[ad_1]

Thoughts Catalog / Unsplash.com

United States Federal The Commerce Commission took a major step towards Facebook’s potential breakup by formally filing an antitrust lawsuit against the tech giant, accusing it of abusing its monopoly powers on social media to stifle competition.

The FTC and a coalition of states that also sued the company focused on Facebook’s acquisition of the photo-sharing app Instagram in 2012, and the deal for the messaging service WhatsApp two years later. The deals, which left regulators behind when proposed, were intended to “quell” competitive threats, the commission wrote in its complaint Wednesday. Now, the FTC wants Facebook to ditch the two businesses, an idea that poses an existential threat to the empire built by CEO Mark Zuckerberg.

Because much of the company’s revenue growth already comes from Instagram, and WhatsApp is central to Facebook’s bid for digital commerce, losing both platforms would threaten to erase much of Facebook’s long-term value. Shares in the company, which have soared more than 35% in 2020, fell as much as 4% on Wednesday, ending the trading day down about 2%.

“Breakouts are scary for investors because they could somehow disrupt business models,” said Dan Ives, an analyst at Wedbush Securities, who called Instagram one of the top three business acquisitions of the past 15 years. Still, Ives believes that the possibility of an actual breakdown is “minimal” without legislative changes from the US Congress, which he believes are unlikely. “It’s a loud headline, but it doesn’t make a big difference for Facebook in the short term.”

As remote as the outlook, any sign that the FTC is leaning toward a breakout will likely weigh more on Facebook’s stock price.

Coverage

Facebook acquired these promising rival platforms precisely because it expected the main social network to fade one day, and it wanted to be the company that would decide which apps people would turn to next. A breakup would undo most of Zuckerberg’s coverage for Facebook’s future, just as his massive investments in Instagram and WhatsApp are starting to pay off. Facebook argues that those investments made Instagram and WhatsApp what they are today.

“Our acquisitions of Instagram and WhatsApp have dramatically improved those services and helped them reach many more people,” Zuckerberg wrote in an employee post Wednesday. “We compete hard and we compete fairly. I’m proud of that. “

Here’s how a forced breakup would affect Facebook’s prospects:

