In less than a year, Activision Blizzard (NASDAQ: ATVI) three different games released from the Call of Duty franchise and is about to release the fourth installment of the series during the upcoming holiday season. To this day, Call of Duty remains the most profitable series for the publisher, so it’s no surprise that Activision wanted to use the franchise this year, as stay-at-home ordering helped the gaming sector to set new records reach. Thanks to this aggressive strategy, Activision recently had one of the largest quarters in its history, as it could beat the consensus of street sales by more than $ 300 million. While such a tremendous performance is impressive, there is every reason to believe that the company will be able to create even more value in the coming months. With a net cash position of $ 3.76 billion, Activision has enough resources for further expansion, and because its shares are close to its full-time high, the company is unappreciated and has more room for growth. For that reason, I remain in a long position in the company and I have no plans to relax it in the long run.

FY21 is all about Call of Duty

Activision like any other gaming publisher is considered a pandemic resistant company. The performance in the first months of the lockdown only improved and its stock trading is already close to its very low. In recent years, Activision has begun releasing extensive titles based on its legacy franchises, as they are the ones that have historically generated the most amount of revenue for the publisher.

During the previous holiday season, Activision started using its Call of Duty franchise and in less than a year released the following titles: Call of Duty Modern Warfare, Call of Duty Mobile, and Call of Duty Warzone. In just two months since its launch, Call of Duty Modern Warfare generated $ 1 billion in revenue, while Call of Duty Mobile went to the top-grossing chart in the US app store. At the same time, Call of Duty Warzone reached more than 75 million players in less than five months since its release and it remains its momentum to this day. Such an amazing performance from his legacy titles helped Activision show an outstanding performance in Q2.

From April to June, Activision’s total revenue was $ 2.08 billion, up 71.9% Y / Y. The company beat revenue estimates by more than $ 300 million and all three of its subsidiaries grew across the board. to look. Activision’s revenue (excluding Blizzard and King) was only 270% higher than Y / Y, as the Call of Duty franchise delivered a top-notch performance. Call of Duty Warzone alone accounted for nearly a quarter of total revenue during the period and helped the company reach a total number of monthly average users of 428 million.

Source: Activision

Continuing, Activision will continue to drive growth throughout the future. While Newzoo expects the gaming sector to grow at a compound annual growth rate of 9.3% in the coming years, Activision, as one of the largest gaming publishers in the world, will benefit from such growth. At the same time, a new round of possible lockdowns will only benefit the company, as it did in Q1. The publisher also plans to release new games and updates from their other legacy franchises such as Diablo, Overwatch, and World of Warcraft. However, there are no release dates for new titles and at the moment all eyes are on Call of Duty at the moment.

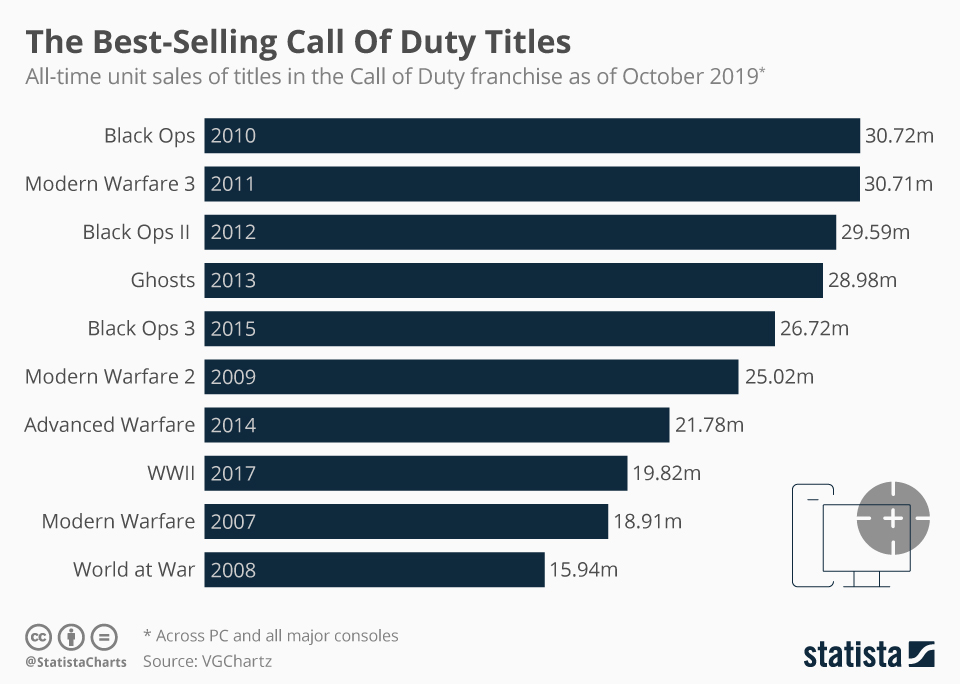

The biggest catalyst in the second half of the year would be another game from the Call of Duty franchise. The upcoming title is called Call of Duty Black Ops Cold War, and it is expected that they will be released along with the launch of the next generation of consoles this holiday season. Considering that the Black Ops series is one of the most successful series in the Call of Duty franchise, the game could show similarly outstanding performances in Q4 and help the publisher easily reach its fiscal year goals.

Note: This card does not include Modern Warfare 2019. Source: Statista

The biggest disadvantage of Activision is that its business is not diversified enough. The company relies on the success of its legacy titles such as Call of Duty, World of Warcraft, and Candy Crush and has no new AAA titles in the pipeline. Electronic Arts (EA) had the same problem in the past, when it relied too much on the success of one title, and when that title underperformed, the company could not meet its guidance and tumbled its supply. This is something that Activision investors should be aware of.

However, Activision has enough resources to minimize its disadvantage, as some titles underperform. At the end of Q2, Activision had a net cash position of $ 3.76 billion, which is an increase from a net cash position of $ 1.98 billion a year ago. At the same time, in early August, the issuer successfully priced $ 2 billion worth of senior notes at 1.35% and 2.5% rates and with a maturity date of 2030 and 2050. Thereafter, Activision used the proceeds of the transaction to cover its 2021 and 2022 notes with high interest rates and it has no major debt that will expire shortly. The fact that Activision was able to get such a low rate for its newly released notes shows how fundamental its business is and how it can weather any crisis. Given that Activision continues to thrive during the pandemic, there is every reason to believe that the stock market will appreciate even more in the coming months.

For Q3 and FY21, Activision expects their bookings to be $ 1.65 billion and $ 7.63 billion, respectively. Considering an excellent performance in Q1 and Q2, these goals are achievable. Considering that Activision’s shares trade at an EV / EBITDA and forward P / E ratios, which are in line with the median of the sector, it is safe to say that the company is not undervalued, even if it is the share price about to reach a new record high.

Because all of their Call of Duty titles continue to hold momentum and another title of the franchise will be released later this year, there are no reasons not to be active on Activision. I continue to hold a long position in the company and believe that its share has even more room for growth.

Source: Yahoo Finance. The table was created by the author

Announcement: I am / we have long been ATVI, EA, UBSFY, TTWO, SNE, NTDOY, NTES. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.