities (provinces, regulators and national departments) to consider more effective and rapid responses to such non-payment of contributions to retirement funds by any state body, including reporting to the National Treasury or provincial treasuries. as part of the current financial information system in terms of the Municipal Financial Management Law “.

Several municipalities have defaulted on pension fund payments. Most of the municipalities are local municipalities.

Are:

- Eastern Cape

- Beyers Naude: R25 982 074.82

- River Valley Sundays: R1 192 370

- Great Kei: R627 525.82

- Forest: R6 058 151.01

- Walter Sisulu: R8 936 753.31

The municipality of Dr Beyers Naude is up to date with the contributions to the pension fund, however, the municipality indicated that there was a pending case in the Superior Court that is a dispute with the Samwu Provident Fund for contributions that increased from 2007 to 2013 and amounted to R17 million. , including interest. The municipality is contesting this amount.

READ | Mboweni assures the public that unclaimed pension fund benefits will not be used for Covid-19 relief

The local municipality of Walter Sisulu has paid the outstanding balance for each individual employee nearing retirement.

Free State

- Kaponong: R113 120103

- Mohokare: R60 970 287

- Masilonyana: R6 317312

- Matjabeng: R16 558 368

- Dihlabeng: R3 540 987

- Nketoana: R7 692608.00 (Four employees’ pensions expire due to defaults)

- Maluti-a-Phofung: R5 598 892

- Mantsopa: R3 200,000

- Mafube: R6 971185

North Cape

- Kammiesberg: R1 344 042.78

- Renosterberg: R5 274 175.62 (96 employees’ pensions have expired due to non-compliance)

- ! Kai! Garieb: R5 436 667.35

- ! Kheis: R9 123 276.57

- Magareng: R1 360 000

northwest

- Kgetlengrivier: R3 507 344.20 (224 employee pensions expire due to non-compliance)

- Tswaing: R27 647 776 (228 employees’ pensions have expired due to non-compliance)

- Naledi: R11 655185 (606 employee pensions have expired due to non-compliance)

- Mamusa: R12 163 312.26 (161 employees’ pensions have expired due to non-compliance)

READ ALSO | Over the counter, but we need pension funds to support the recovery plan, says Masondo

Mboweni said that the practice of non-payment of pension contributions to the pension fund by employers was a criminal offense under Section 13A of the Pension Fund Act after the law was amended in 2013.

“The law also holds employers personally liable for non-payment of pension contributions to a pension fund. Additionally, the Financial Sector Conduct Authority (FCSA) has published a Draft Standard of Conduct for public comment in May 2020 , related to the requirements for the payment of contributions to the pension fund ”, he added.

After processing the comments received to review the Draft Standard of Conduct, the FSCA will forward it to Mboweni, who will then forward it to Parliament.