[ad_1]

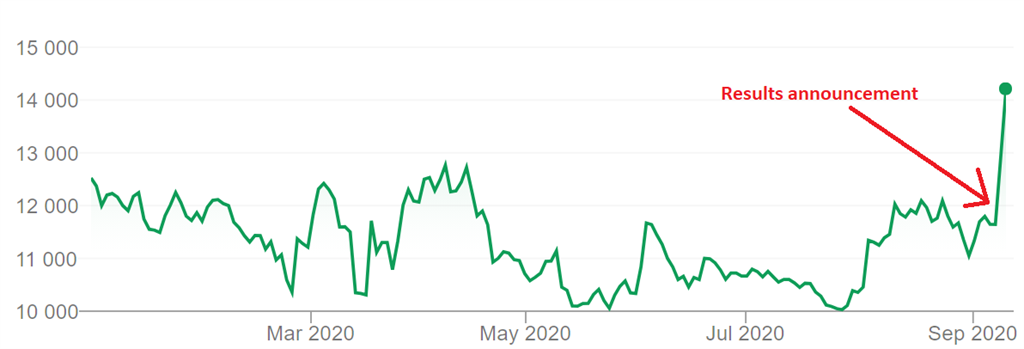

- Shoprite’s share price has soared nearly 22% in two days, after the company reported strong annual results.

- Sales in South Africa grew by almost 9%, with ladies in particular taking market share, probably from Pick n Pay.

- Across the group, prices were up 3% last year, from just 1.2% the year before.

- For more articles, go to www.BusinessInsider.co.za.

Shoprite’s latest set of financial results triggered an all-powerful rally in its share price, which soared nearly 22% in two days, adding 15 billion rand, nearly a full Truworths, measured in market capitalization, to its market value at the end of Wednesday.

His annual numbers were “ridiculously good”, according to fund manager Keith McLachlan, as the retailer increased sales, it stole market share, increased its overall profit by nearly 17% and increased its dividend by 20% for the year.

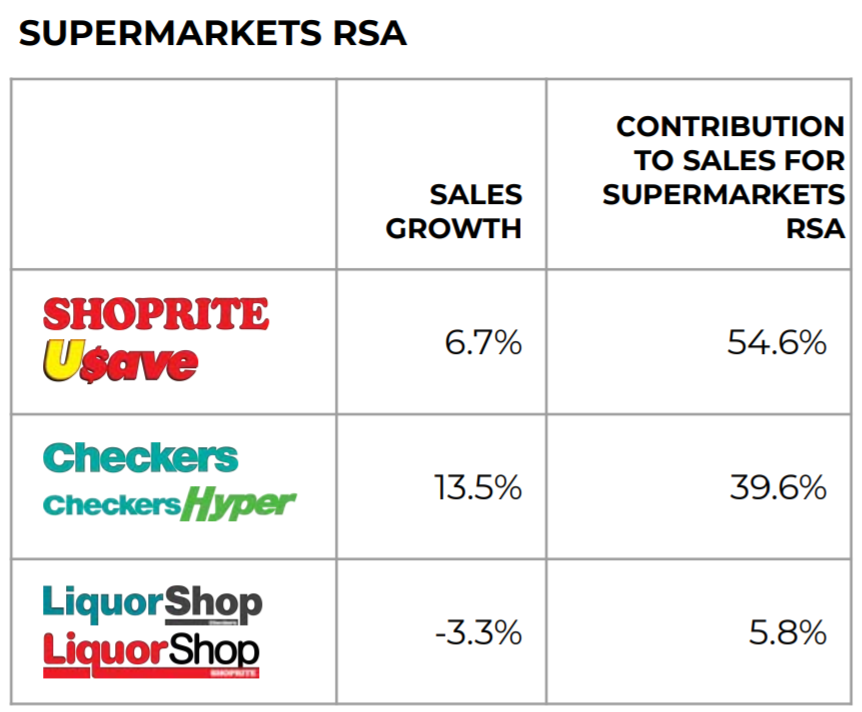

In its South African supermarkets, sales grew by almost 9%, and its business profits increased by 13% to more than R18 billion, the group reported Tuesday morning.

The ladies, in particular, saw strong sales.

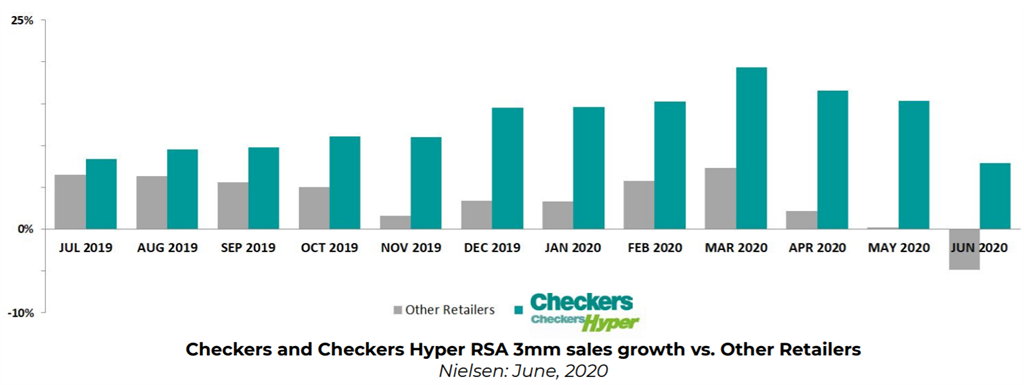

Shoprite says the group has gained market share for 16 consecutive months, and last year stole R4.9 billion in sales from its competitors.

It’s clear the group is taking market share from Pick n Pay in particular, says FNB portfolio manager Wayne McCurrie. Pick n Pay achieved sales growth of less than 5% in the year through March, before closing came.

Checkers garnered perhaps the largest market share of competitors, and the group said in a statement that its “assault” on premium food retailing had been successful, as it increased its “share of the luxury shoppers’ wallet.”

Checkers’ new Xtra Savings Rewards program exceeded expectations, with 5 million members enrolled, and its Checkers Sixty60 delivery app has been growing at breakneck speed, creating 1,250 new jobs.

The group was able to gain market share because of its logistical capacity to keep products available and because of its competitive prices, McCurrie says.

But while its products may be cheaper than many other stores, it saw a solid increase in its prices of an average of 3.0% over the past year, compared to domestic sales price inflation of just 1.2% in past year. Since the beginning of the new year, it has managed to increase prices at an annual rate of over 4%.

Shoprite’s margins will continue to benefit from some food inflation that’s coming in, McCurrie says.

The group is also experiencing strong growth in sales of its own-brand products, which now account for 17% of its total sales, and more than half of all buyers bought these products last year.

“Shoprite’s cash flow generation is just amazing,” adds McCurrie.

At the end of June, Shoprite maintained a net cash position of R10 billion, up from R3.6 billion at the end of the previous year. The company managed to reduce its net loans by 76%, from R8.1 billion to R2.0 billion in a single year.

Their results weighed on supermarkets outside of South Africa. While its stores in 11 of 13 countries sold more in local currencies, foreign exchange losses, especially in Angola, were substantial. The group is now closing its stores in Kenya and is in talks to sell its Nigerian chain.

Despite record earnings over the past year, Shoprite’s share price is still down nearly 47% from two years ago. McCurrie calls Shoprite “probably a buy”, even after this week’s skyrocketing rally.

Compiled by Helena Wasserman

Receive a daily update on your cell phone with all our latest news – click here.

Get the best of our site by email daily: Click here.

Also from Business Insider South Africa:

[ad_2]