[ad_1]

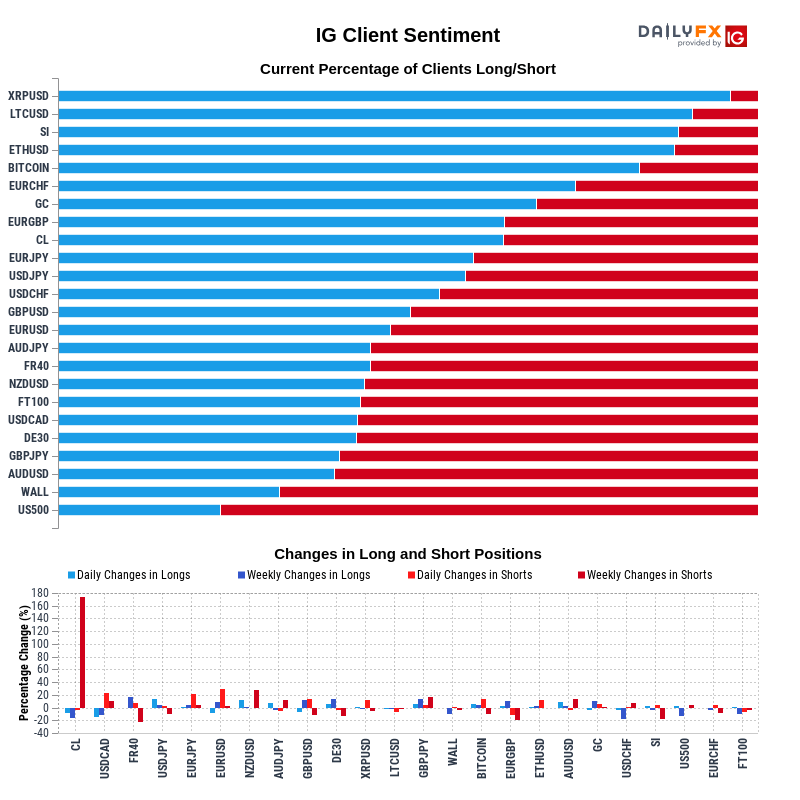

Summary table

|

SYMBOL |

BUSINESS BIAS |

% NET LENGTH |

NET SHORT% |

CHANGE IN LENGTHS |

SHORT CHANGE |

CHANGE IN OI |

|

AUD / JPY |

MIXED |

45.01% |

54.99% |

10.50%

-1.78% |

-7.22%

9.31% |

0.00%

4.03% |

|

AUD / USD |

MIXED |

40.33% |

59.67% |

14.29%

5.53% |

-3.04%

10.20% |

3.27%

8.26% |

|

Bitcoin |

MIXED |

83.12% |

16.88% |

3.77%

3.77% |

14.20%

-12.23% |

5.40%

0.68% |

|

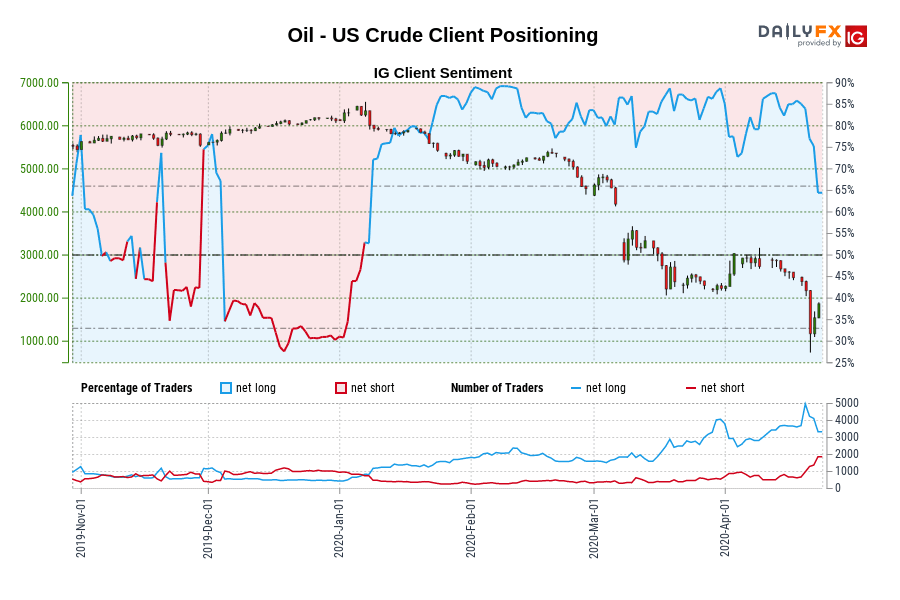

Oil – US Crude |

MIXED |

63.17% |

36.83% |

-7.30%

-12.74% |

-14.46%

179.94% |

-10.07%

16.88% |

|

