[ad_1]

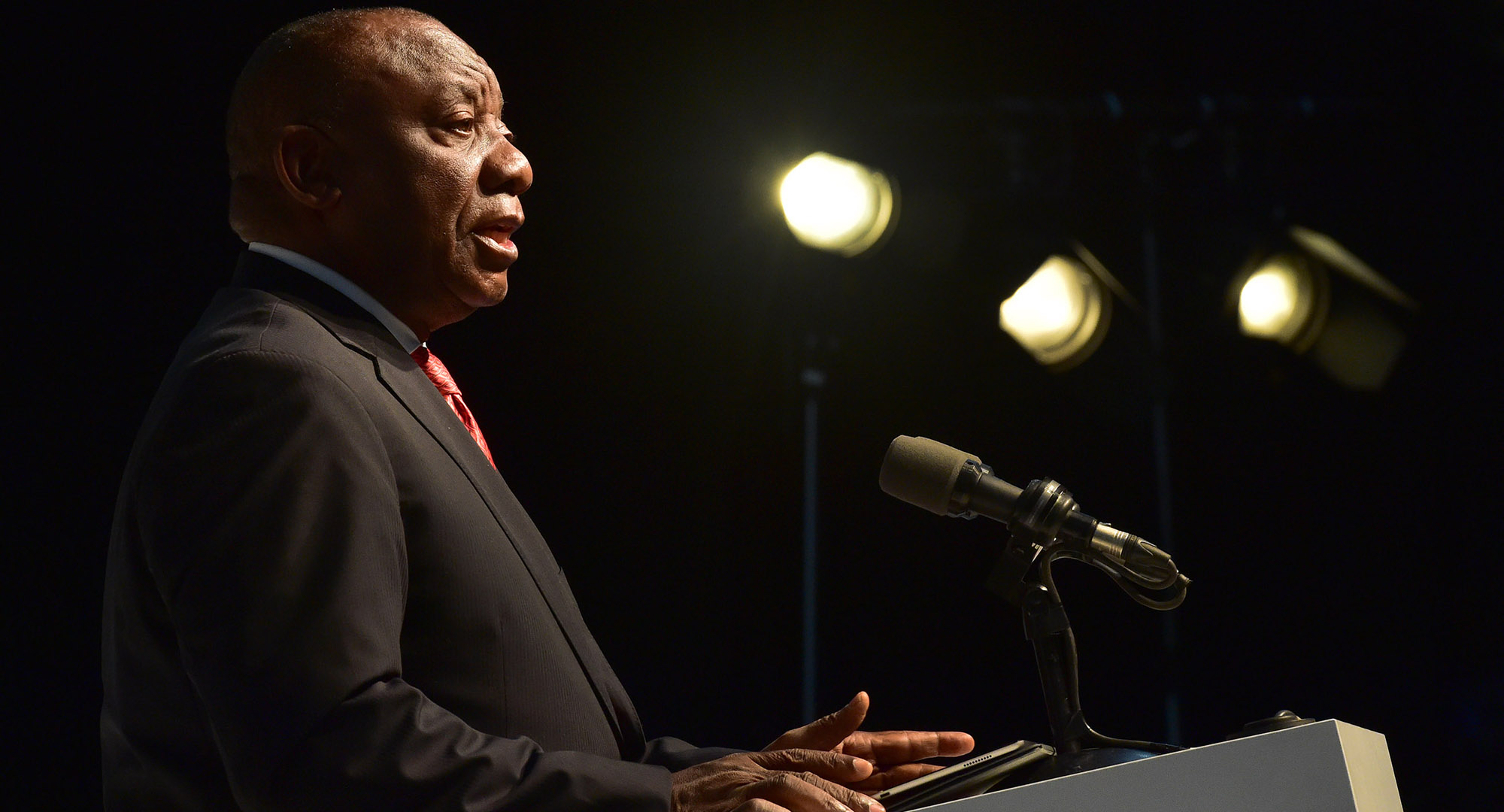

President Cyril Ramaphosa said the investment promises will go a long way towards rebuilding the economy in the wake of the devastating Covid-19 pandemic that has wiped out prospects for economic growth and job creation. (Photo: Flickr / GCIS)

The total sum of investment promises that the president has secured since the start of his SA Investment Conference in 2018 is R773.6 billion. It includes new investments and those previously announced by local and foreign companies.

President Cyril Ramaphosa’s push to raise R1.2-trillion over five years received a boost on Wednesday, November 18, when his third SA Investment Conference attracted R109.6-billion in investment commitments from local and foreign companies.

This brings the investment promises that Ramaphosa has secured since the conference’s inception in 2018 to R773.6 billion, including new investments and those previously announced by companies and outlined in their capital expenditure plans since 2017.

The Ramaphosa investment envoy team, which is responsible for marketing SA Inc to cash settlement investors, does not yet have the exact data on the split between new and existing investment promises.

But Trade, Industry and Competition Minister Ebrahim Patel, who is part of Ramaphosa’s investment team, said that most of the investment promises involve expansion of existing projects / investments by companies. In other words, it is not a new investment.

Regardless, Ramaphosa said that the investment promises will go a long way toward rebuilding the economy in the wake of the devastating Covid-19 pandemic that has erased prospects for economic growth and job creation.

“These investments will greatly contribute to the recovery of the economy,” Ramaphosa said, adding that he did not expect to attract investment this year from companies due to the pandemic.

“We don’t think about it [pledges raised] it would reach R100 billion. We think it would be lower than this. We even considered not hosting the investment conference, but the Cabinet said we should. “

The conference is part of Ramaphosa’s campaign to raise R1.2-trillion in new national and international investments over the next five years to boost South Africa’s fragile economy and create jobs. If it hits the target and the investment promises are met, they are expected to add 2.5% to SA’s gross domestic product by 2022/23.

Ramaphosa said that the third installment of the investment conference was about the implementation and delivery of the commitments made by the companies during the last two years. In 2018 and 2019, companies had pledged R664 billion, which included companies that built roads and other infrastructure, production factories and invested in research and design, or commitments to extend funds to small and medium-sized companies. Of the 664 billion rand in investment commitments, 70% were from domestic companies and the rest from foreign companies.

Impact of Covid-19

Ramaphosa’s investment envoys likely had a lot of work ahead of them in marketing SA as an attractive investment destination for potential investors during an economic crisis fueled by the Covid-19 pandemic.

SA’s economy, like others around the world, is expected to contract by more than 7% in 2020, according to government and business forecasts. Public finances have deteriorated further; the fiscal deficit (deficit between revenue and expenditure) increased from 6.4% of GDP in early 2020 to 16%, and the national debt is expected to peak at 95.3% of GDP in 2026.

During the pandemic, many companies and fund managers decided to defer capital allocations to a later stage until the world is safer, or worse, permanently eliminate them. SA has already experienced this enigma.

“Unfortunately, 21 projects, which represent around 10% of the total commitments [worth about R66-billion] – have been delayed or on hold as a result of the coronavirus pandemic. This means that, despite the severe disruption in recent months, the vast majority of projects are making steady progress, ”Ramaphosa said.

The SA Investment Conference in 2020 is more important to SA’s fortunes because aspects of Ramaphosa’s recently released plan, which seeks to restart an economy hit by Covid-19, rely on private sector investments.

For example, the Ramaphosa economic plan proposes that the government spend around R100 billion over the next decade on new infrastructure projects such as roads, water fountains and new power generation projects. The government will look to the private sector to finance infrastructure projects because it is running out of money quickly.

The investment conference was also an event for Ramaphosa to showcase the plan to investors. DM / BM

![]()