[ad_1]

Inglewood Oil reservoir pumping jacks work amid the coronavirus pandemic in Los Angeles, California. US crude oil prices turned negative on April 20 when demand disappeared due to lockdown measures. (EPA-EFE / Etienne Laurent)

The Covid-19 pandemic and measures to contain it not only paralyzed the oil sector in 2020. According to PwC’s Annual Oil and Gas Review for Africa, global oil demand is forecast to “ never again exceed 2019 levels. ” as the energy transition is new. wings. Talk about a game changer.

If the latest forecast from the international consulting firm PwC is good, the global economy will never consume the amount of oil it consumed in 2019 again. It’s all downhill for oil here.

Companies like Sasol will see “lower oil prices for longer.” Eternity certainly counts as “longer.” But the global economy is not expected to stop growing after it recovers from the collapse of 2020 and will continue to need energy.

“Fueled by the global Covid-19 pandemic, the world is finally galvanizing its commitment to moving towards a green and sustainable future by mid-century, and the global energy transition is the cornerstone of this new world,” says PwC.

“Covid-19 has not only caused the largest drop in global oil demand in history, almost 40 times worse than the global financial crisis of 2007, But, in fact, it has accelerated the global energy transition by up to five years, as the developed world uses the transition to renewable energy to anchor economic stimulus packages and new economic diversification. Now that world oil demand is projected to never again exceed 2019 demand levels, global energy markets have truly reached a tipping point, ”the report says.

The change in the space of a year has been dramatic:

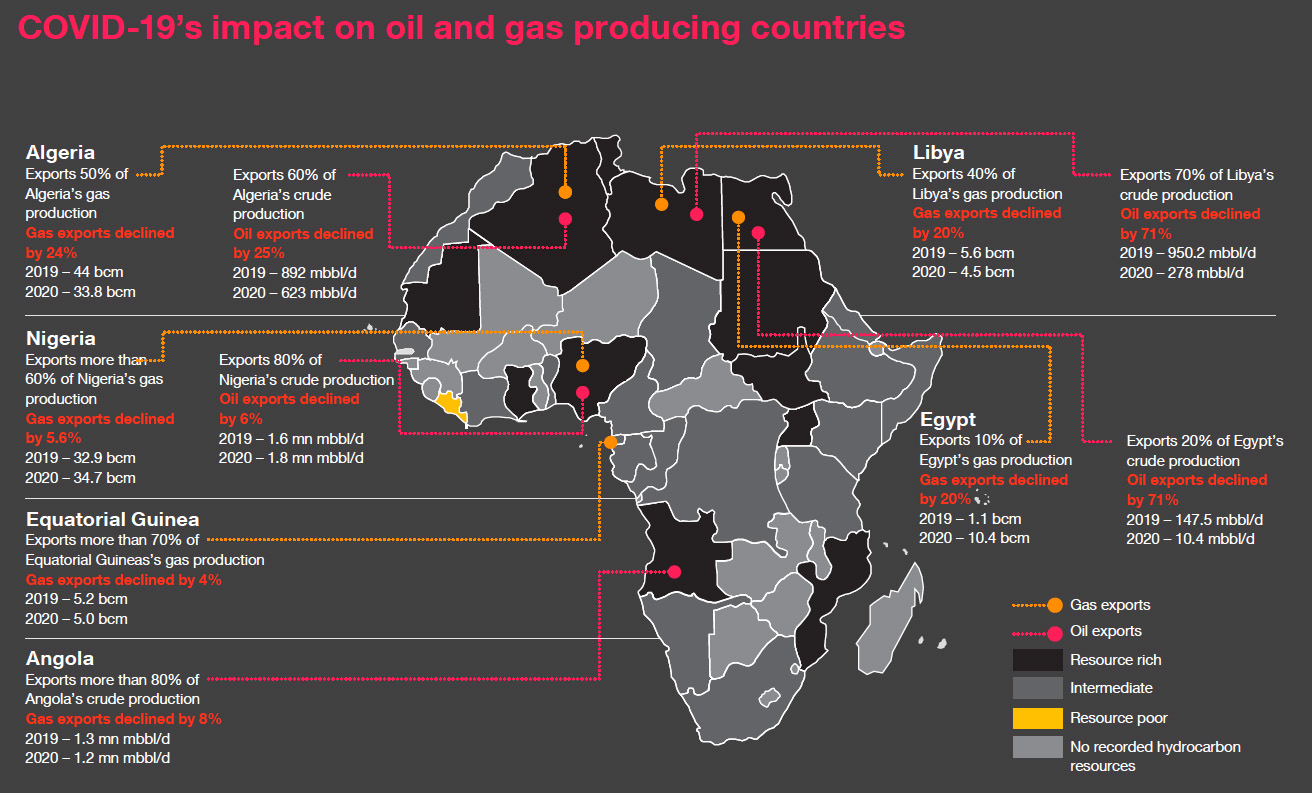

“In the 2019 edition of this report, many trend lines in the African oil and gas industry were heading into positive territory for the first time in many years. The exciting liquefied natural gas (LNG) developments in Mozambique were featured in our 2019 report as the industry flagship, destined to rival the growth and wealth of Qatar. As we approach the end of 2020 and review the estimated damages induced by the pandemic, we see significant delays in investments and projects in Africa, including Mozambique; an estimated decrease in oil production of 19% for the top five African producers by 2020, and an overall depressed market outlook. “

In Africa, Nigeria, Angola and other oil producers may face mounting fiscal strain as their over-reliance on crude takes its toll. Given the role oil has played in corrupting their policies and fueling conflict, that may not be a bad thing.

PwC notes: “In this changing world … Africa has the opportunity to take advantage of the global energy transition and the new global markets that are taking shape. The energy transition provides an opportunity for Africa ”… to diversify and address energy poverty and reap dividends from emerging investment incentives.

Indeed, as the continent considered by many to be the most affected by the climate crisis, Africa already has a significant social incentive to embrace renewable energy. Financial and investment incentives would give a boost to this.

“Africa can benefit enormously from technology initiatives and learning curves largely paid for by the developed world. Even though most African countries have ‘greening’ policies, implementation is largely poor, domestic market momentum is low, and countries cannot afford the level of investment or incentives that the developed world is implementing. “

So far, progress has been tepid. PwC notes that the African economies that have made the most progress, including Kenya, Algeria, Egypt, Morocco and South Africa, “are still not meeting their initial renewable energy installation targets.”

South African readers are certainly familiar with this topic, and the Department of Mineral Resources and Energy shows little sense of urgency, even when Eskom doesn’t keep the lights on. Yet Africa is not short of resources like sunlight to fuel a renewable transition.

There has been a lot of talk over the years about “peak oil,” which generally refers to production. The shale oil revolution ended that concept in the eyes of many energy analysts. But the peak in demand for oil is a different story.

Whether this is indeed the case remains to be seen, and it is probably premature to start writing the industry obituary. However, a tipping point appears to have been reached, with all the disruptions and opportunities that come with it. DM / BM

![]()