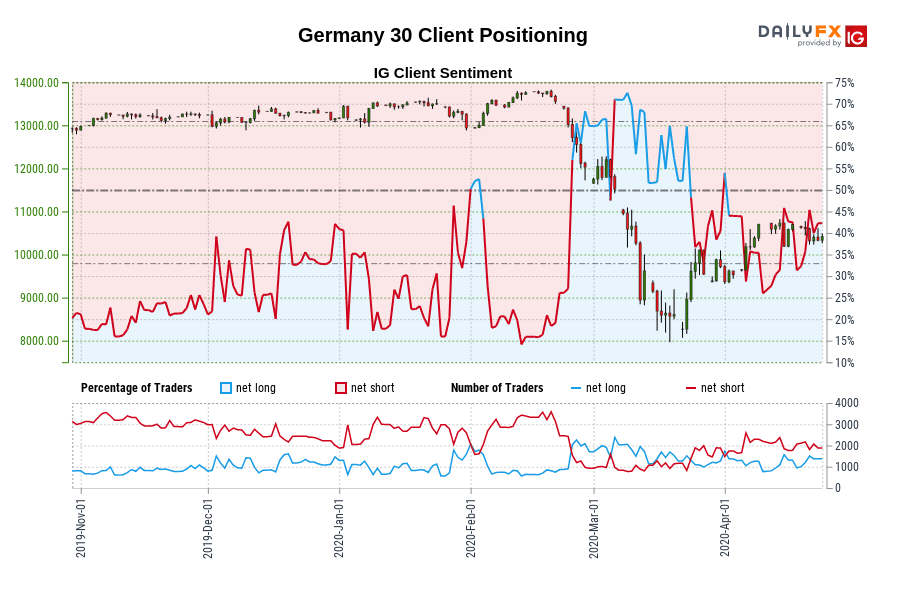

Germany 30 |

BEARISH |

42.33% |

57.67% |

17.61%

13.12% |

-0.10%

-4.99% |

6.70%

1.92% |

|

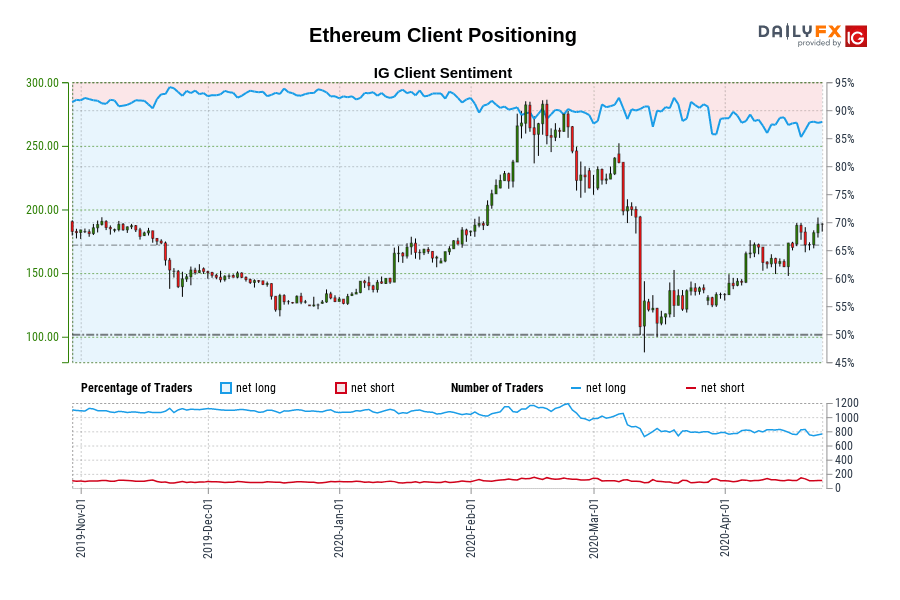

Ethereum |

MIXED |

87.77% |

12.23% |

2.13%

2.81% |

15.05%

0.94% |

3.55%

2.58% |

|

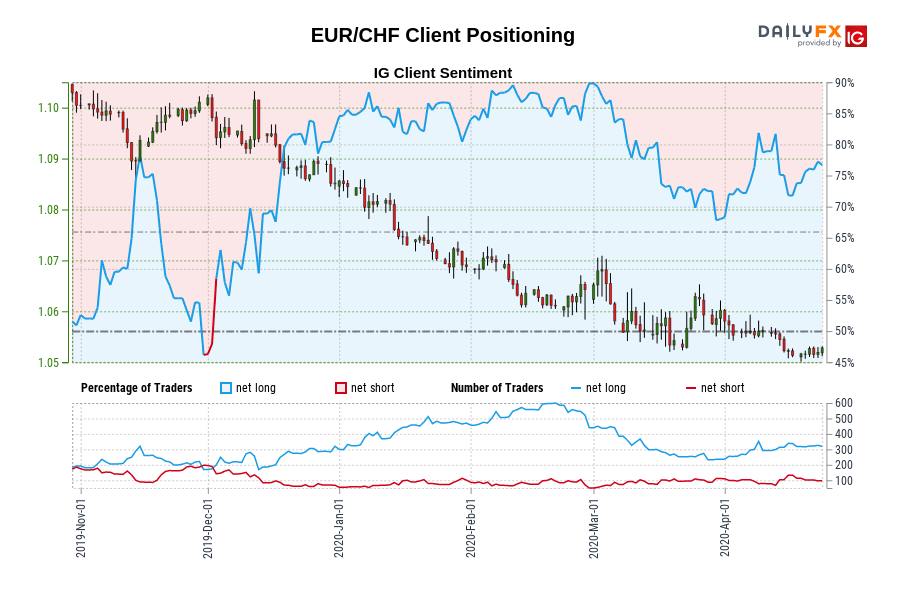

EUR / CHF |

MIXED |

74.07% |

25.93% |

0.31%

-2.14% |

10.89%

-11.11% |

2.86%

-4.64% |

|

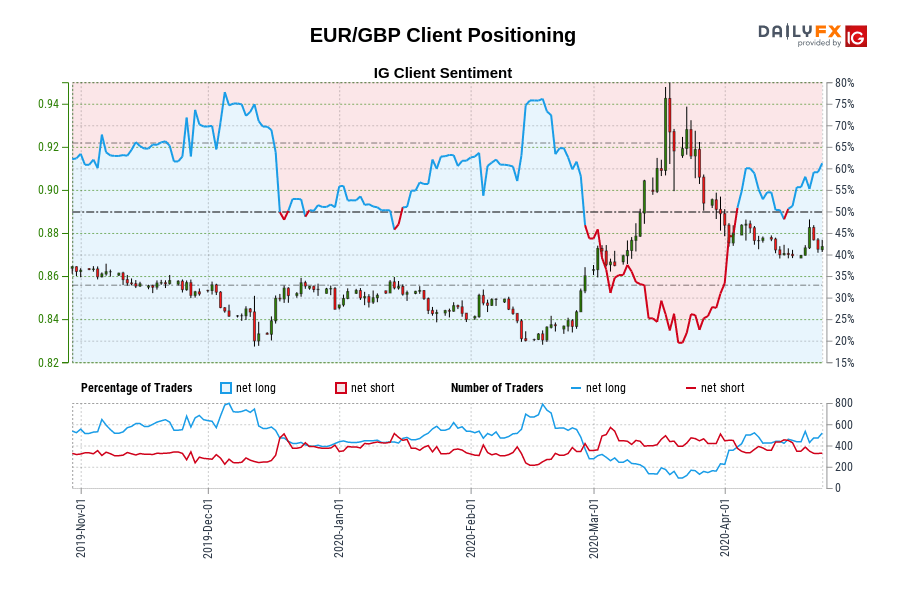

EUR / GBP |

BEARISH |

63.16% |

36.84% |

-2.19%

12.87% |

-4.59%

-14.99% |

-3.09%

0.71% |

|

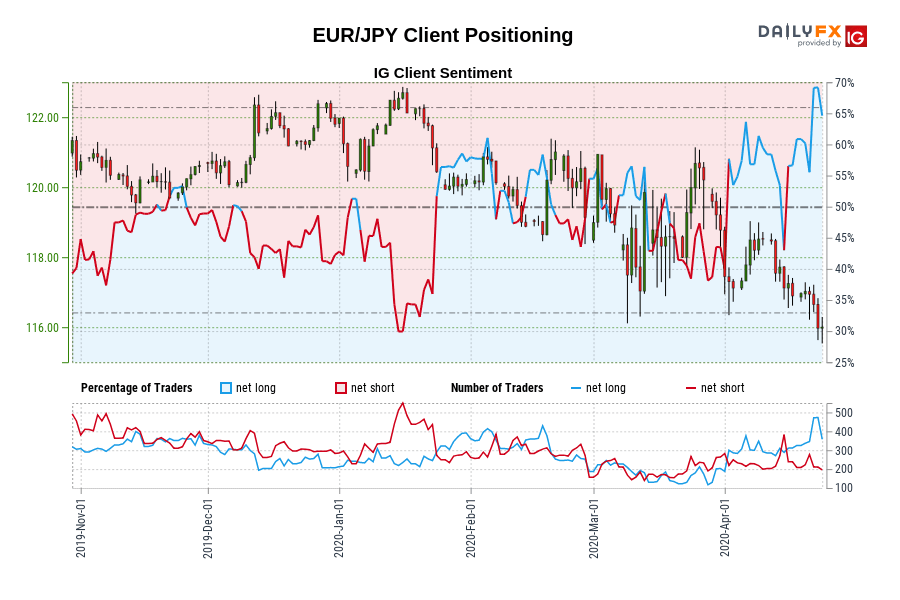

EUR / JPY |

BULLISH |

57.55% |