Electronic commerce

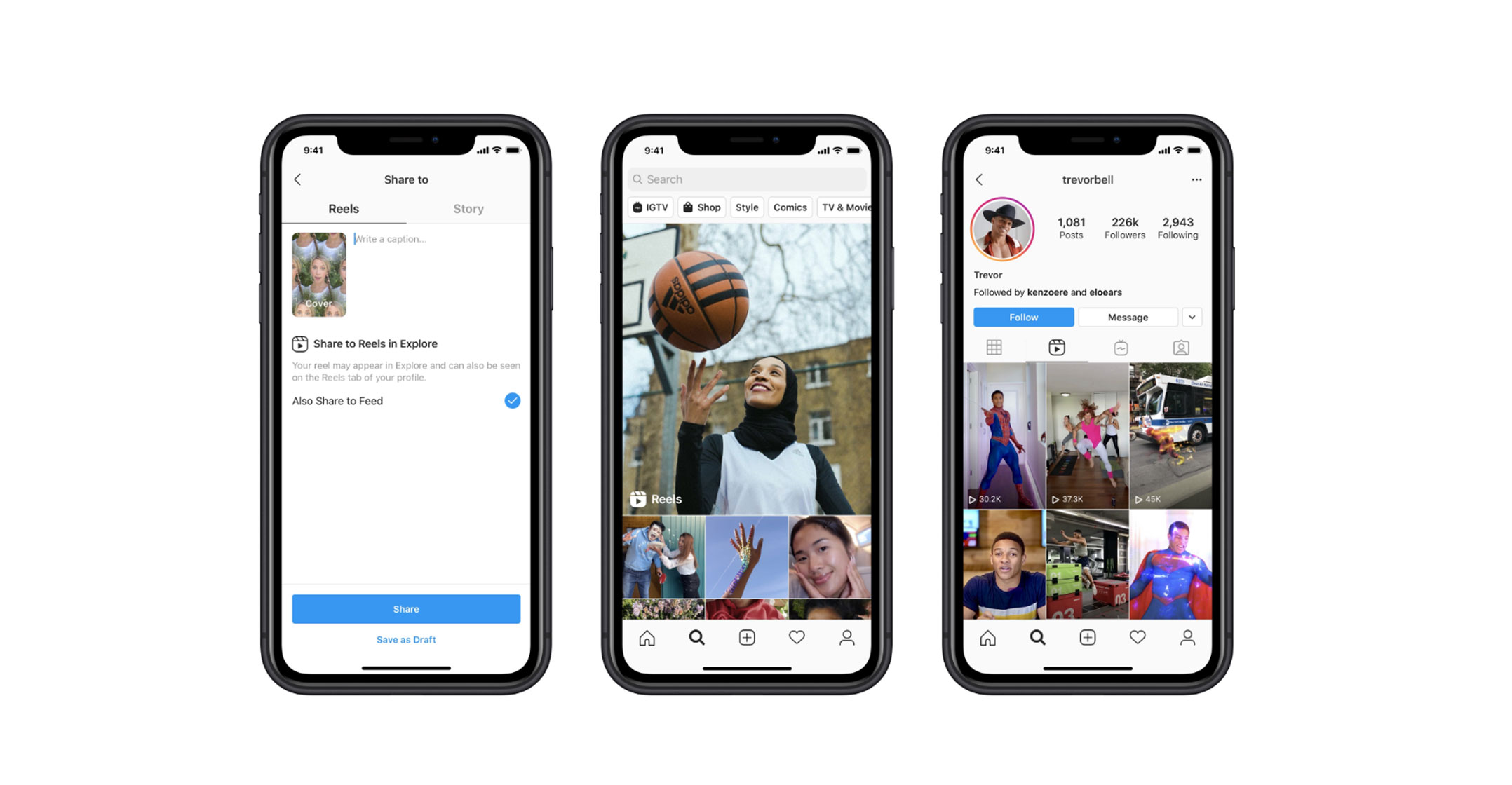

Facebook is running out of ad space on its flagship social network – too many ads in the feed diminish the user experience. So you are leaning heavily on the income potential of shopping. This year, the company has created ways to shop directly through images and videos on Instagram, and has brought together businesses from around the world to use WhatsApp to communicate with customers. Facebook has worked to weave those business aspirations with its main social network by requiring companies to have Facebook Pages to run Instagram ads, for example. The Menlo Park, California-based company also plans to eventually link WhatsApp chat with Instagram purchases. But without those two properties that businesses depend on, Facebook’s path to becoming an e-commerce giant seems much more difficult.

Revenue growth

The number of Facebook users has started to stabilize in some of its most valuable markets, and the company has been warning for years that News Feed’s main ad space is reaching saturation. That means the company’s recent revenue growth has been primarily driven by Instagram. The photo and video sharing app generated around $ 20 billion in revenue in 2019, which would equal roughly 29% of all Facebook ad sales last year. Research firm EMarketer estimates that Instagram sales in 2020 will be $ 28.1 billion, or about 37% of Facebook’s total ad revenue. That would mean Instagram’s $ 8.1 billion annual sales profit would account for the vast majority of Facebook’s ad revenue growth, according to EMarketer.

Meanwhile, WhatsApp makes practically no money for Facebook. But that is expected to change soon, as the company makes a big bet on payments, commerce and customer service tools for the more than two billion users of the messaging app. Any income WhatsApp generates will further fuel Facebook’s growth.

International markets

International markets

Both WhatsApp and Instagram are crucial to Facebook’s international strategy, providing the company with a solid foothold in fast-growing markets like India and Brazil. In some countries, WhatsApp or Instagram far outnumber their parent company by users. In India, for example, WhatsApp has more than 100 million more users than Facebook, according to EMarketer. That’s important to Facebook, which sees India as the next great internet frontier, and the company has raised concerns that Chinese competitors will come first. In Japan, Instagram has 70% more users than the main Facebook platform.

While Facebook remains the largest social network in most of the world, Instagram and WhatsApp give the company a much larger footprint than it would have as a standalone service. Losing those apps would drastically reduce Facebook’s total user base and, in turn, its revenue.

Demography

Everybody uses Facebook. Everyone except teenagers, that is. Pew Research found that 51% of 13-17 year olds said they used Facebook in 2018, compared with 71% a few years earlier. Meanwhile, Instagram was used by 72% of American teens.

Facebook isn’t as popular as it once was with the younger generation of Internet users, in part because it has so much more competition for Gen Z consumers. Instagram has been the company’s secret weapon in avoiding Snapchat, and it could eventually become a bulwark against the viral video upstart TikTok. Without Instagram in the fold, Facebook would have to create its own products that appeal to the youngest and most coveted group of Internet users, something it has been unable to do recently. There are no signs that you can suddenly do it without Instagram under the same roof.

Reputation

Reputation

As Facebook weathered scandals over privacy violations, misinformation, and election meddling, it became more common to hear people say they were leaving Facebook and that they planned to use Instagram and WhatsApp as alternatives to stay in touch with friends and family on line. Although they are all part of the same company, Facebook understands that its newbies have a more positive public reputation. The company recently put the Facebook brand on other members of its platform family, in an attempt to recapture some of those positive sentiments. Without Instagram, now with the “Facebook Instagram” brand, for example, Facebook will not be able to benefit from the more favorable attitude that the application has maintained among its users.

WhatsApp + Instagram

Facebook wouldn’t be the only company in a fight if divestments are ultimately required. WhatsApp has spent the past six years focused not on revenue or profit, but on user growth, reliability, and encryption – a freedom given it thanks to Facebook’s strong ad business, which paid the bills. WhatsApp is building a business, but there is no guarantee that it will be worth it, and without the deep pockets of Facebook, WhatsApp will be under greater pressure to make money.

Meanwhile, Instagram relies on Facebook for many parts of its operations, including the technology that powers the business of advertising and content moderation. An Instagram spin-off could mean building a whole new advertising platform and would also cut off access to important targeting data that Instagram gets from users’ Facebook profiles, possibly making in-app ads less relevant.

The photo-sharing app also relies heavily on Facebook’s automated content monitoring tools to combat hate speech, terrorist content, and other types of inappropriate posts by users, a system that the company has invested billions in. to develop and maintain as part of a safety push. An independent Instagram would potentially need to build those tools on its own. – Reported by Kurt Wagner and Sarah Frier, (c) 2020 Bloomberg LP