[ad_1]

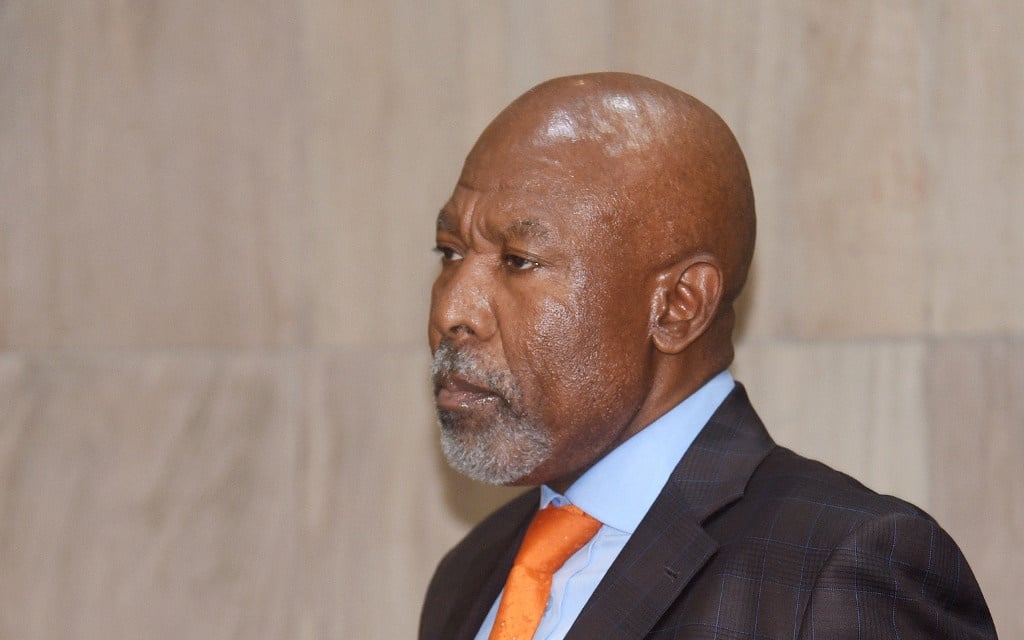

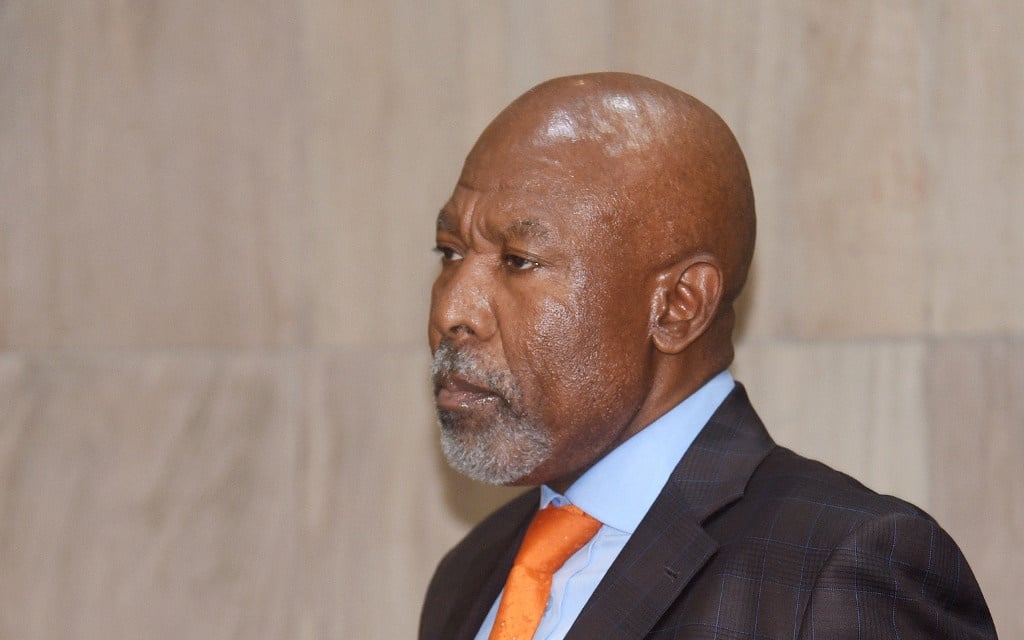

Reserve Bank of South Africa Governor Lesetja Kganyago announces a buyback rate cut at the central bank headquarters on January 16, 2020 in Pretoria.

Gallo Images / Business Day / Freddy Mavunda

Interest rates will remain at 3.5%, announced the Governor of the Reserve Bank, Lesetja Kganyago.

Kganyago spoke at a briefing on Thursday after the bank’s Monetary Policy Committee concluded its last meeting of the year.

Economists had predicted a “narrow divide” among members. According to Kganyago, two members were in favor of a cut, while three were not.

Inflation is expected to remain “well contained” in the medium term. The bank’s quarterly projection model indicates that there will be no further cuts in buyback rates in the short term, with increases introduced in the latter part of 2021.

The MPC also revised the economic contraction projection for the year to -8%, an improvement from the -8.2% projected in the last meeting. “At the local level, further easing of lockdown restrictions has supported economic growth, with high-frequency indicators continuing to show a rebound in economic activity during August and September,” Kganyago said. During a question and answer session, he explained that there has been increased economic activity in manufacturing and mining, so a “robust” performance is expected in the third quarter.

But Kganyago stressed that the lockdowns in Europe, South Africa’s major trading partners, will affect trade and, by extension, growth in the fourth quarter.

With rating agencies scheduled to make rating decisions this week, Kganyago noted that they can choose not to make announcements and wait. He said it is difficult to take into account their decisions, they are treated as a “risk event” if they affect the market. He said that in the bank’s commitments to the credit rating agencies, it is clear that they are not concerned about the stance of its monetary policy.

The MPC has reduced rates by 300 basis points this year.