42.45% |

-1.15%

-0.29% |

16.06%

5.42% |

5.49%

2.05% |

|

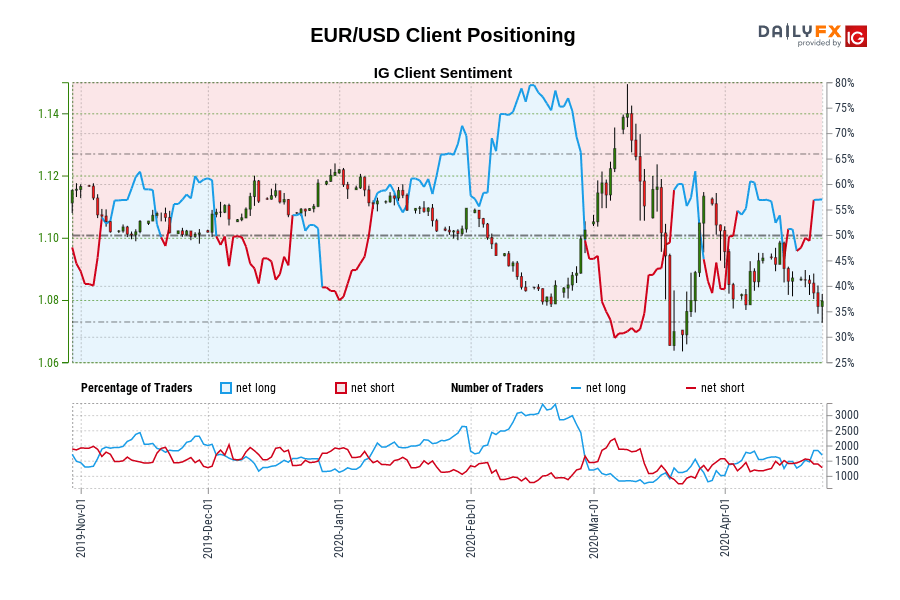

EUR / USD |

MIXED |

46.56% |

53.44% |

-8.71%

7.67% |

22.70%

5.69% |

5.76%

6.60% |

|

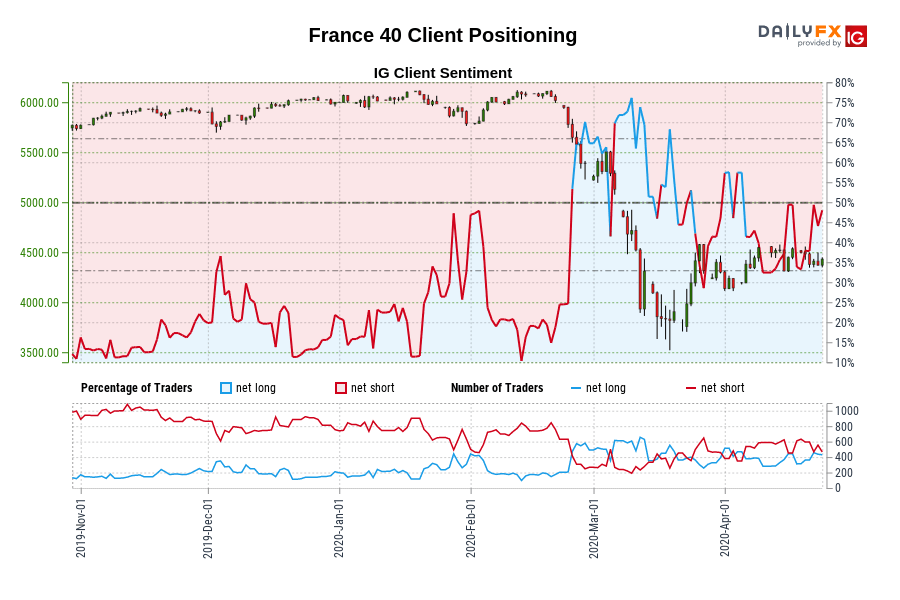

France 40 |

BEARISH |

46.04% |

53.96% |

9.95%

21.76% |

2.98%

-22.22% |

6.08%

-6.71% |

|

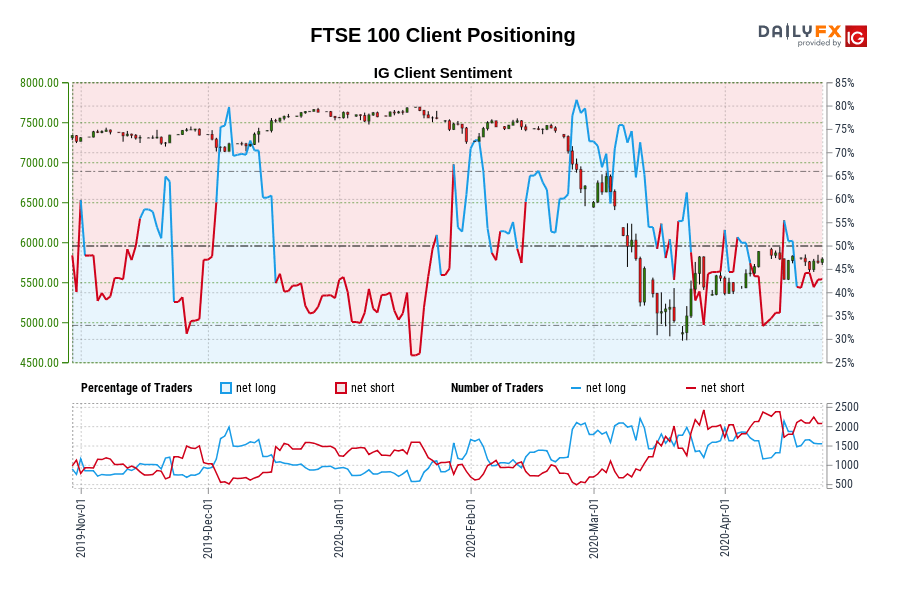

FTSE 100 |

MIXED |

44.02% |

55.98% |

7.48%

-5.51% |

-9.02%

-3.48% |

-2.43%

-4.38% |

|

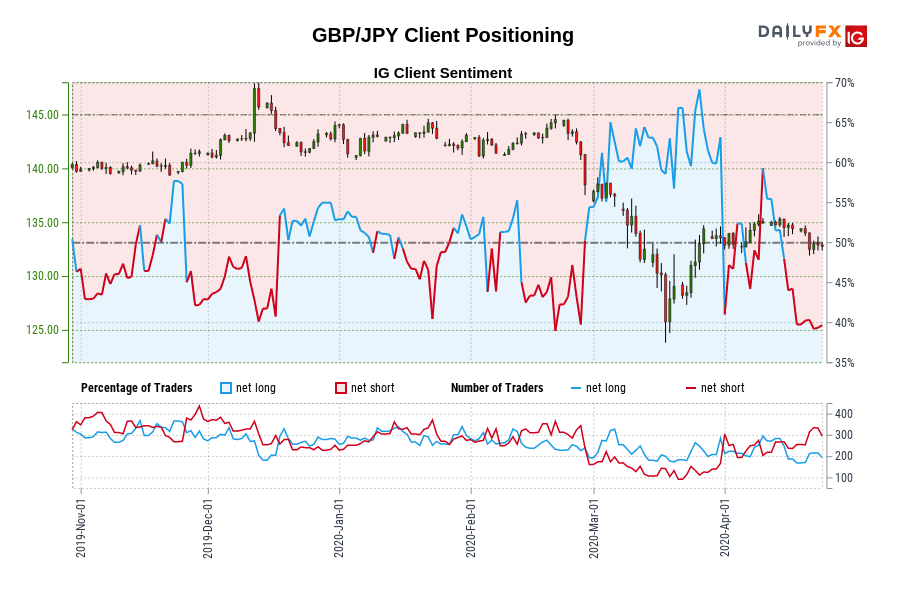

GBP / JPY |

MIXED |

39.74% |

60.26% |

11.28%

17.93% |

8.58%

22.76% |

9.64%

20.80% |

|

