The last time I wrote about AstraZeneca (AZN) was on May 14 of this year. It is still one of my favorites Dividend and Growth stocks. I explained the whole reason for that statement in that article. When it comes to dividend stocks, I like companies that pay dividends and are still increasing their profits at a good pace.

Many of these large dividend stocks I read on this site have little or no earnings growth to go along with their huge dividends. I prefer total return to come from both dividend and earnings growth. In other words, I like that my dividend comes with a strong dose of capital appreciation.

Retirees seem to forget that most of their income in the stock market will come from capital appreciation, not dividends. I’ve even had retirees arguing that even though their dividend-paying stocks are down 50% from where they bought it, “they are still getting their dividend check.”

This is a very strange reasoning, to say the least.

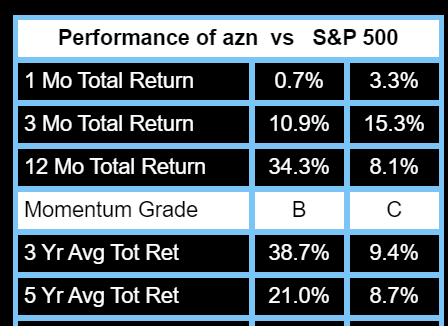

The combination of increasing dividends and increasing earnings has been a very powerful combination for equity investors over the years. Look at the total return on stocks for the past one, three and five years compared to the S&P 500. The stock has delivered serious alpha with this combination.

Data from the Best Stocks Now database

I realize that performance is retrospective and there are no guarantees going forward, but I have found that companies that have delivered alpha in the past are more likely to continue to deliver alpha than companies that have not in the future.

I also like to look to the future by evaluating the shares I buy. The shares I buy must meet my performance and assessment criteria.

AstraZeneca not only passes the alpha test, but also passes the assessment test with great success. My calculations show that the stock has the potential to double in the next five years (with or without the vaccine).

Data from the Best Stocks Now database

Also, when I combine performance with value, stocks currently rank # 353 overall in my proprietary ranking formula.

Data from the Best Stocks Now database

In addition to performance and value, there have been some major developments with the company on the COVID-19 vaccine front since my last article. According to a recent article in BloombergThe company has now become the leader in the race for a vaccine.

As the world approaches 600,000 COVID-19 deaths and the economic turmoil continues, the market moves whenever there are new developments in this race. The race is underway and moving at high speed. A shot could be a game changer in this war.

AstraZeneca It is slated to report highly anticipated results from the first tests evaluating the coronavirus vaccine being developed with researchers at the University of Oxford soon.

The company received $ 1B from the US Advanced Biomedical Research and Development Authority in late May to supply 400 million doses of the vaccine to the United States.

AstraZeneca shares on Wednesday They rose more than 5% after British media reports said the results of the Phase 1 tests were promising. These reports will be published in the Lance medical journal on Monday, July 20. The company has said it will sell the injection at cost during the pandemic crisis.

AstraZeneca is already in the tests of the final stage. The company has said it can start delivering doses of the vaccine to the UK starting in September. The action was working well before the news about the vaccine, and now it really has taken off again.

Moderna (MRNA) also reported very good news about its vaccine candidate on Wednesday. Moderna chief scientist Dr. Tal Zaks recently told the Jerusalem Post: “People who took the Modern vaccine have not only developed antibodies, these antibodies can also fight the virus.”

“When we examine the results, we look at two things: the first, if there are antibodies that can bind to the virus, the second, these antibodies can neutralize the virus’s ability to infect other cells.”

This was a test on only 45 people, but ultimately the research will have to vaccinate 30,000 people, half of whom will receive the vaccine while the other half will not.

Phase two is now complete and Moderna is monitoring the approximately 600 volunteers for side effects and to confirm the safety of the vaccine.

Phase III will begin in approximately two weeks. AstraZeneca has a huge advantage in testing as of now. Completion of Moderna depends largely on the number of infected subjects among whom they will be vaccinated. The investigation will conclude once they have less infected subjects among those who have been vaccinated compared to the control group.

Moderna plans to do its research in the most affected areas of the United States. They are looking for public servants, medical personnel and other people who are in the public, compared to those who are mainly at home, any volunteer.

Moderna’s chief scientist remains optimistic, but the timing of the vaccine will be determined by local governments, which one It will also be in charge of distributing it.

Moderna’s shares have been in tears since August last year. The company went public in late 2018 and has recently hit new all-time highs.

|

|

AstraZeneca he does not live or die from the results of his vaccination efforts. On the other hand, Modern it would take a huge hit on your share price if your shot doesn’t work. They don’t have the rich drug and earnings portfolio AZN currently has.

Other players in the vaccine race include, but are not limited to: Novavax (NVAX), Nanoviricides (NNVC), Pfizer (PFE) and a new Canadian entrant by the name of Imv Inc. (IMV).

Which company will finally win this important race? According to Dr. Tal Zaks, chief scientist at Moderna: “I think we would take the vaccine that would show the most promising results in the later stages of clinical trials, which is often called the ‘third phase’, in which we could potentially proves that it is indeed effective. “

In the meantime, my money is in AZN but I am supporting you all.

yesest Stocks Now Premium gives you access to 4 unrestricted model portfolios, daily live transactions (if any) and a detailed weekly market sync newsletter.

This bulletin published a PURCHASE SIGNAL on 03/27/2009. That BUY SIGNAL has been around for almost 11 years, but what are we saying now?

We search for the best stocks now for each portfolio. Sometimes we deploy reverse funds for protection.

All of this comes from a professional analyst and money manager with over 22 years of business experience.

Try it free for two weeks.

Join us today and get instant access to everything mentioned above.

Divulge: I am / we are long AZN. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.