[ad_1]

South Africa’s National Treasury expects job losses, tax losses and a shrinking economy due to the coronavirus pandemic and blockade to stop its spread.

The finance minister will only present an adjustment budget, which explains the impact of economic and pandemic relief measures, in June or July, according to Treasury officials and prosecutors who briefed lawmakers on the possible impact of the virus on Thursday.

South Africa’s economy could contract as much as 16.1% this year, depending on how long it takes to contain the coronavirus pandemic and how the economy recovers until the end of 2020, according to Treasury estimates.

“We have to move quickly to bring the economy back to normal, but also bear in mind that we have to contain the impact of the virus,” said Dondo Mogajane, director general of the National Treasury.

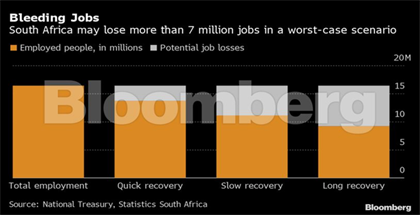

The Treasury scenarios showed that more than 7 million jobs could be eliminated as a result of the virus and the blockade that has stopped almost all economic activity. Manufacturing, construction, commerce, catering and accommodation, as well as financial and business services, will be the most affected sectors.

The Treasury was expecting a “substantial” revenue deficit from the tax collection estimate of $ 1.43 trillion in the February 26 budget. That is due to weak economy and virus-related tax relief measures, the Treasury said.

While the forecasts have yet to be updated, tax collection could drop 32% or more, according to Finance Minister Tito Mboweni.

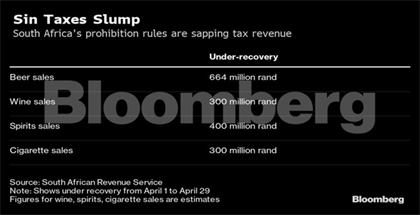

The ban on the sale of alcohol and tobacco products during the shutdown has already led to an insufficient recovery of more than 1.5 billion rand last month alone, said Edward Kieswetter, commissioner of the South African Revenue Service.

The country counts on accessing $ 5.07 billion from multilateral lenders and development banks, including the International Monetary Fund, the World Bank and the New Development Bank to help finance the government’s stimulus package.

The term for some of these loans would be up to 35 years, which includes a grace period and no post-disbursement conditionality, according to the Treasury. The cost of financing the loans is favorable relative to market prices because they are not based on the country risk premium, the Treasury said.

The Treasury presentation followed a downgrade of S&P Global Ratings’ credit rating, which has brought South Africa’s debt assessments to the lowest levels thus far.

The downgrade is “a great blow to the country” and underscored the need for structural reforms, Mboweni said.