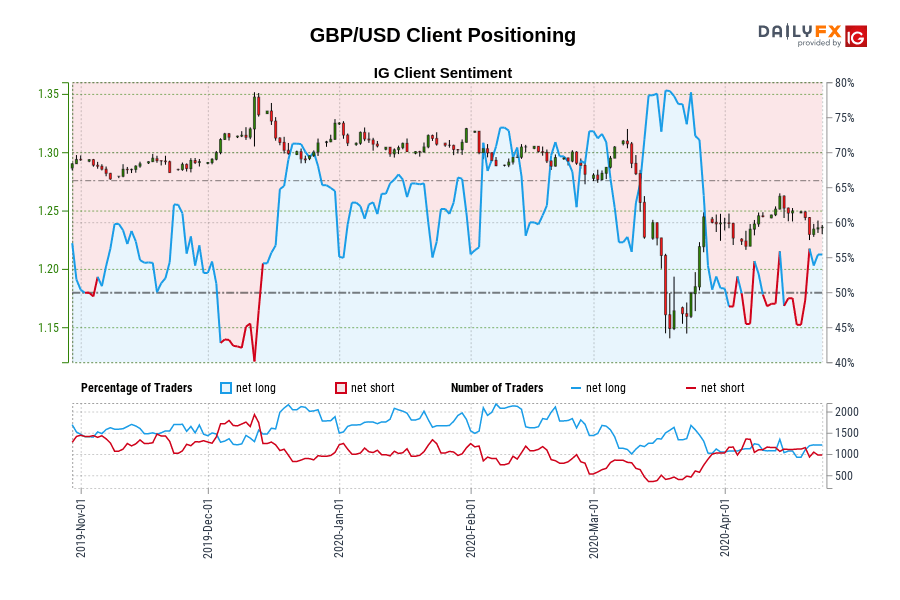

GBP / USD |

MIXED |

50.33% |

49.67% |

-1.20%

13.43% |

15.24%

-8.79% |

6.34%

1.19% |

|

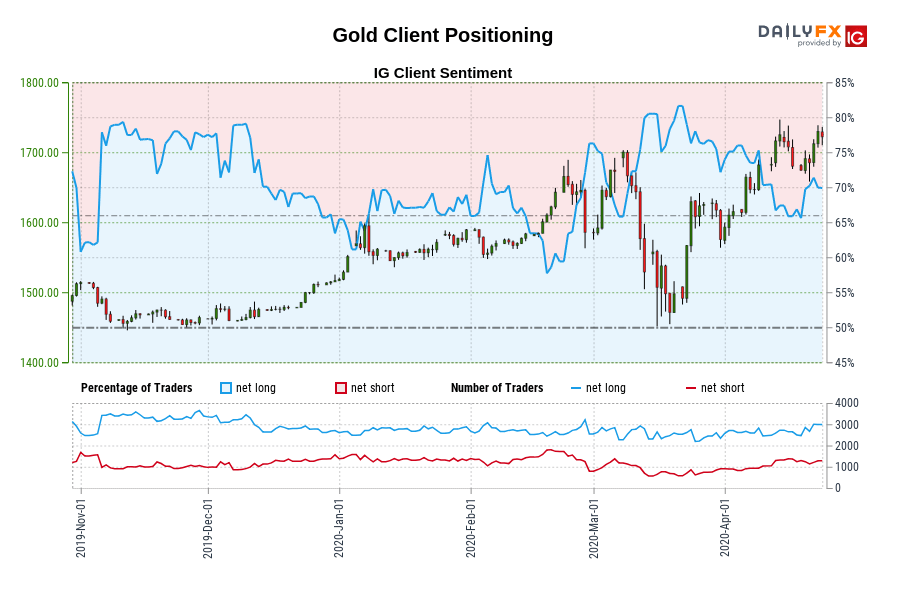

Gold |

MIXED |

68.60% |

31.40% |

-3.49%

10.68% |

4.73%

-0.23% |

-1.05%

7.01% |

|

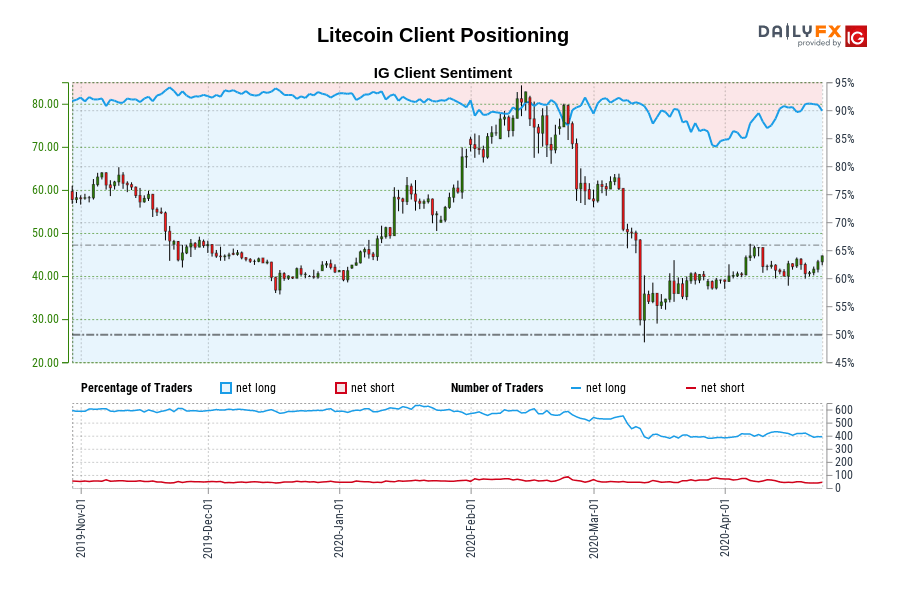

Litecoin |

BEARISH |

91.00% |

9.00% |

-1.54%

-2.78% |

-9.52%

-5.00% |

-2.31%

-2.99% |

|

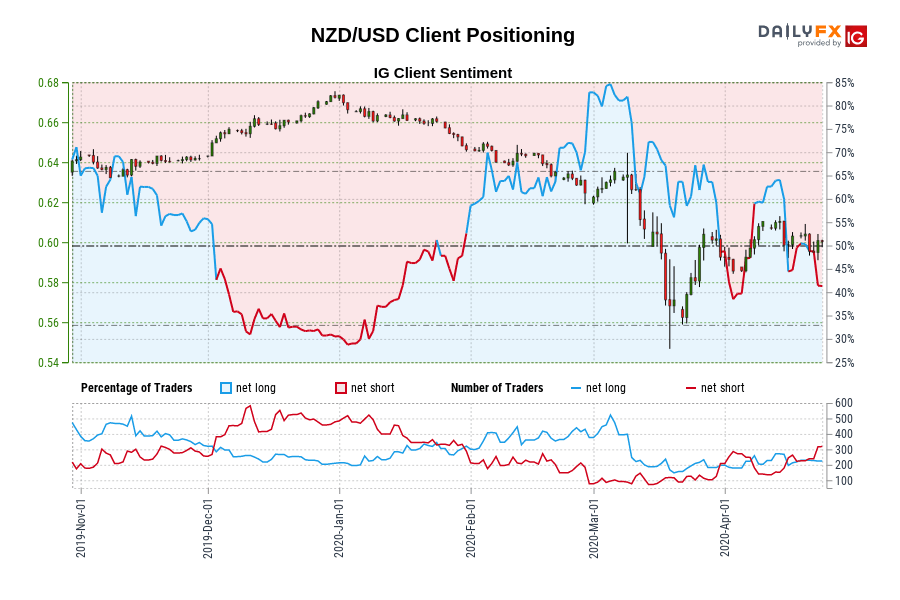

NZD / USD |

MIXED |

43.07% |

56.93% |

11.65%

0.00% |

4.47%

25.62% |

7.44%

13.14% |

|

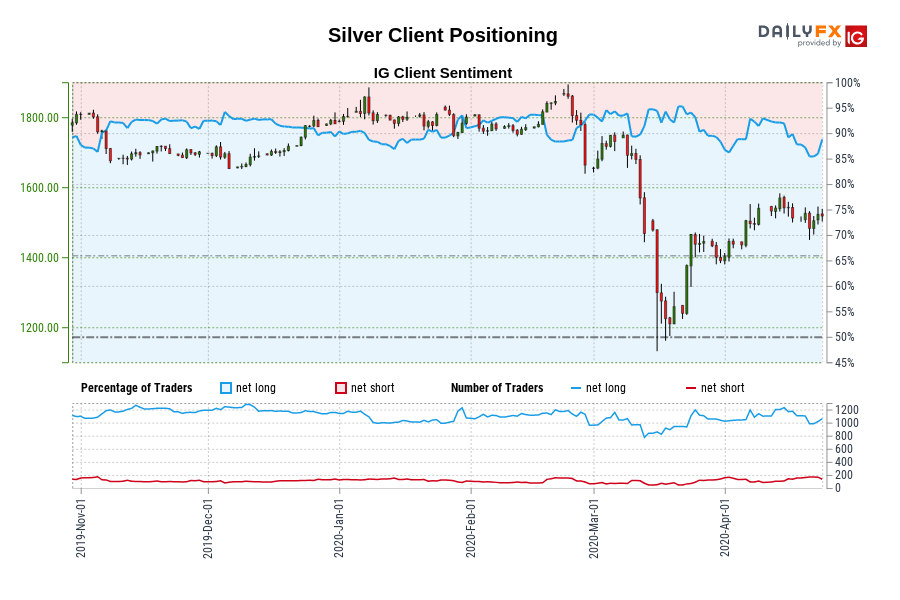

Silver |

MIXED |

88.57% |

11.43% |

