[ad_1]

- The rand has recovered to its best level since February on Thursday.

- This is largely due to an outbreak of dollar weakness, as traders take in the impact of the Biden administration on the US currency.

- Additionally, new confidence that the pandemic could soon be under control has increased appetite for emerging market currencies.

- For more articles, go to www.BusinessInsider.co.za.

On Thursday morning, the rand was trading around R15.11, its best level since February 26, exactly nine months ago. It was also stronger against the euro (R18.02) and the pound (R20.23).

The currency has come under massive pressure in recent months, exploding to R19.26 in the first week of April, shortly after South Africa entered a hard lockdown and the rating agency Moody’s downgraded the country’s rating to “junk.” .

Last week, Moody’s and Fitch further reduced SA to the trash, expressing concern about mounting government debt, with little confidence that the state will not follow through on its promises to cut spending on civil servants’ salaries.

So why is the rand rebounding?

Dollar weakness

Markets believe that the administration of President-elect Joe Biden will be less reluctant than Republicans to inject billions in stimulus into the US economy. This means more debt from the US government, which is negative for the dollar in the long run.

Biden is also expected to stop the US trade war with China and others. This will mean more imports to the United States, which could also weigh on the dollar. US importers will have to sell dollars to pay for the goods in another currency.

The dollar, a safe haven investment in times of tumult, could also weaken if the US gets a less erratic leader. The president of the United States, Donald Trump, has introduced a great element of uncertainty in the markets during the last four years with his pronounced pronouncements, specifically on trade and international relations.

High interest rates in South Africa

Traders are attracted to currencies that earn higher interest rates, and although rates have dropped to the lowest levels in half a century in South Africa, the benchmark rate of 3.5% is still much better than the one that they offer most of the other major currencies. . Many countries now have negative interest rates below zero percent.

And interest rates are not expected to fall in South Africa any time soon: This week, new consumer inflation figures hit a seven-month high, which may deter the Reserve Bank from easing its monetary policy.

Increased appetite for emerging market currencies

For many months, investors have worried about the coronavirus pandemic and its impact on the world economy. They have been very risk averse, choosing to buy “safe” investments like gold, US bonds and dollars. But the recent good news about Covid-19 vaccines has increased confidence that the worst of the crisis could be over. Your appetite for risk has increased and emerging market currencies are back on the menu.

In case you missed it: Top 3-year-ahead trades to 2021 are according to fund managers surveyed by BofA # 1) long emerging markets, # 2) S&P 500 and # 3) long oil. pic.twitter.com/IQ1byvib2U

– Holger Zschaepitz (@Schuldensuehner) November 22, 2020

South Africa’s current account looks better than in years

If more money flows from a country than inwards, it is bad for its currency.

Flows out of a country are measured by current account, and because South Africa imports most of its oil and pays huge amounts in interest and dividends to foreigners outside the country, the country has run a large current account deficit ( up to about 6% of GDP) for many years.

But this year the current account deficit will be closer to 0%, said Mike Keenan, head of fixed income and currency research at Absa, in a recent podcast. “This is very positive.”

The price of oil plummeted during the pandemic, and foreign investment in South African bonds and stocks has declined in recent years, which means lower interest rates and dividend payments being sent abroad.

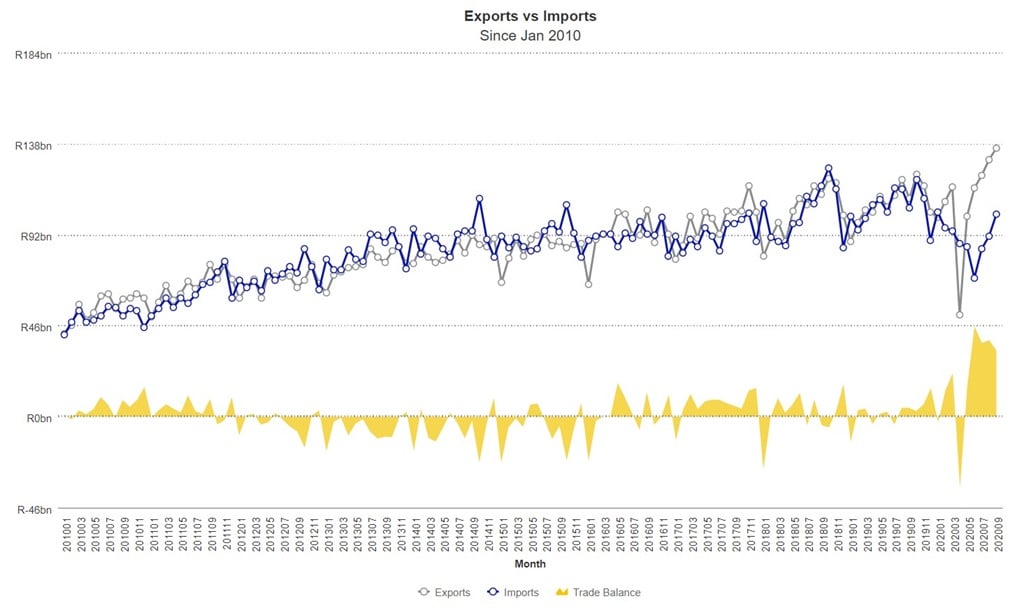

In addition, South Africa has had record harvests and its agricultural exports have been strong. And due to the depressed local economy, imports of machinery and other expensive goods have been weak. So where we generally import more than we export, this changed in 2020:

There are almost no current account deficits in emerging markets right now. The recession erased them. Under the hood, positive CAs reflect an increase in net savings in the private sector offset by large fiscal deficits (so the public sector is filling the gap in domestic demand). pic.twitter.com/MgnwNMJuYj

– Lanau Exhibition (@SergiLanauIIF) November 25, 2020

The rand is one of the most undervalued currencies in the world.

The Economist’s most recent Big Mac index, released in July, showed the rand to be 67% cheaper than it should theoretically be against the dollar, the worst undervaluation of any measured currencies.

The Big Mac index is based on the theory of purchasing power parity. In the long run, theoretically, exchange rates should be adjusted so that an identical product, the McDonald’s hamburger, must cost the same in all countries.

READ | The rand is now the most undervalued currency in the world – this is where it should be

While the vast majority of currencies were also undervalued against the dollar, Brazil by 32%, Argentina (-39%), India (-56%) and Turkey (-64%), none exceeded the rand. The rand was even weaker than the Russian ruble (-66.5%)

Just a decade ago, the rand was “only” 39% undervalued against the dollar, according to the Big Mac index.

Receive a daily news update on your cell phone. Or receive the best of our site by email.

Go to the Business Insider home page for more stories.

[ad_2]