1.14%

-4.21% |

9.52%

-16.87% |

2.03%

-5.85% |

|

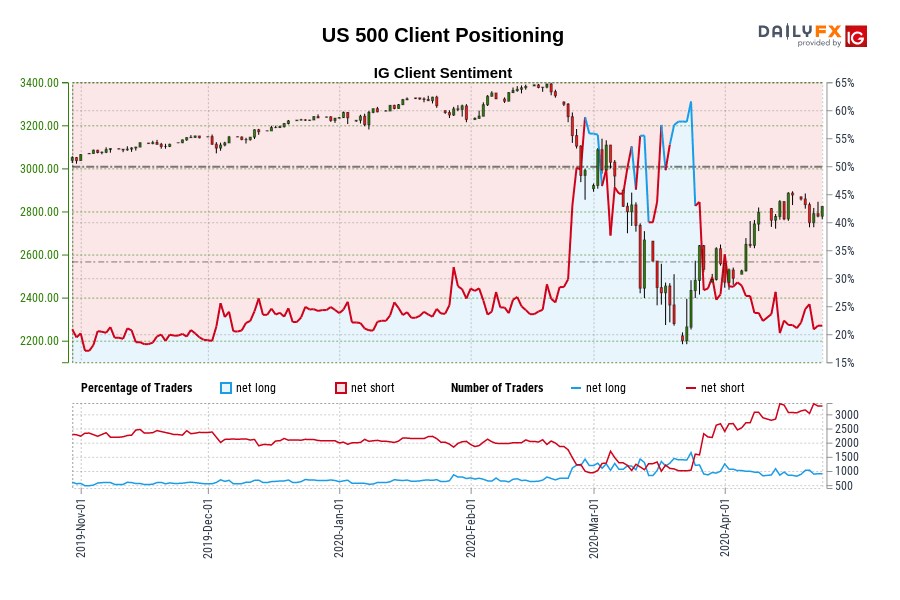

US 500 |

MIXED |

23.41% |

76.59% |

8.61%

-16.34% |

1.56%

9.02% |

3.13%

1.80% |

|

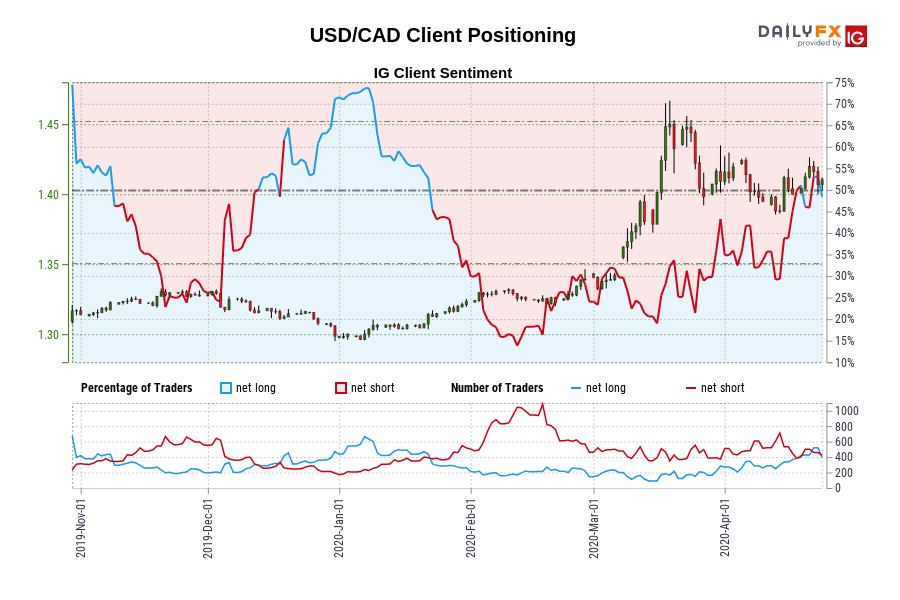

USD / CAD |

BULLISH |

42.37% |

57.63% |

-12.68%

-11.64% |

30.41%

15.26% |

7.86%

2.09% |

|

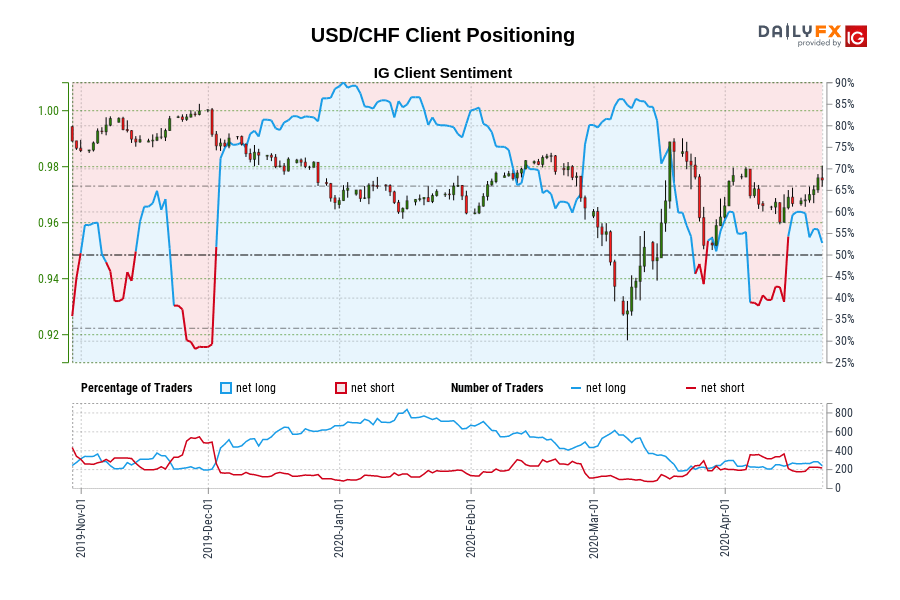

USD / CHF |

BULLISH |

56.05% |

43.95% |

-2.72%

-14.09% |

3.70%

6.52% |

0.00%

-6.11% |

|

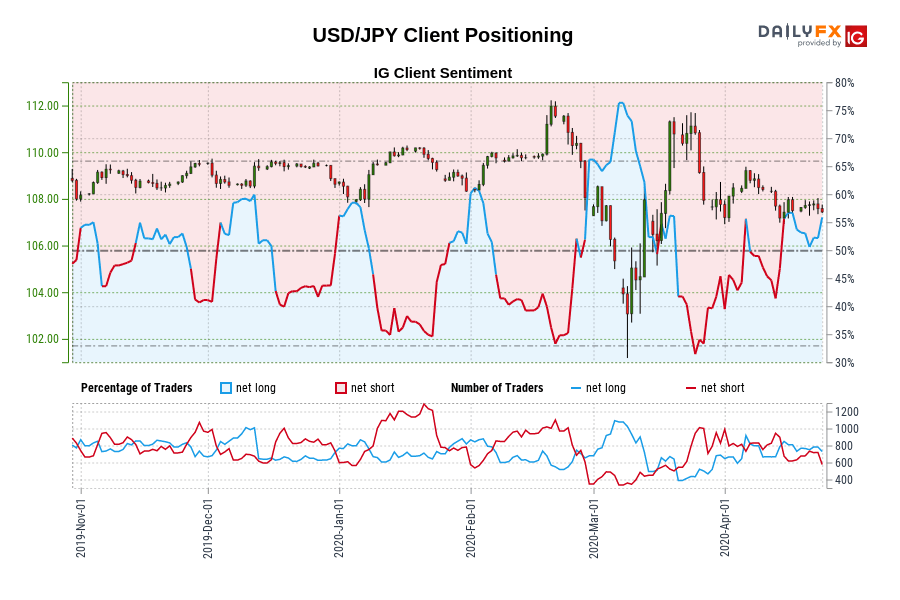

USD / JPY |

BEARISH |

57.63% |

42.37% |

13.96%

1.89% |

-0.50%

-10.54% |

7.35%

-3.77% |

|

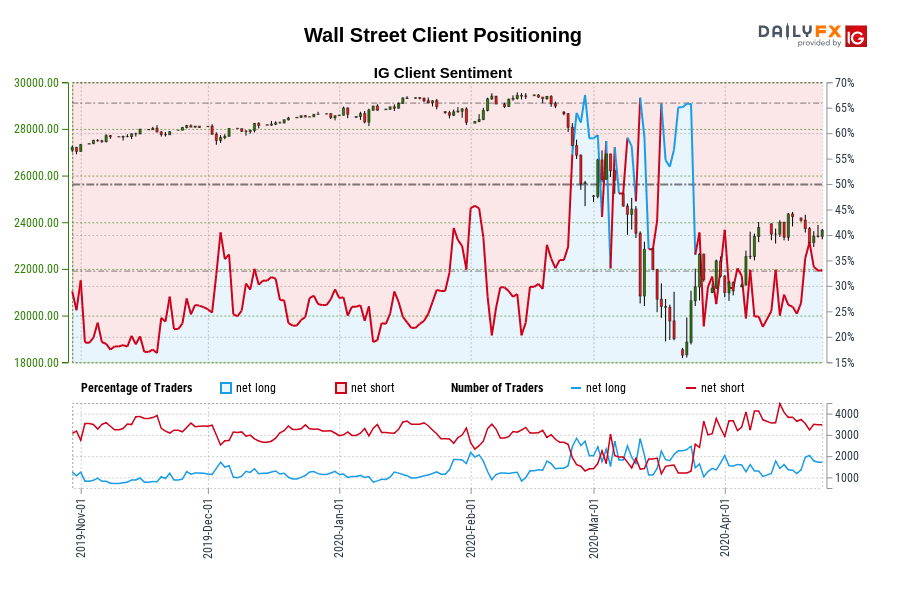

financial world |

MIXED |

34.15% |

65.85% |

15.50%

-8.60% |

-1.45%

-1.60% |

3.75%

-4.11% |

|

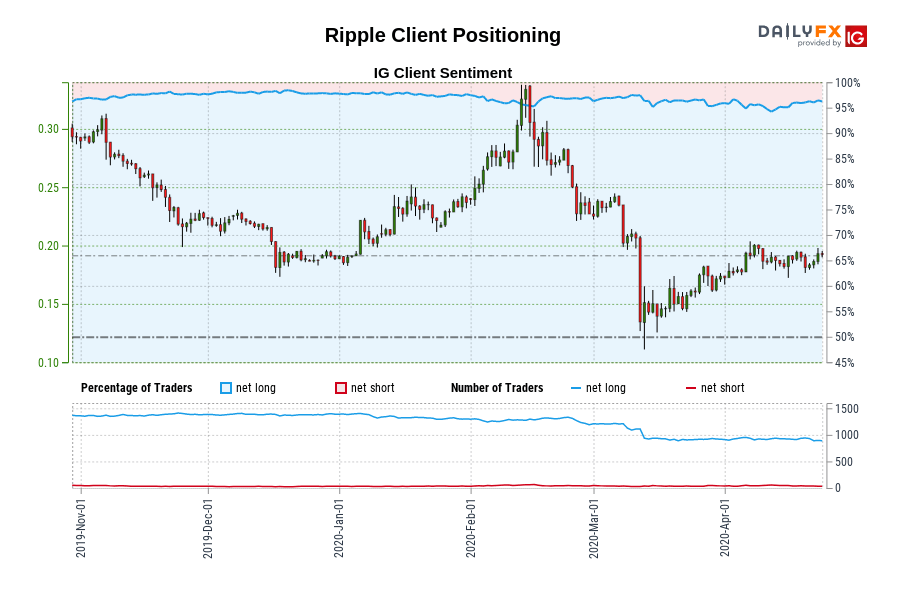

Wave |

MIXED |

95.94% |

4.06% |

0.79%

-1.75% |

11.76%

-5.00% |

1.19%

-1.89% |

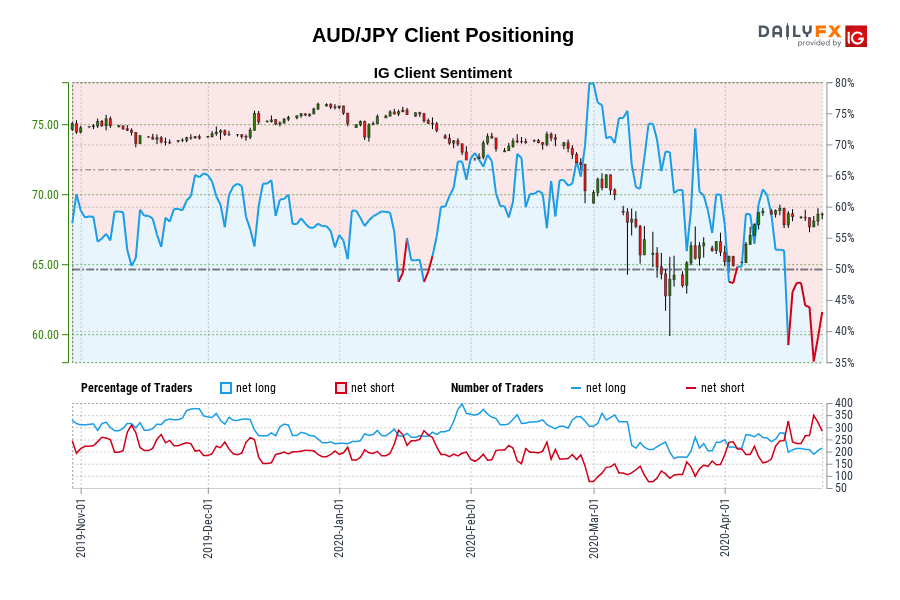

AUD / JPY

AUD / JPY: Retail data shows that 45.01% of traders are net in length with a ratio of short to long traders at 1.22 to 1. The number of net traders is 10.50% higher than yesterday and 1.78% lower than last week, while the number of net traders is 7.22% lower than yesterday and 9.31% higher than last week.

We generally have a counter view to crowd sentiment, and the fact that traders are short in net terms suggests that AUD / JPY prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes give us an additional AUD / JPY mixed trading bias.

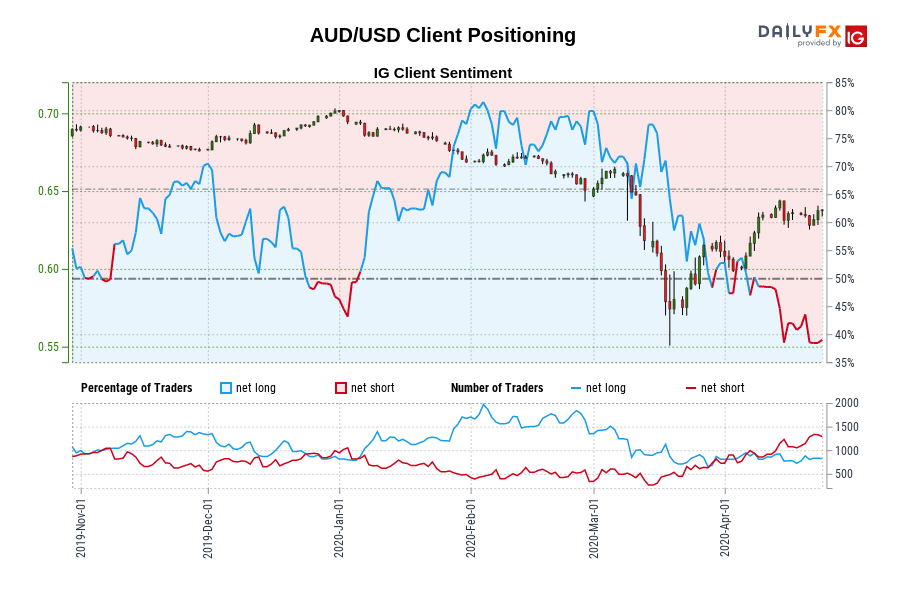

AUD / USD

AUD / USD: Retail merchant data shows that 40.33% of merchants are net in length with a ratio of short to long traders of 1.48 to 1. The number of net traders is 14.29% higher than yesterday and 5.53% more than last week, while the number of net traders is 3.04% lower than yesterday and 10.20% higher than last week.

We generally have a counter view to crowd sentiment, and the fact that traders are short in net terms suggests that AUD / USD prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes gives us an additional AUD / USD mixed trading bias.

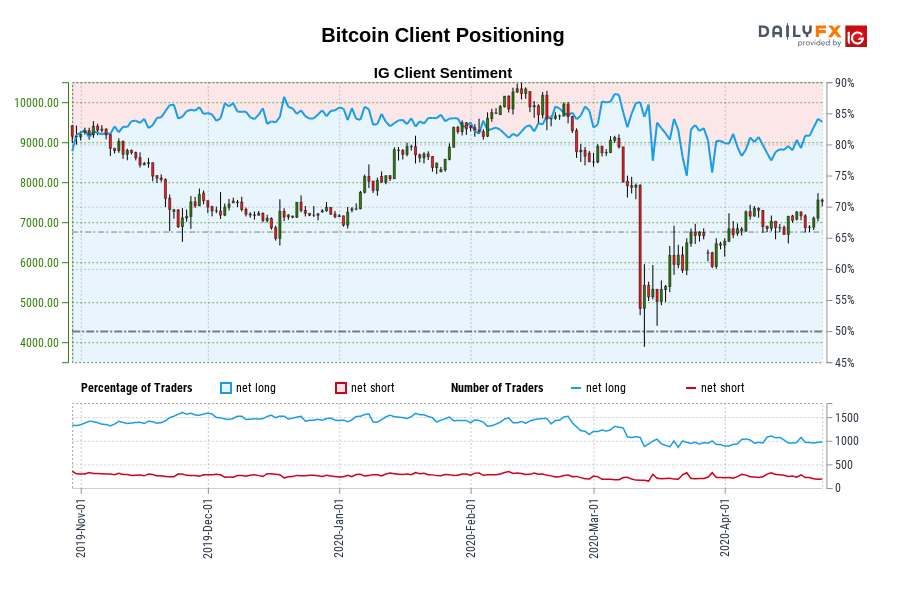

Bitcoin

Bitcoin: Retail merchant data shows that 83.12% of merchants are net in length with a ratio of long to short traders of 4.93 to 1. The number of net operators is 3.77% higher than yesterday and 3.77% higher than last week, while the number of net operators is 14.20% higher than yesterday and 12.23% lower than last week.

We generally have a counter view to crowd sentiment, and the fact that traders have a net net suggests that Bitcoin prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes give us a mixed Bitcoin trading bias.

Oil – US Crude

Oil – US Crude: Retail data shows that 63.17% of operators are net in length with a ratio of long to short operators of 1.72 to 1. The number of net operators is 7.30% lower than yesterday and 12.74% lower than last week, while the number of net operators is 14.46% lower than yesterday and 179.94% more than the last week.

We generally have a contrary view of crowd sentiment, and the fact that traders are net suggests that oil: US crude prices may continue to drop.

The positioning is net longer than yesterday but less net length than last week. The combination of current sentiment and recent changes gives us an additional mixed bias in the oil and US oil trade.

Germany 30

Germany 30: Retail merchant data shows that 42.33% of merchants are net in length with a ratio of short to long traders at 1.36 to 1. The number of net traders is 17.61% higher than yesterday and 13.12% higher than last week, while the number of net traders is 0.10% lower than yesterday and 4.99% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders are short in net terms suggests that Germany 30 prices may continue to rise.

However, the operators are less short than yesterday and compared to last week. Recent changes in sentiment warn that the current price trend for Germany 30 may soon reverse downward even though traders remain short on the net.

Ethereum

Ethereum: Retail merchant data shows that 87.77% of merchants are net in length with a ratio of long to short traders of 7.18 to 1. The number of net traders is 2.13% higher than yesterday and 2.81% higher than last week, while the number of net traders is 15.05% higher than yesterday and 0.94% higher than last week.

We generally have a counter view to crowd sentiment, and the fact that traders are net suggests that Ethereum prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes gives us a mixed Ethereum trading bias.

EUR / CHF

EUR / CHF: Retail data shows that 74.07% of operators are net in length with a ratio of long to short operators of 2.86 to 1. The number of net operators is 0.31% higher than yesterday and 2.14% lower than last week, while the number of net operators is 10.89% higher than yesterday and 11.11% lower than last week.

We generally have a counter view to crowd sentiment, and the fact that traders have net coverage suggests that EUR / CHF prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes gives us a mixed EUR / CHF trading bias.

EUR / GBP

EUR / GBP: Retail merchant data shows that 63.16% of merchants are net in length with a ratio of long to short traders of 1.71 to 1. The number of net operators is 2.19% lower than yesterday and 12.87% higher than last week, while the number of net operators is 4.59% lower than yesterday and 14.99% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have a net net suggests that EUR / GBP prices may continue to fall.

Traders are longer on the network than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger bearish EUR / GBP counter trading bias.

EUR / JPY

EUR / JPY: Retail data shows that 57.55% of operators are net in length with a ratio of long to short operators of 1.36 to 1. The number of net traders is 1.15% lower than yesterday and 0.29% lower than last week, while the number of net traders is 16.06% higher than yesterday and 5.42% higher than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have net coverage suggests that EUR / JPY prices may continue to fall.

However, operators have less net time than yesterday and compared to last week. Recent changes in sentiment warn that the current EUR / JPY price trend may soon reverse even though traders remain net.

EUR / USD

EUR / USD: Retail data shows that 46.56% of traders are net in length with a ratio of short to long traders of 1.15 to 1. The number of net traders is 8.71% lower than yesterday and 7.67% more than last week, while the number of net traders is 22.70% higher than yesterday and 5.69% more than the week pass.

We generally have a counter view to crowd sentiment, and the fact that traders are short in net terms suggests that EUR / USD prices may continue to rise.

The ranking is net shorter than yesterday but less net short than last week. The combination of current sentiment and recent changes give us a mixed EUR / USD trading bias.

France 40

France 40: Retail merchant data shows that 46.04% of merchants are net in length with a ratio of short to long traders of 1.17 to 1. The number of net traders is 9.95% higher than yesterday and 21.76% more than last week, while the number of net traders is 2.98% higher than yesterday and 22.22% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders don’t have net coverage suggests that France 40 prices may continue to rise.

However, the operators are less short than yesterday and compared to last week. Recent changes in sentiment warn that the current price trend in France 40 may soon reverse downward even though operators remain short on the net.

FTSE 100

FTSE 100: Retail merchant data shows that 44.02% of traders are net in length with a ratio of short to long traders at 1.27 to 1. The number of net traders is 7.48% higher than yesterday and 5.51% lower than last week, while the number of net traders is 9.02% lower than yesterday and 3.48 % less than last week.

We generally take a view contrary to crowd sentiment, and the fact that operators are short in net terms suggests that FTSE 100 prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes give us an additional mixed trade bias for FTSE 100.

GBP / JPY

GBP / JPY: Retail merchant data shows that 39.74% of traders have a net length with a ratio of short to long traders at 1.52 to 1. The number of net operators is 11.28% higher than yesterday and 17.93% more than last week, while the number of net operators is 8.58% higher than yesterday and 22.76% more than last week.

We generally have a counter view to crowd sentiment, and the fact that traders are short in net terms suggests that GBP / JPY pair prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes gives us a mixed GBP / JPY trading bias.

GBP / USD

GBP / USD: Retail merchant data shows that 50.33% of operators are net in length with a ratio of long to short operators of 1.01 to 1. The number of net traders is 1.20% lower than yesterday and 13.43% higher than last week, while the number of net traders is 15.24% higher than yesterday and 8.79% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have net coverage suggests that GBP / USD pair prices may continue to decline.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes give us a mixed GBP / USD trading bias.

Gold

Gold: Retail merchant data shows that 68.60% of operators are net in length with a ratio of long to short operators of 2.18 to 1. The number of net operators is 3.49% lower than yesterday and 10.68% higher than last week, while the number of net operators is 4.73% higher than yesterday and 0.23% lower than last week.

We generally have a counter view to crowd sentiment, and the fact that traders have a net net suggests that gold prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes give us a mixed gold trading bias.

Litecoin

Litecoin: Retail data shows that 91.00% of operators are net in length with a ratio of long to short operators of 10.11 to 1. The number of net traders is 1.54% less than yesterday and 2.78% less than last week, while the number of net traders is 9.52% less than yesterday and 5.00% less than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have a net net suggests that Litecoin prices may continue to drop.

Traders are netter than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger bearish Litecoin counter trading bias.

NZD / USD

NZD / USD: Retail merchant data shows that 43.07% of traders are net in length with a ratio of short to long traders at 1.32 to 1. The number of net traders is 11.65% higher than yesterday and unchanged from last week, while the number of net traders is 4.47% higher than yesterday and 25.62% more than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders are short in net terms suggests that NZD / USD prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes give us an additional mixed NZD / USD trading bias.

Silver

Silver: Retail data shows that 88.57% of operators are net in length with a ratio of long to short operators of 7.75 to 1. The number of net operators is 1.14% higher than yesterday and 4.21% lower than last week, while the number of net operators is 9.52% higher than yesterday and 16.87% less than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have a net network suggests that silver prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes gives us a mixed silver trading bias.

US 500

US 500: Retail merchant data shows that 23.41% of merchants are net in length with a ratio of short to long traders at 3.27 to 1. The number of net operators is 8.61% higher than yesterday and 16.34% lower than last week, while the number of net operators is 1.56% higher than yesterday and 9.02% more than the last week.

We generally take a view contrary to crowd sentiment, and the fact that operators are short in net terms suggests that prices of $ 500 may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes give us an additional mixed trade bias of US $ 500.

USD / CAD

USD / CAD: Retail merchant data shows that 42.37% of traders have a net length with a ratio of short to long traders of 1.36 to 1. The number of net operators is 12.68% lower than yesterday and 11.64% lower than last week, while the number of net operators is 30.41% higher than yesterday and 15.26% higher than last week.

We generally have a counter view to crowd sentiment, and the fact that traders are short in net terms suggests that USD / CAD prices may continue to rise.

Traders are even shorter than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD / CAD bullish counter trading bias.

USD / CHF

USD / CHF: Retail data shows that 56.05% of traders have a net length with a ratio of long to short traders of 1.28 to 1. The number of net operators is 2.72% lower than yesterday and 14.09% less than last week, while the number of net operators is 3.70% higher than yesterday and 6.52% more than last week.

We generally have a counter view to crowd sentiment, and the fact that traders have a net net suggests that USD / CHF prices may continue to drop.

However, operators have less net time than yesterday and compared to last week. Recent changes in sentiment warn that the current USD / CHF price trend may soon reverse even though traders remain net.

USD / JPY

USD / JPY: Retail data shows that 57.63% of operators are net in length with a ratio of long to short operators of 1.36 to 1. The number of net traders is 13.96% higher than yesterday and 1.89% more than last week, while the number of net traders is 0.50% lower than yesterday and 10.54% less than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders are net suggests that the prices of the USD / JPY pair may continue to decline.

Traders are longer on the network than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger bearish USD / JPY counter trading bias.

financial world

Financial world: Retail data shows that 34.15% of traders are net in length with a ratio of short to long traders at 1.93 to 1. The number of net traders is 15.50% higher than yesterday and 8.60% lower than last week, while the number of net traders is 1.45% lower than yesterday and 1.60% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders are short in net terms suggests that Wall Street prices may continue to rise.

The ranking is less net short than yesterday but shorter net than last week. The combination of current sentiment and recent changes gives us a mixed Wall Street trade bias.

Wave

Wave: Retail merchant data shows that 95.94% of merchants are net in length with a ratio of long to short traders of 23.61 to 1. The number of net operators is 0.79% higher than yesterday and 1.75% less than last week, while the number of net operators is 11.76% higher than yesterday and 5.00% lower than last week.

We generally take a view contrary to crowd sentiment, and the fact that traders have a net network suggests that Ripple prices may continue to drop.

The positioning is less net length than yesterday but net longer than last week. The combination of current sentiment and recent changes give us additional mixed bias in Ripple trading.

[ad_2]